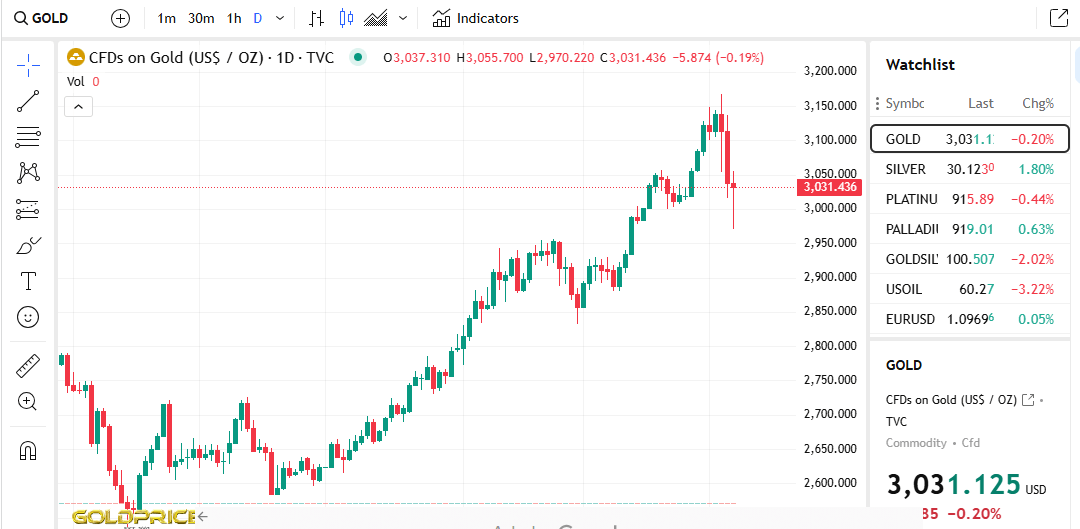

After a rally that saw it reach new milestones in the first quarter of 2025, gold appeared to be a victim of the trade war, dropping below $3,000 per ounce for the first time since March 18. Data showed gold traded at just above $2,969 at one point on April 7 before staging a recovery.

The precious metal’s price performance came against the backdrop of plunging markets. Prior to its nearly 3% drop in the opening trading hours, gold had largely trended upward, rising from just over $2,500 per ounce at the start of 2025 to peak at more than $3,165 on April 3. With a year-to-date gain of more than 25% at the time, gold seemed to be investors’ go-to asset in uncertain times.

The revived perception of gold as a safe-haven asset among investors prompted U.S. investment banking giant Goldman Sachs to revise its year-end projection upward to more than $2,600 per ounce. At the time, gold’s contrasting fortunes with those of bitcoin, which is down 17% from its Jan. 1, 2025, helped to revive debate on which of the two assets is a better store of value.

However, the precious metal’s drop of nearly $100 in the opening trading hours on so-called Black Monday again appeared to upend its safe-haven asset credentials. Gold’s drop just hours before U.S. markets were set to open highlighted deepening fears that U.S. President Donald Trump’s trade war was driving the global economy into a recession.

As reported by Bitcoin.com News, the trade war, which escalated with Trump’s “Liberation Day” tariff announcement, left Asian markets reeling on April 7. On that day, Hong Kong’s main stock market index dropped more than 13%, its worst single day loss in more than two decades. An intervention by China’s sovereign wealth fund limited the Asian nation’s blue-chip stock index losses to 7%.

However, at the time of this report (April 7, 6:45 a.m. EST), gold, like global stocks, had recovered and was trading above $3,000 per ounce.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。