Bitcoin ETFs Extend Losing Streak With $158M Outflow As Ether ETFs Also Retreat

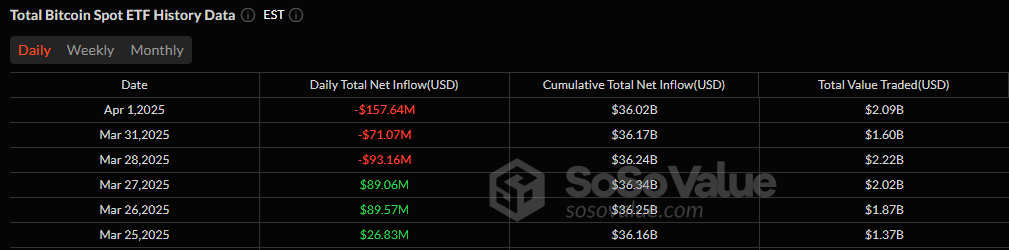

The bleeding continued for bitcoin ETFs on the first day of April, with a 3rd straight day of outflows. The hefty $157.64 million exit reinforced bearish sentiment in the crypto ETF space.

Ark 21shares’ ARKB led the sell-off with a substantial $87.37 million outflow, followed by Fidelity’s FBTC with $85.35 million in redemptions. Grayscale’s GBTC and Wisdomtree’s BTCW also recorded outflows of $10.07 million and $6.76 million, respectively.

Source: Sosovalue

Not all funds were in the red, though. Bitwise’s BITB pulled in $24.53 million, while Franklin’s EZBC added $7.39 million, but these inflows did little to counter the broader exodus. At the end of the trading day, bitcoin ETF net assets stood at $95.45 billion, with total trading volume surging to $2.09 billion.

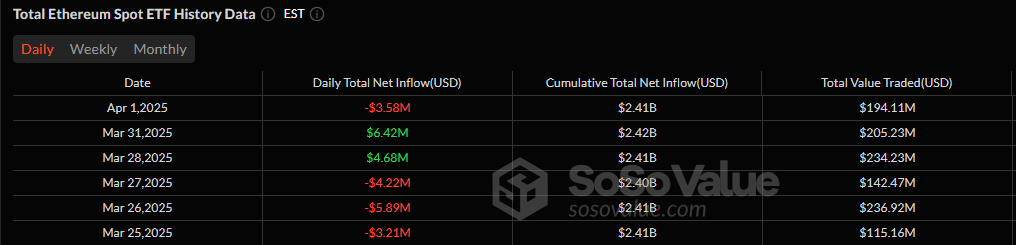

Ether ETFs, after two brief days of inflows, fell back into negative territory with a $3.58 million outflow. Grayscale’s ETH led the decline, losing $2.7 million, while Bitwise’s ETHW shed $2.6 million.

Source: Sosovalue

A modest $1.72 million inflow from 21shares’ CETH wasn’t enough to change the tide, as total net assets for ether ETFs settled at $6.54 billion, with daily trading volume reaching $194.11 million.

With crypto markets facing macroeconomic uncertainty and renewed investor caution, the ETF space continues to see capital flight. Bitcoin ETFs are now navigating a renewed sell-off, while ether ETFs struggle to break out of their long-term downtrend. The question remains: How long will the sell-off last?