On April 2, 2025, President Trump declared the implementation of “Liberation Day” tariffs, enacting a sweeping 10% duty on all imported goods effective April 5, accompanied by countervailing tariffs targeting nearly 90 trading partners – including China, the EU, Canada, and Mexico. While the administration framed these measures as necessary to correct trade imbalances and combat unfair practices, economists immediately warned of potential shockwaves through the global economic system.

The following day, April 3, financial markets reeled as the Dow Jones Industrial Average plummeted 1,630 points in its worst single-day performance in years. The S&P 500 mirrored this distress with its most severe decline since the pandemic-induced volatility of 2020, while the Nasdaq Composite experienced a parallel rout of similar magnitude. The cryptocurrency market wasn’t spared, with the broader digital asset sector losing 5.21% of its value and bitcoin ( BTC) specifically shedding 6.7% against the dollar.

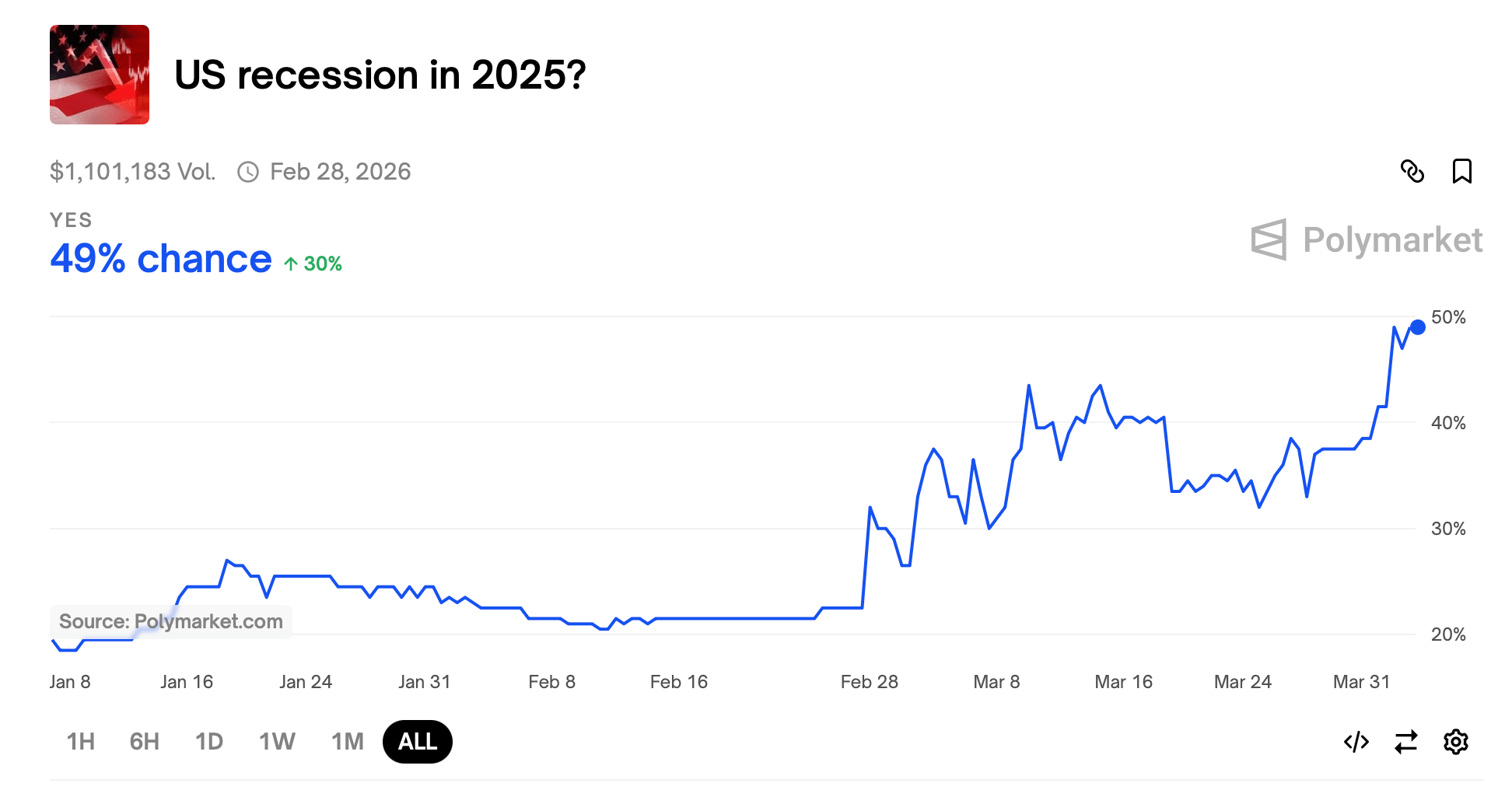

Polymarket’s prediction market now shows heightened probability of a recession, with $1.1 million wagered on the outcome. The likelihood stood at a modest 39% on March 31, then leaped to 49% following Wednesday’s presidential announcement. While experiencing marginal fluctuations earlier today, the probability remained firmly at 49% as of 4:30 p.m. ET Thursday.

The contract’s comment section has become a battleground of political jabs, with critics targeting Trump supporters over economic anxieties. “Remember a few months ago when Kamala Yessers were getting laughed at in here for saying Trump WILL crash the economy? Who’s laughing now, regards?” quipped one particularly sardonic participant, capturing the tense mood. The U.S. equity market hemorrhaged a staggering $2.85 trillion in value today, with the S&P 500 bearing the brunt of this financial maelstrom.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。