Bitcoin Drops Below $75,000: Is This Time to Buy the Dip? | ETF & Derivatives Daily

Bitcoin has dropped below the $75,000 mark, signaling a bearish phase. However, futures data and positive funding rates suggest market optimism persists despite the dip.

The leading coin, Bitcoin, has slipped below the $75,000 mark. As of writing, it is trading at around $74,800, the levels last seen during November 2024.

The asset is down 7% on the day, while trading volume has surged over 200%, signaling intense selling pressure. With a strengthening bearish bias, the leading crypto might be set on recording new lows in the near term.

Bitcoin Futures Show Traders Pulling Out, But Bulls Aren’t Letting Go

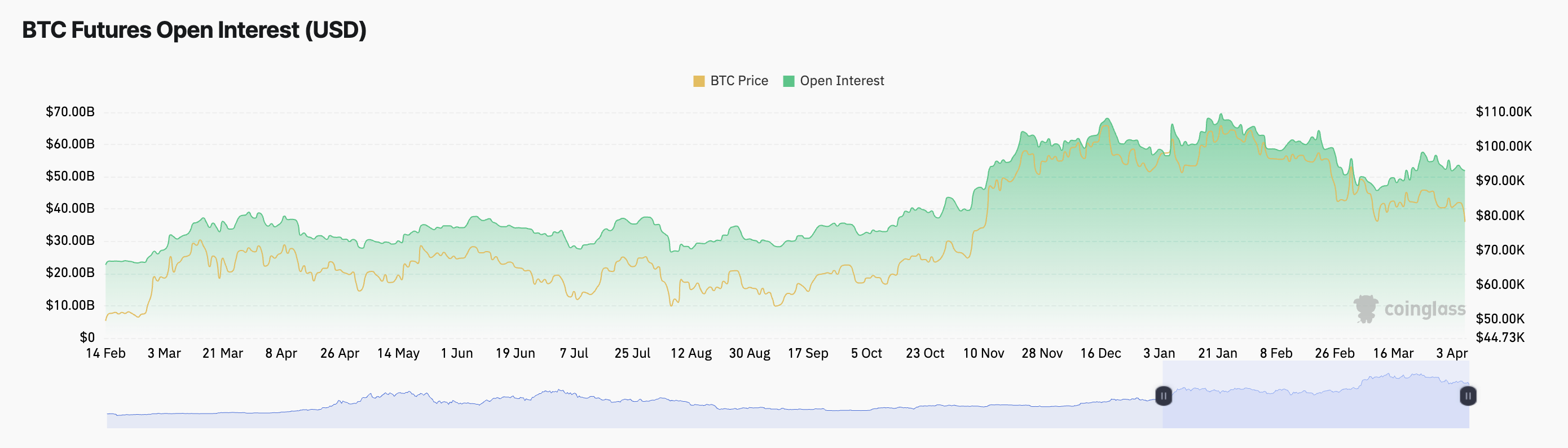

This bearish wave in BTC’s market is reflected in the coin’s falling futures open interest (OI), which points to traders closing positions and exiting the market. At press time, this stands at $51.88 billion, plummeting 1% over the past 24 hours.

Bitcoin Open Interest. Source:

Coinglass

Bitcoin Open Interest. Source:

Coinglass

BTC’s futures OI measures the total number of active futures contracts that have not been settled or closed. When it falls like this, it usually indicates that traders are closing out positions—either taking profits or cutting losses—rather than opening new ones.

This decline signals reduced market participation and waning confidence in the possibility of any short-term price rebound.

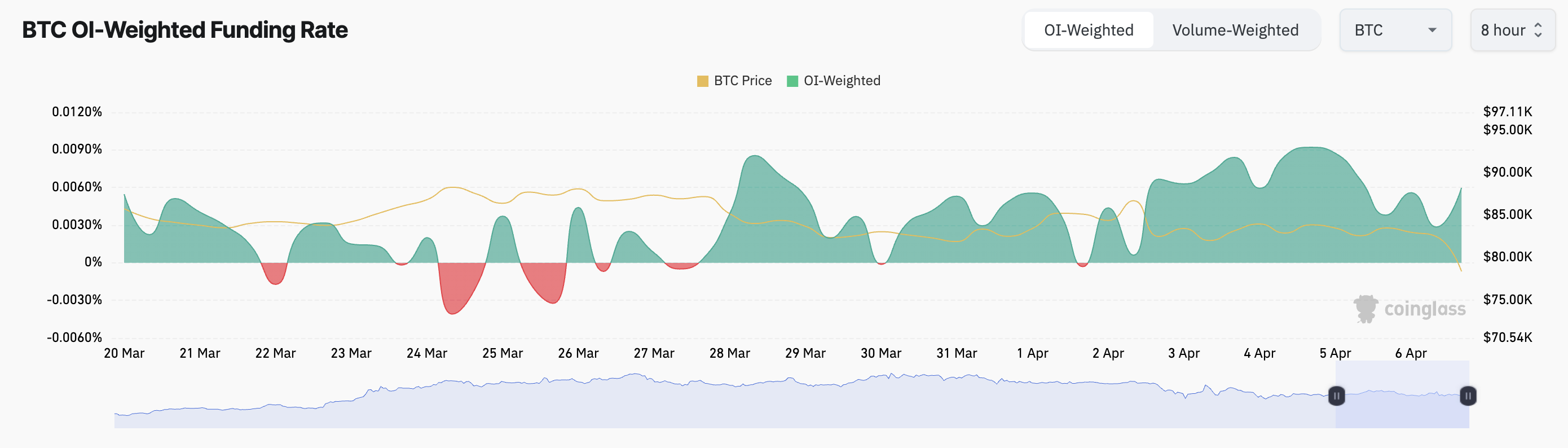

However, despite the sharp decline, market sentiment remains surprisingly resilient. BTC’s steady positive funding rate, currently at 0.0060%, reflects this.

