Bitcoin (BTC) Price Prediction for April 2

Even though Wednesday has started bearish for the market, some coins are coming back to the green zone, according to CoinStats.

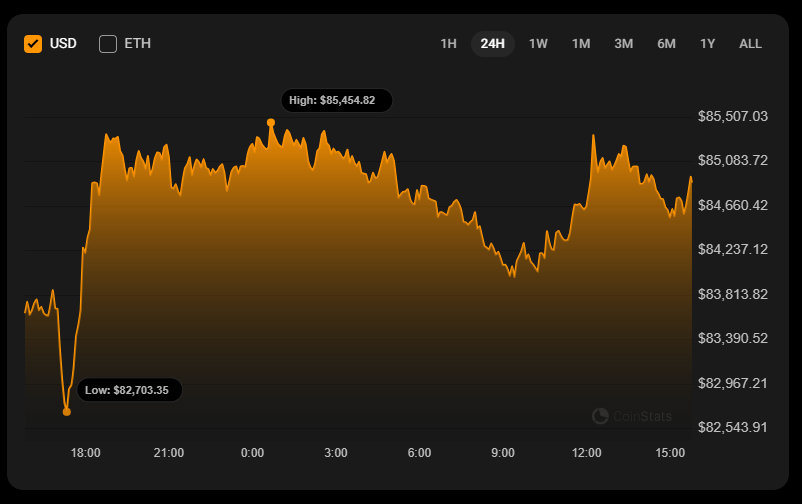

BTC/USD

The price of Bitcoin (BTC) has risen by 0.22% over the last day.

On the hourly chart, the rate of BTC is trying to come back to the local resistance of $85,235. If bulls' pressure continues, there is a chance to see a test of the $86,000 mark.

On the bigger time frame, traders should focus on the candle's closure in terms of the previous bar peak.

If it happens around $86,000, the upward move is likely to continue to the $88,000-$90,000 area.

From the midterm point of view, the price of the main crypto keeps accumulating energy. The volume remains low, which means traders are unlikely to expect sharp ups or downs shortly.

Bitcoin is trading at $85,325 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!