Ethena gears up for massive token unlock – can ENA price withstand the sell pressure?

Ethena is facing a potential wave of sell pressure as 266 million ENA tokens are set to unlock in two phases, starting with the first $34 million unlock today.

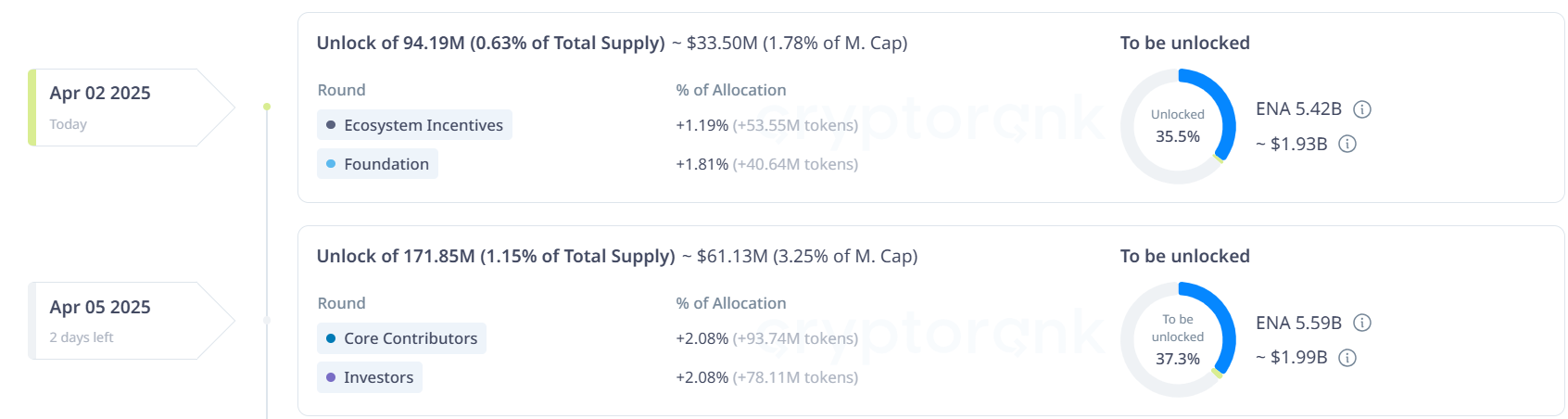

According to CryptoRank.io , Ethena ( ENA ) will unlock 94.19 million ENA tokens today, worth $33.87 million—0.63% of total supply and 1.79% of market cap. Further, 171.85 million tokens will be unlocked on April 5.

Source: CryptoRank.io

Source: CryptoRank.io

The upcoming token unlocks come as ENA trades at $0.35, down by 17% over the past week, following World Liberty Financial ‘s dump of 184,000 ENA tokes, worth $69,000, on March 25. Prior to that, on March 5, Ethena unlocked a massive 2.07 billion ENA tokens—worth $728 million—representing 13.9% of the total supply.

Looking at the chart, ENA price has been in a clear downtrend from the start of the year, trading below the 21-day Exponential Moving Average. The price attempted a breakout above the 21-day EMA for a few days in late March, but failed to sustain above it.

The RSI is at 44.26, below the neutral 50 level. However, the RSI moving average is at 46.88, meaning there is some attempt to recover, but it’s still weak.

The recent lows around $0.342 act as short-term support. If the price holds above this zone, it could attempt another move towards the 21-EMA at 0.3817. According to technical analyst Ali Martinez , if ENA defends this support level, it could climb to $0.473.

However, if this support fails, the price could drop to $0.30 – $0.32, where the price consolidated in October last year before breaking out into a major bullish rally .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!