Bitcoin Funding Rate. Source:

Coinglass

Bitcoin Funding Rate. Source:

Coinglass

The funding rate is a periodic payment between long and short traders in perpetual futures contracts designed to keep prices in line with the spot market. A positive funding rate means traders holding long positions are paying those with shorts, indicating that more traders are betting on prices going up.

This trend reflects the dominance of bullish sentiment among many BTC holders in the market, even as the coin’s prices are temporarily falling.

Options Traders Brace for More Downside

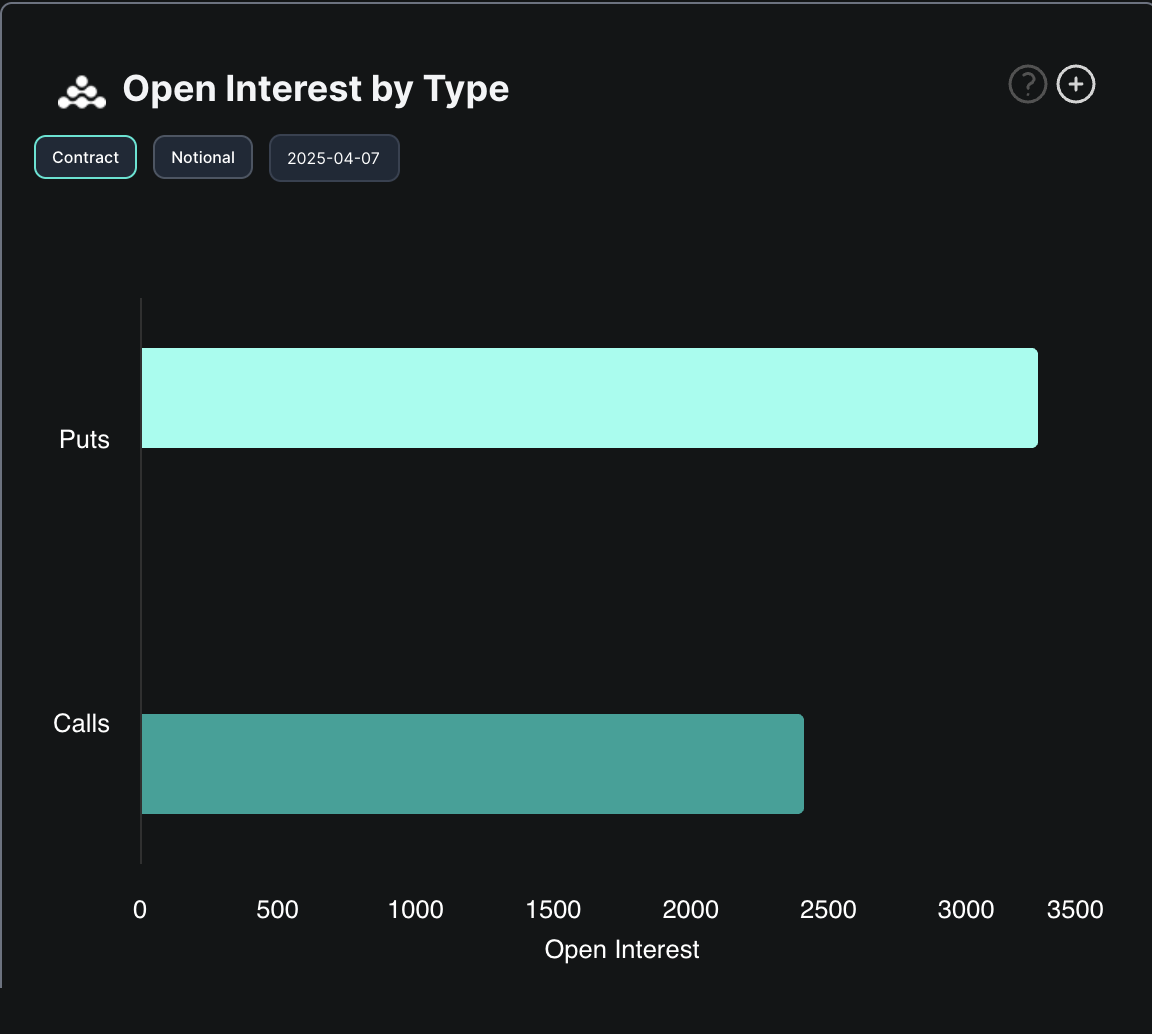

Data from the options market confirms the spike in selling pressure among traders. According to Deribit, there are currently more open put contracts than calls. This is a clear sign that investor confidence in a short-term Bitcoin rebound continues to fade.

Bitcoin Options Market Data. Source:

Deribit

Bitcoin Options Market Data. Source:

Deribit

It can be said that this mix of signals—bullish funding rates, bearish options positioning, and falling OI— points to one thing. It highlights a market in conflict, where sentiment is split and uncertainty reigns. Hence, caution is advised.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DefiLlama founder: Under pressure for investigating and questioning Figure's claimed RWA data

XRP May Reenter Global Top 100 After Price Tops $3 Amid ETF Developments