QCP Capital: The market is focusing on tonight's non-farm unemployment report, hoping for a short-term rebound

QCP Capital announced on its official channel that Trump declared a 10% tariff on all imported goods this Wednesday, and implemented "reciprocal tariffs" against countries with high trade deficits with the United States. The market responded quickly. Bitcoin plummeted from an intraday high of $88,500 to $81,200, erasing earlier gains and triggering a massive liquidation in the cryptocurrency market. More than $221 million in long positions were forcibly closed, with Bitcoin taking a harder hit compared to Ethereum.

As expected, risk assets fell across the board. U.S. stock index futures took the brunt of it; S&P 500 futures fell by 3.38%, while Nasdaq 100 futures plunged by 4.28%. The sell-off continued into yesterday's U.S. stock trading session; consumer stocks like American Eagle Outfitters plummeted by 17.47%, reflecting investors' concerns about exposure to Asian supply chains.

As key macro risk events settle, the market focus shifts to tonight's non-farm employment report. Investors are on alert for signs of weakness in the US labor market. If data is below expectations, it will strengthen the reason for the Federal Reserve to further cut interest rates this year - policymakers are trying to buffer economic slowdown. As of press time, the market expects four rate cuts (25 basis points each in June, July, September and December) in 2025.

In terms of options markets, trading desks have observed that short-term volatility remains high and demand for downside protection has surged. This bias highlights current market sentiment: uncertainty and caution dominate. Nevertheless, as positions have become lighter and risk assets generally oversold, a stage may already be set for a short-term rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Biodefense startup Valthos raises $30 million in funding, with participation from OpenAI

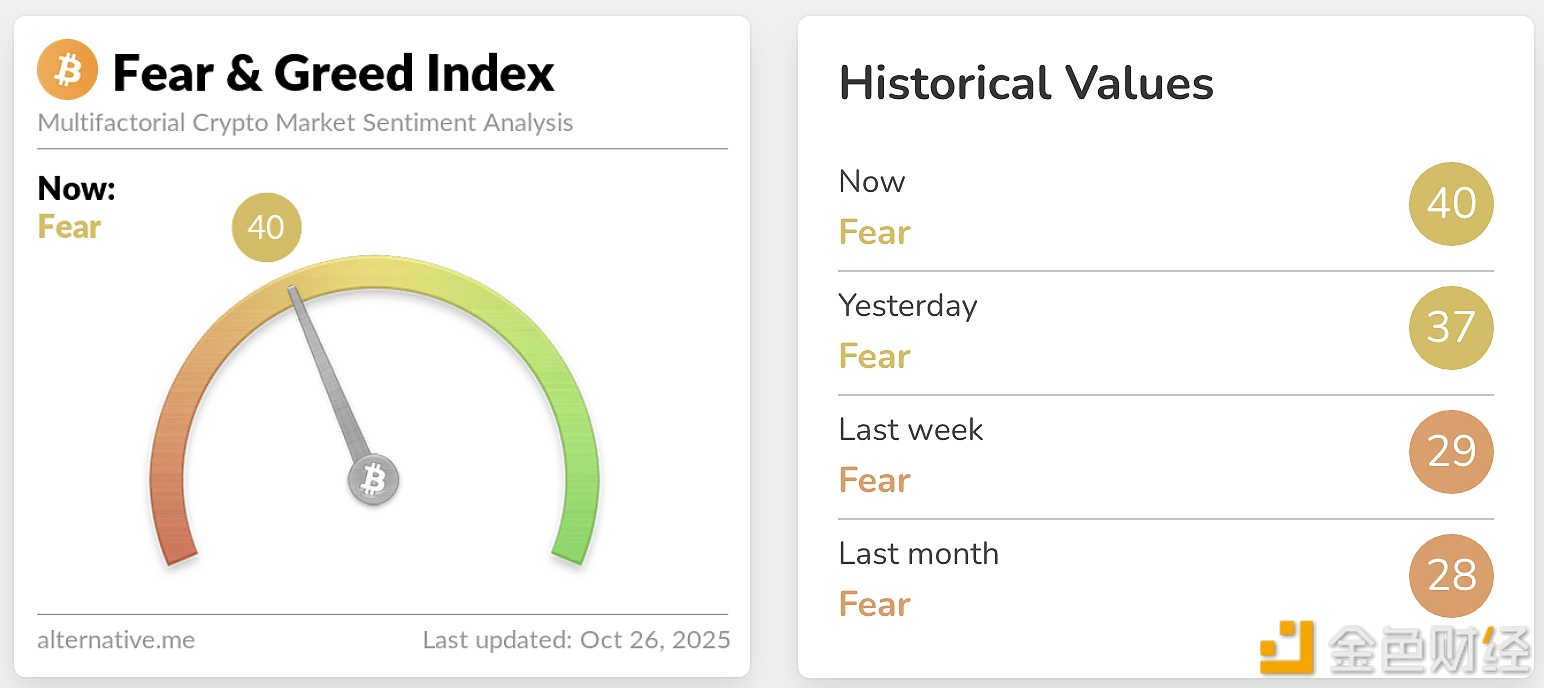

Today's Fear and Greed Index rises to 40, still in a state of fear