Bitcoin price gearing up for next leg of ‘acceleration phase’ — Fidelity research

A recent Fidelity Digital Assets report questioned whether Bitcoin’s price had already seen its cyclical “blow off top” or if BTC is on the cusp of another “acceleration phase.”

According to Fidelity analyst Zack Wainwright, Bitcoin’s acceleration phases are characterized by “high volatility and high profit,” similar to the price action seen when BTC pushed above $20,000 in December 2020.

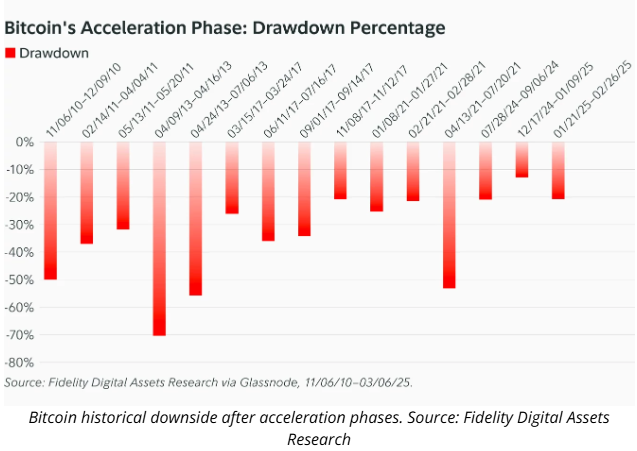

While Bitcoin’s year-to-date return reflects an 11.4% loss, and the asset is down nearly 25% from its all-time high, Wainwright said the recent post-acceleration phase performance aligns with BTC’s average drawdowns, compared with previous market cycles.

Wainwright suggests that Bitcoin is still in an acceleration phase but is moving closer to the completion of the cycle, as March 3 represented day 232 of the period. Previous peaks lasted slightly longer before a corrective period set in.

“The acceleration phase of 2010 - 2011, 2015, and 2017 reached their tops on day 244, 261, 280, respectively, suggesting a slightly more drawn-out phase each cycle.”

Is another parabolic rally in the cards for Bitcoin?

Bitcoin’s price has languished below $100,000 since Feb. 21, and a good deal of the momentum and positive sentiment that comprised the “Trump trade” has dissipated and been replaced by tariff-war-induced volatility and the markets’ fear that the US could be heading into a recession.

Despite these overhanging factors and the negative impact they’ve had on day-to-day Bitcoin prices, large entities continue to add to their BTC stockpiles.

On March 31, Strategy CEO Michael Saylor announced that the company had acquired 22,048 BTC ($1.92 billion) at an average price of $86,969 per Bitcoin. On the same day, Bitcoin miner MARA revealed plans to sell up to $2 billion in stock to acquire more BTC “from time to time.”

Following in the footsteps of larger-cap companies, Japanese firm Metaplanet issued 2 billion yen ($13.3 million) in bonds on March 31 to buy more Bitcoin, and the biggest news of March came from GameStop announcing a $1.3 billion convertible notes offering , a portion of which could be used to purchase Bitcoin.

The recent buying and statements of intent to buy from a variety of international and US-based publicly listed companies show a price-agnostic approach to accumulating BTC as a reserve asset, and highlight the positive future price expectations among institutional investors.

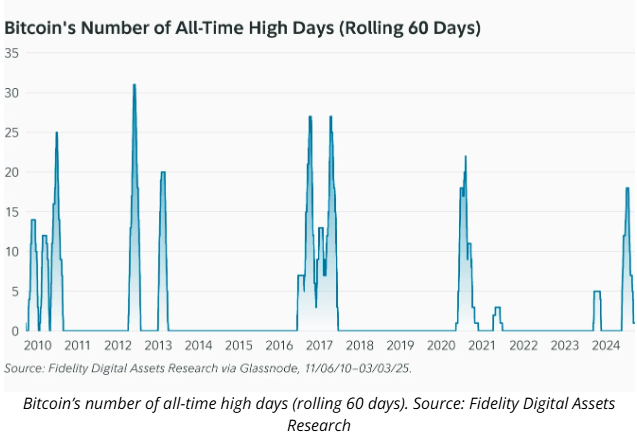

While it is difficult to determine the impact of institutional investor Bitcoin purchases on BTC price, Wainwright said that a metric to watch is the number of days during a rolling 60-day period when the cryptocurrency hits a new all-time high. Wainwright posted the following chart and said:

“Bitcoin has typically experienced two major surges within previous Acceleration Phases, with the first instance of this cycle’s following the election. If a new all-time high is on the horizon, it will have a starting base near $110,000.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone