Ethereum’s Bullish Breakout Blocked by Bearish Death Cross – Here’s the Fix

Bearish sentiment in Ethereum’s futures market has intensified following a death cross pattern, complicating hopes of recovery as traders eye the $2,100 resistance zone.

Ethereum (ETH) has gone up by nearly 3% in the past 24 hours as sellers took a pause yesterday and may be progressively buying back the token now that it has dropped below the $1,900 level again.

The past week was quite negative for the top altcoin as it experienced losses of 9.7% as the crypto sell-off resumed.

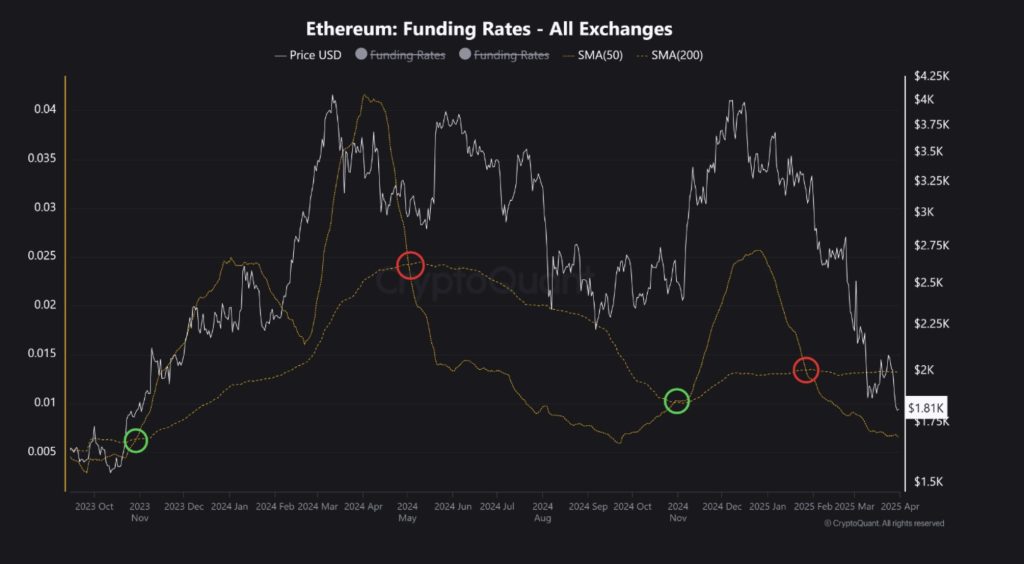

A graph shared by CryptoQuant provided insights into speculators’ sentiment.

It appears that Ethereum bears continue to dominate the price action as reflected by the behavior of funding rates – a measure of the financing fees that traders pay for keeping their positions open.

When the difference between the funding rates paid by traders is positive, it indicates that market sentiment is bullish as the volume of outstanding long positions exceeds that of shorts.

However, if market sentiment depresses, this difference will progressively shrink. CryptoQuant’s analysts measured the simple moving average of financing rates for the past 50 and 200 days and identified a “death cross”.

This means that the short-term average crossed below the long-term average. This reflects a trend reversal and confirms a bearish outlook.

Ethereum Bounces Off Key Support – Can It Recover?

Despite the latest recovery that Ethereum experienced during the second half of March, last week’s drop has now resumed the token’s downtrend.

For ETH to reverse this trend, it has to climb above the $2,100 level now.

One encouraging sign for bulls is that the token is bouncing off a key area of support ranging from $1,750 to $1,800.

If the RSI crosses above the signal, this would confirm a bullish near-term outlook as a double-bottom pattern would be in play.

A first target in that case would be set at $2,100, the nearest resistance for Ethereum, meaning an upside potential of 13%.

Identifying and investing in the best cryptocurrencies can be a daunting task, especially when it comes to the meme coin sector.

Meme Index (MEMEX) is a decentralized platform that helps investors buy a basket of meme coins to have diversified exposure to this category.

Just a few weeks after its launch, this crypto presale has raised $4.5 million as investors have been captivated by its value proposition.

Meme Index (MEMEX) Offers Access to Four Different Indexes

Meme Index (MEMEX) is a decentralized protocol that gives investors a chance to get exposure to meme coins by holding a basket of various cryptocurrencies within this category.

This solution currently offers access to four indexes: Titan, Moonshot, Midcap, and Meme Frenzy. Each basket is designed with different risk profiles in mind.

These portfolios are composed of the most well-established tokens like Dogecoin (DOGE) and Shiba Inu (SHIB) in the case of Titan to the most exotic corners of the sector for Meme Frenzy.

$MEMEX is the native asset of this decentralized solution. It is the gateway to the Meme Index ecosystem and its demand is primarily fueled by the protocol’s adoption.

As its popularity rises among meme coin investors, so will the price of $MEMEX. Hence, this token offers significant upside potential to early buyers who take advantage of its discounted presale price.

To buy $MEMEX, simply head to the Meme Index website and connect your wallet (e.g. Best Wallet). You can either swap USDT or ETH for this token or use a bank card to complete the purchase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!