China Hits Back with Rare Earth Export Controls — U.S. Tech and Crypto Markets on High Alert

China Strikes Back with Rare Earth Export Controls

Tensions between the U.S. and China are escalating fast. In a fresh move that could have major consequences across multiple industries, China has imposed rare earth export controls — a critical blow aimed squarely at U.S. technology and defense supply chains.

Rare earth elements are indispensable for the production of semiconductors, electric vehicles, military hardware, and even some mining rigs used in cryptocurrency operations. With China controlling over 70% of the global rare earth supply, this decision could set off a new wave of economic turbulence.

A Calculated Retaliation by Beijing

China’s move is widely seen as retaliation against increasing U.S. pressure, particularly in the form of new tariffs and restrictions on Chinese tech. But this isn't a simple tit-for-tat — it’s a display of Beijing’s long-term leverage and strategic patience.

Contrary to common belief, China is not as economically reliant on the U.S. as it once was. Over the past decade, China’s export economy has surged by nearly 80%, but its trade with the U.S. has remained stagnant, consistently hovering around 15–16%. More importantly, trade with the U.S. now accounts for less than 2% of China’s GDP.

In other words, Washington’s efforts to threaten or pressure China economically might not carry the weight many assume. The Chinese leadership, seasoned by decades of internal strife and political survival, is unlikely to fold in response to external threats — especially not ones targeting such a small portion of their economic engine.

If the U.S. chooses to raise tariffs even further, experts believe it could backfire, inflicting more pain on American companies while having minimal impact on China. The Chinese government appears unbothered by the possibility of U.S. consumption dropping from 16% to, say, 10% — and seems prepared for a longer-term standoff.

