US Dollar Weakness Hinting at High Probability Setup for Bitcoin According to Real Vision Analyst – Here’s When

Crypto analyst Jamie Coutts says that a breakdown in the US Dollar Index (DXY) could be hinting at coming rallies for Bitcoin ( BTC ).

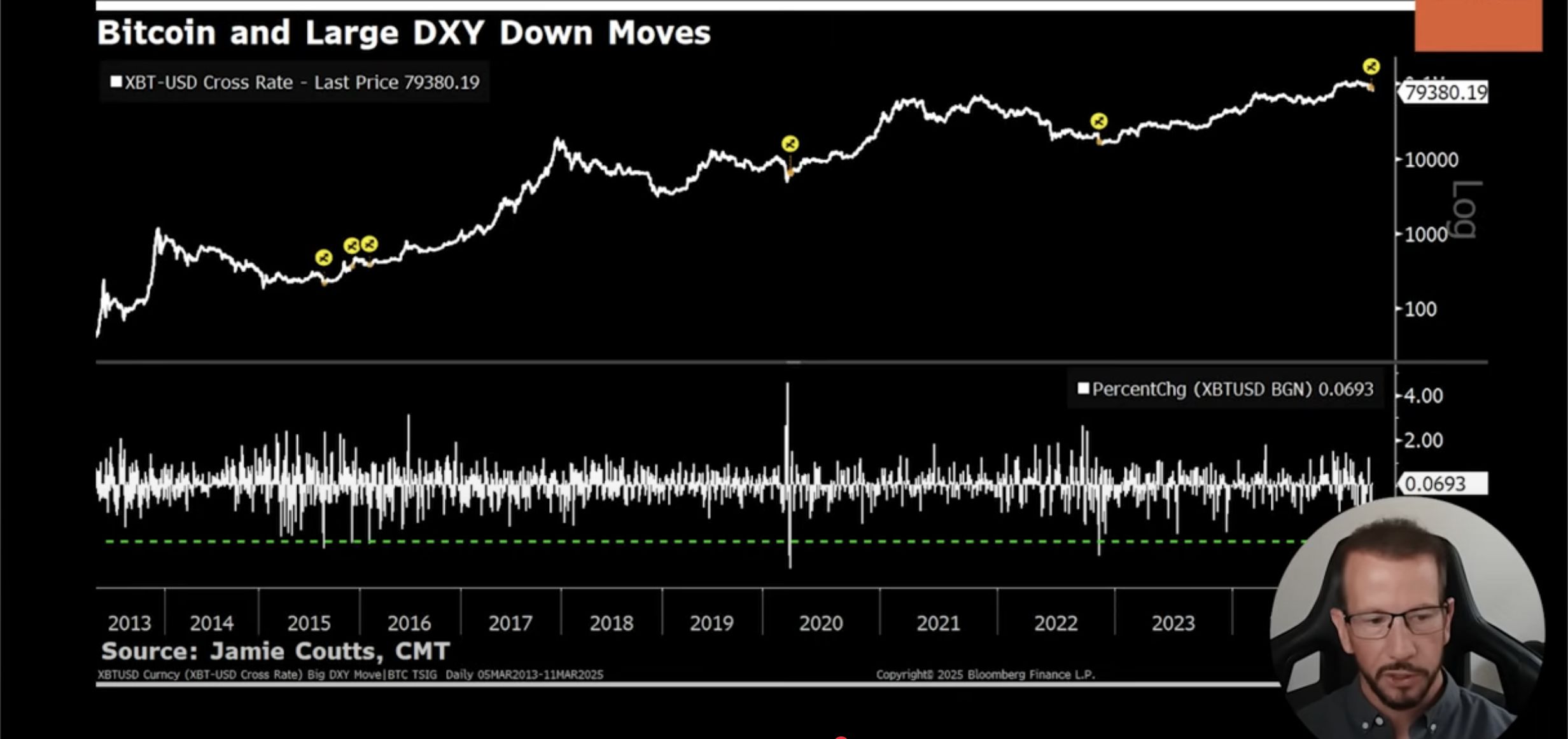

In a new interview on the Less Noise More Signal YouTube Channel, Coutts shares a chart that shows the price of Bitcoin overlaid with large down moves – of at least 2.5% or more – in the DXY.

The DXY measures the strength of the USD against a basket of other major foreign currencies weighted by volume and often moves inversely to risk assets like Bitcoin.

According to Coutts, many of the large downward moves in DXY – like the one that happened in late March – have coincided with the beginning of BTC rallies.

“I’m just showing the Bitcoin chart and when these have occurred, which are the yellow icons. And so, on the eight occasions set, we’ve seen this play out 90 days later on all eight occasions – the Bitcoin [price] has been higher on average by about 30%, but anywhere by about 30% to 50% or 60%.

So if this was to play out and the lag between financial conditions and liquidity and asset prices plays out, then, really, we’re sort of looking at May as being a strong month for Bitcoin and potentially a retest of the all-time highs.”

Source: Jamie Coutts/YouTube

Source: Jamie Coutts/YouTube

At time of writing, Bitcoin is trading at $85,138, 21% below its all-time high.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: DALLE-3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Spot Margin Announcement on Suspension of SANTOS/USDT, MYRO/USDT, DUSK/USDT, PHB/USDT, ALPINE/USDT Margin Trading Services

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US