Key Market Intelligence on April 1st, how much did you miss out on?

Top News

1.Analysis: Binance Wallet's Next New Coin IDO Suspected to be a PUMP

3.Compound Founder Suspected of Selling 50,000 COMP, Worth $3.19 Million

4.Backpack Completes Acquisition of FTX EU, Initiates User Fund Return Process Today

5.Binance Announces Adjustment to T+1 Withdrawal Plan

Featured Articles

1.《When ETH Dropped Below $1800, What Was Vitalik Thinking?》

As ETH continued to plummet, with many users shouting "Fix your eth" under Vitalik's tweets, people were curious about what Ethereum's founder, Vitalik, was thinking. On March 29, 2025, Vitalik posted two blog posts in a row, revealing his current thoughts. Apparently, Vitalik is not particularly concerned about the ETH price.

2.《In-Depth Comparison of GMX, Jupiter, and Drift, Who Is Solana's Perpetual King?》

This article analyzes the key on-chain derivative protocols on Solana, including GMX-Solana, Jupiter Perps, and Drift, comparing their liquidity, trading volume, capital efficiency, and risk management. Jupiter and Drift have shown continued growth but lower capital efficiency, while GMX-Solana has higher capital efficiency but less liquidity. As the protocols introduce better features and incentives, market competition will intensify, and the DEX to CEX derivative trading volume ratio has reached a record high, benefiting Solana.

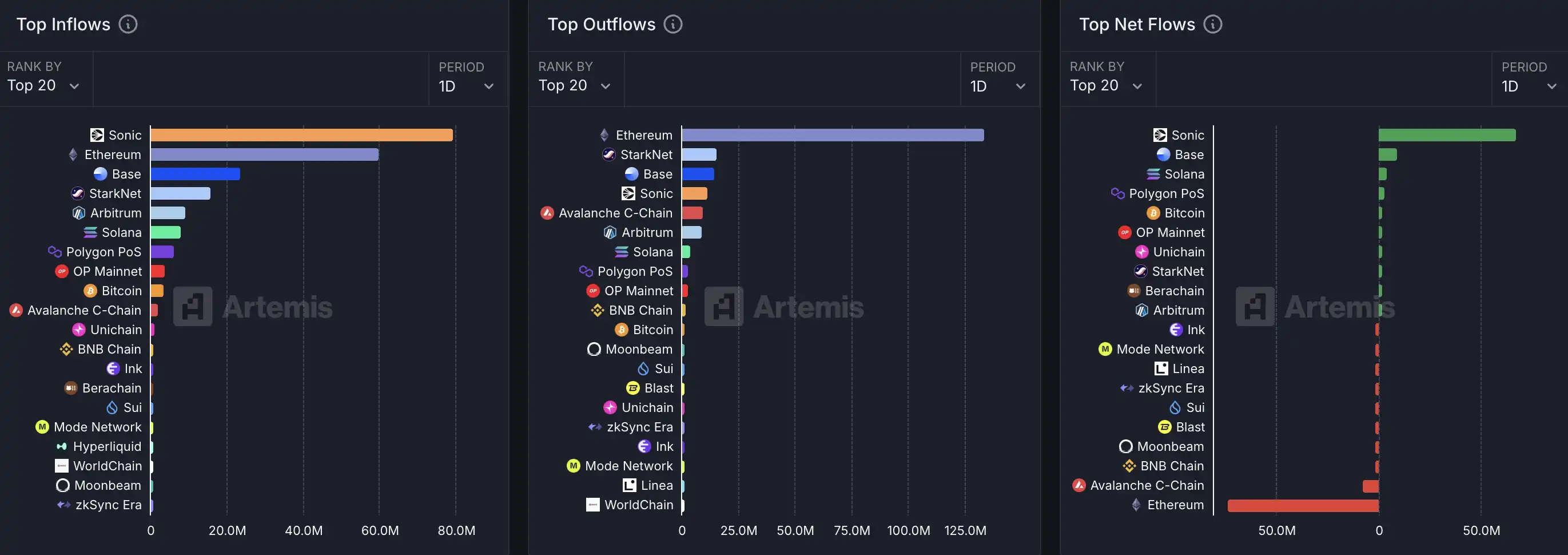

On-chain Data

On-chain fund flows for the week of April 1st

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

100% rebate for KYB users: Earn fee rebates on EUR bank deposits!

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone

Bitget Trading Club Championship (Phase 21)—Up to 1250 BGB per user, plus a ZETA pool and Mystery Boxes

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services