Tech, Defense, and Crypto in the Crosshairs

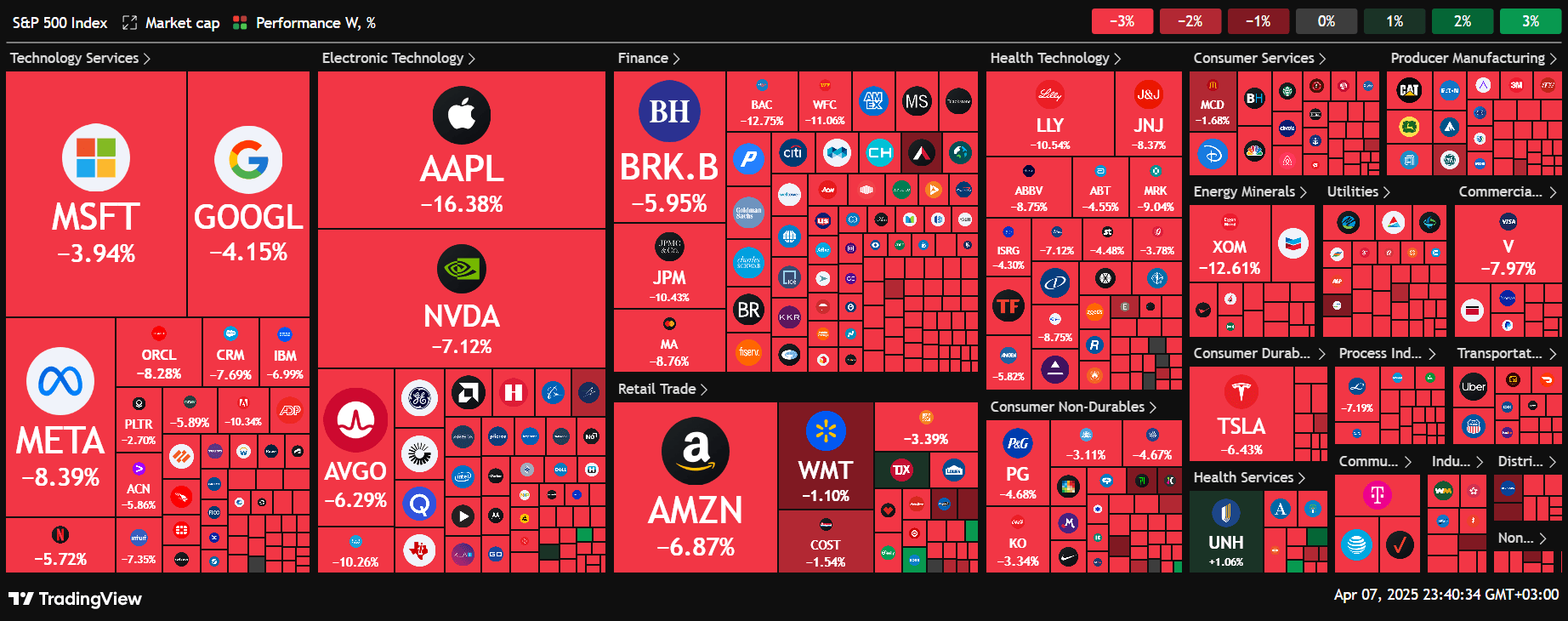

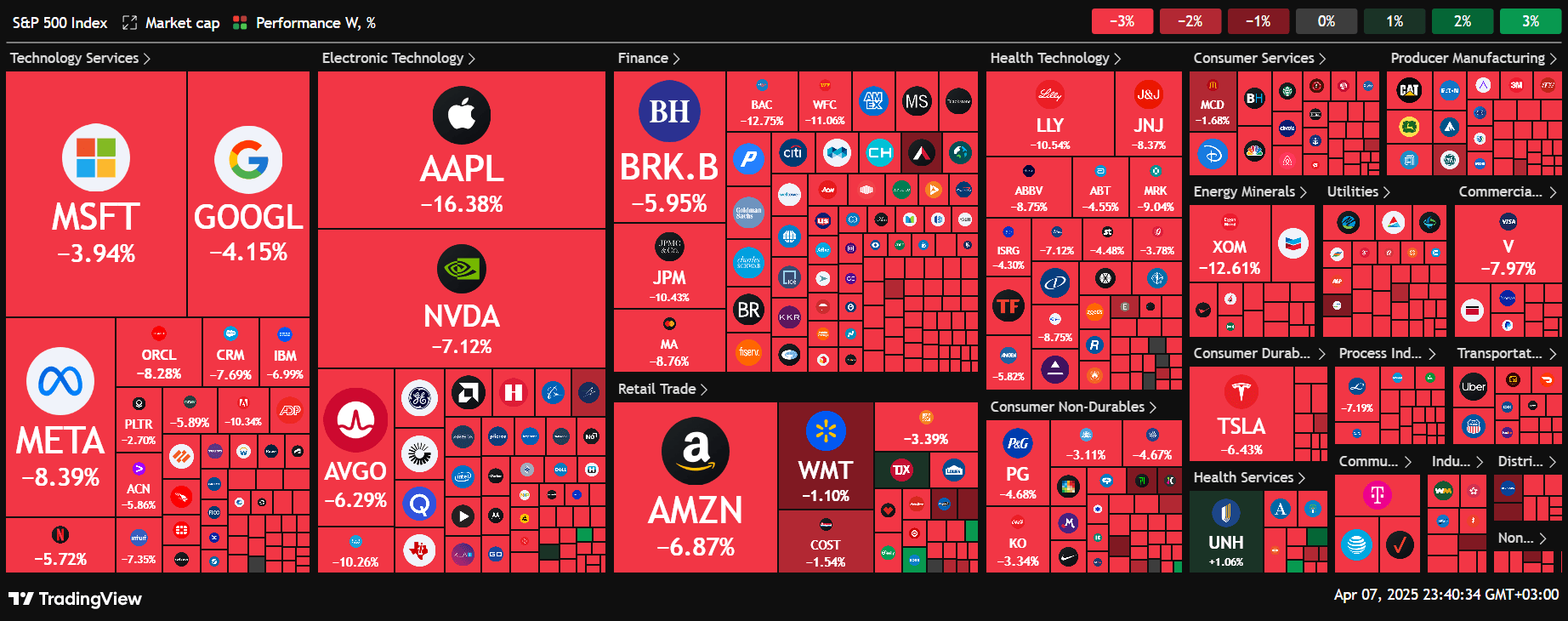

The implications of restricted rare earth exports are massive. These materials are essential in manufacturing everything from smartphones and wind turbines to fighter jets and crypto mining equipment. For tech giants that rely on a steady supply of specialized components, this could lead to production delays, higher costs, and disruptions across the board. In the mining and crypto industries, where equipment performance is heavily reliant on rare earth-based components, the impact could be severe.

