Will PEPE Explode Past Resistance? Why Traders Are Eyeing a Double-Digit Breakout

Pepe (PEPE) finds itself at a critical juncture, nearing the 4-month resistance that has capped its recent upside attempts, and traders are betting on a surge.

Pepe hinges on a potential major bullish move—a double-digit breakout could push it back into the “best crypto to buy” conversation.

The sell-off imposed by recent economic uncertainty—recession fears bolstered by Trump’s planned “tariff war” escalations—appears to have been priced in.

The days since have seen a “buy-the-dip” event unfold, boosting the meme coin to a $0.0000078 peak, though momentum has reigned in today with a 1.79% decline.

PEPE Price Analysis: Why Traders Aim for Double-Digit Gains

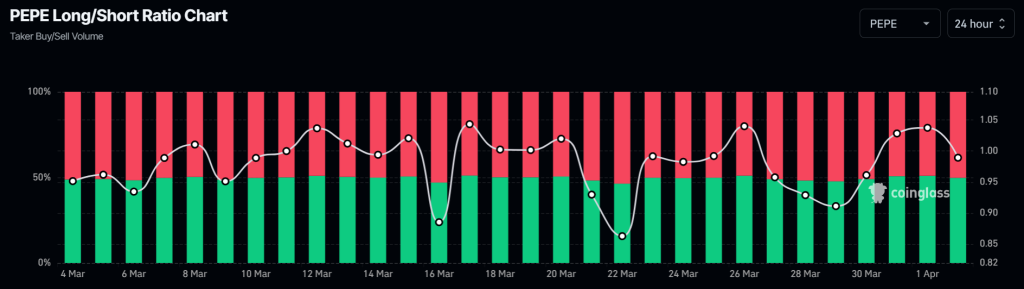

Coinglass data shows that Pepe’s long/short ratio hit one of its highest points over the past month at 1.04, before slipping to 0.99 today.

Pepe long/short ratio chart, month peak. Source: Coinglass.

Pepe long/short ratio chart, month peak. Source: Coinglass.

A ratio above 1 reflects bullish sentiment, as more traders bet on price increases.

The rise and subsequent fall coincide with a potential rejection at the multi-month resistance trendline—mirroring past failed attempts.

PEPE / USDDT 1-day chart, falling wedge pattern. Source: Binance.

PEPE / USDDT 1-day chart, falling wedge pattern. Source: Binance.

Still, Pepe nears a potential confluence zone where this resistance meets a long-term support level that has guided lows since mid-2024.

If this level holds, PEPE could retest the resistance—part of a falling wedge pattern that guided price movements since early December.

This scenario remains credible, as the MACD evades a potential death cross, holding strong in its position above the signal line with dominant buying pressure.

The Relative Strength Index (RSI) is also favorable, trending upward toward a neutral 50 after being stuck in a sideways trend near the oversold threshold since early February.

A pattern breakout targets highs of $0.00002, marking a 175% gain from current levels.

However, a retest of April’s highs at $0.000015—a 55% gain—seems more realistic in the short term given the bearish market backdrop.

It should be noted that while signals lean bullish, they remain weak. A breakout will likely require stronger buying pressure.

This New ICO is Helping Traders Get Ahead of Breakouts

While sentiment is improving, the market remains weighed down by FUD from recent economic uncertainties—few coins are catching tailwinds.

That’s where MIND of Pepe ($MIND) steps in, giving traders a chance to get in early and stay ahead of high-gaining opportunities.

The Mind of Pepe AI will actively engage with the crypto community through X —driving conversations, uncovering alpha opportunities, and delivering exclusive, token-gated insights.

Inside its Telegram community , holders get early access to high-potential tokens before they hit the market, keeping them ahead of the curve.

At the time of writing, MIND has raised over $7.8 million in its ongoing presale, capitalizing on the Pepe brand and one of this cycle’s strongest meme coin narratives: AI agents.

You can keep up with MIND of Pepe on the mentioned socials, or join the presale on the MIND of Pepe website .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!