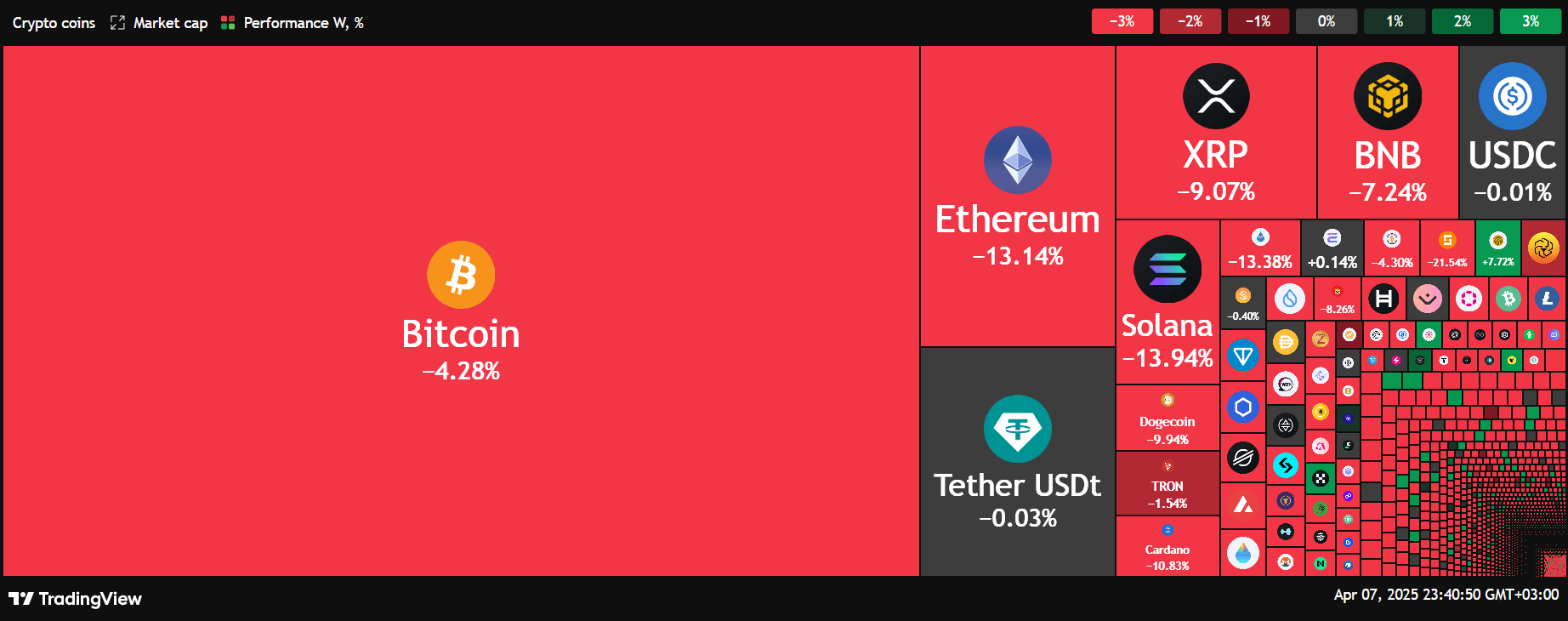

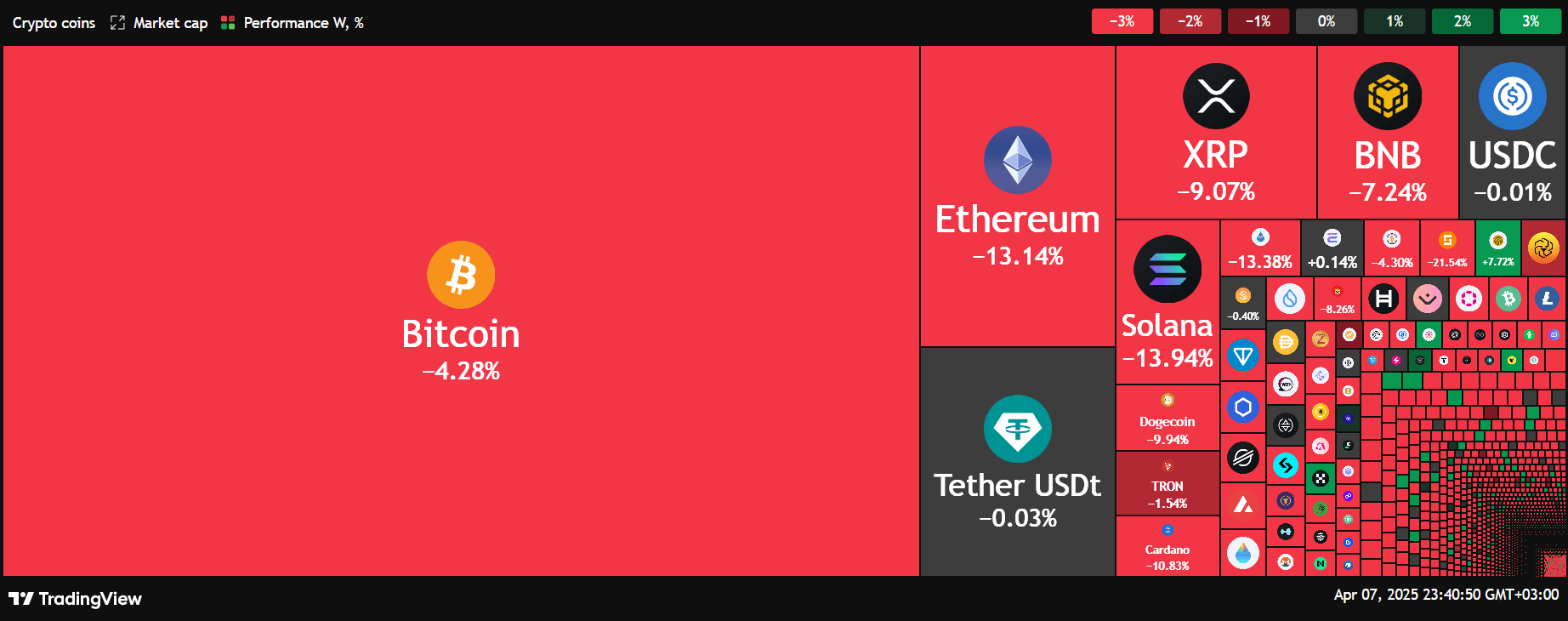

The crypto market, already reeling from a broader market crash and growing global uncertainty, might find itself under even more pressure. If mining operations slow down or become more expensive, this could lead to further selloffs, dragging Bitcoin and altcoins deeper into the red.

Crypto News: What’s Next?

With both superpowers digging in their heels, this isn’t just another flare-up — it could be the beginning of a prolonged economic cold war. And as the tech and crypto sectors brace for impact, investors worldwide are watching closely.

China Strikes Back with Rare Earth Export Controls

Tensions between the U.S. and China are escalating fast. In a fresh move that could have major consequences across multiple industries, China has imposed rare earth export controls — a critical blow aimed squarely at U.S. technology and defense supply chains.

Rare earth elements are indispensable for the production of semiconductors, electric vehicles, military hardware, and even some mining rigs used in cryptocurrency operations. With China controlling over 70% of the global rare earth supply, this decision could set off a new wave of economic turbulence.

A Calculated Retaliation by Beijing

China’s move is widely seen as retaliation against increasing U.S. pressure, particularly in the form of new tariffs and restrictions on Chinese tech. But this isn't a simple tit-for-tat — it’s a display of Beijing’s long-term leverage and strategic patience.

Contrary to common belief, China is not as economically reliant on the U.S. as it once was. Over the past decade, China’s export economy has surged by nearly 80%, but its trade with the U.S. has remained stagnant, consistently hovering around 15–16%. More importantly, trade with the U.S. now accounts for less than 2% of China’s GDP.

In other words, Washington’s efforts to threaten or pressure China economically might not carry the weight many assume. The Chinese leadership, seasoned by decades of internal strife and political survival, is unlikely to fold in response to external threats — especially not ones targeting such a small portion of their economic engine.

If the U.S. chooses to raise tariffs even further, experts believe it could backfire, inflicting more pain on American companies while having minimal impact on China. The Chinese government appears unbothered by the possibility of U.S. consumption dropping from 16% to, say, 10% — and seems prepared for a longer-term standoff.

Tech, Defense, and Crypto in the Crosshairs

The implications of restricted rare earth exports are massive. These materials are essential in manufacturing everything from smartphones and wind turbines to fighter jets and crypto mining equipment. For tech giants that rely on a steady supply of specialized components, this could lead to production delays, higher costs, and disruptions across the board. In the mining and crypto industries, where equipment performance is heavily reliant on rare earth-based components, the impact could be severe.

The crypto market, already reeling from a broader market crash and growing global uncertainty, might find itself under even more pressure. If mining operations slow down or become more expensive, this could lead to further selloffs, dragging Bitcoin and altcoins deeper into the red.

Crypto News: What’s Next?

With both superpowers digging in their heels, this isn’t just another flare-up — it could be the beginning of a prolonged economic cold war. And as the tech and crypto sectors brace for impact, investors worldwide are watching closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!