Bitcoin Long-Term Holders Break Silence — Is the Market Heading for a Big Sell-Off?

Bitcoin's long-term holders are showing signs of selling, driving concerns of further price drops. A surge in Coin Days Destroyed and weakening market signals hint at potential downturns for BTC.

Over the past few days, the wave of liquidations across the cryptocurrency market has shaken investor confidence, leaving many traders on edge. With strengthening bearish pressure, many BTC holders are distributing their coins.

Bitcoin’s long-term holders (LTHs), typically known for extended grip on their coins, have begun selling, adding further pressure to an already cautious market. What does this mean for the coin in the short term?

Old BTC Heads to Exchanges — Are Long-Term Holders Losing Confidence?

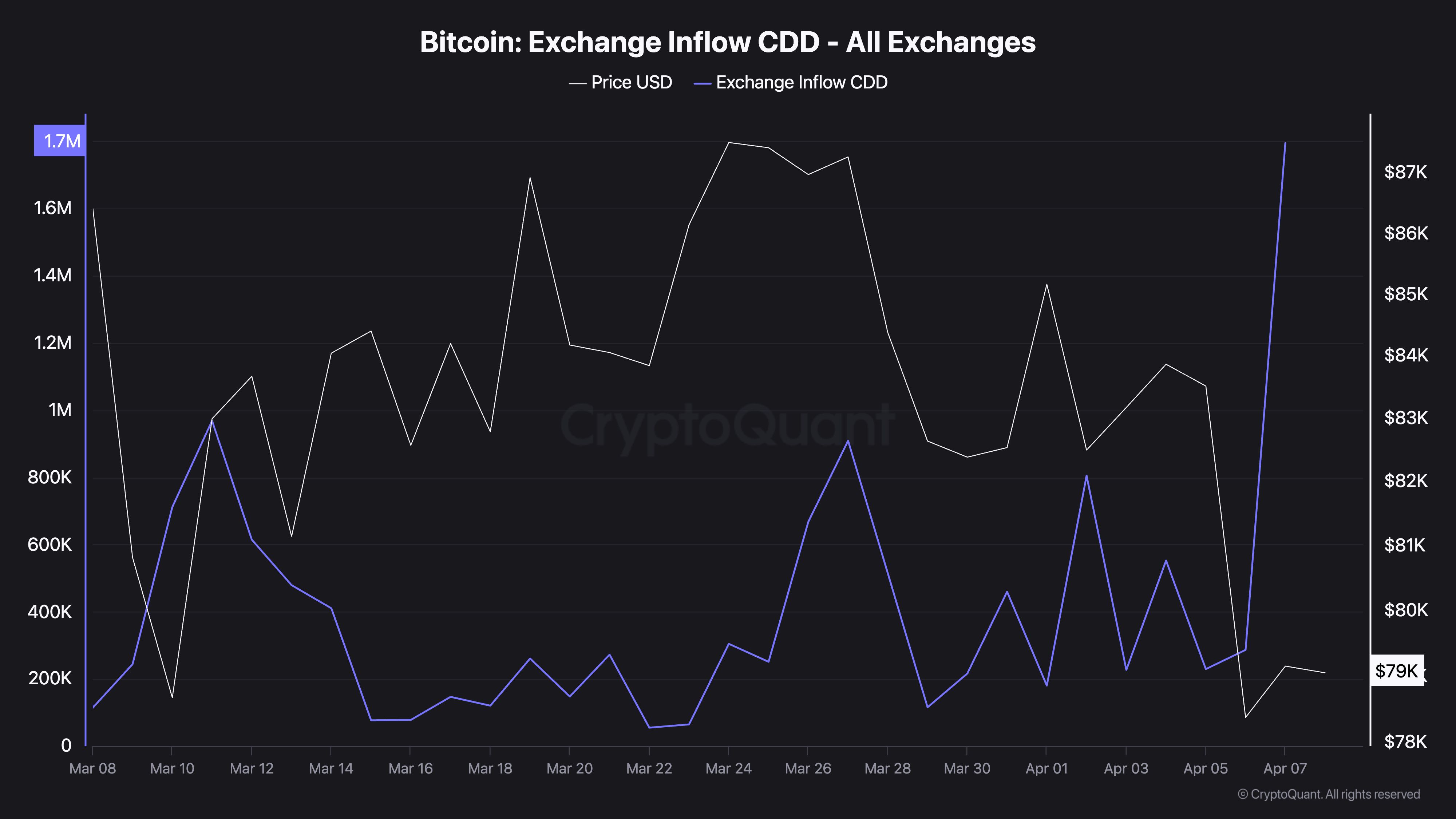

The Coin Days Destroyed (CDD) of Bitcoin being deposited onto exchanges has reached its highest point in 30 days.

According to CryptoQuant, this currently sits at 1.79 million, soaring by over 850% since the beginning of April. This surge signals that coins held for long periods are now being transferred to exchanges, a classic precursor to potential sell-offs.

Bitcoin Exchange Inflow CDD. Source:

CrytpoQuant

Bitcoin Exchange Inflow CDD. Source:

CrytpoQuant

BTC’s Exchange Inflow CDD tracks the movement of older coins into exchanges. It is calculated by multiplying the amount of BTC moved by the number of days those coins have been held without being spent.

When it spikes, it means that LTHs are moving their coins to exchanges, possibly to sell. This trend is noteworthy because this group of investors has “strong hands.” They rarely sell unless there are concerning market conditions. Therefore, when they do, it suggests that their confidence is weakening and hints at a further price drop.

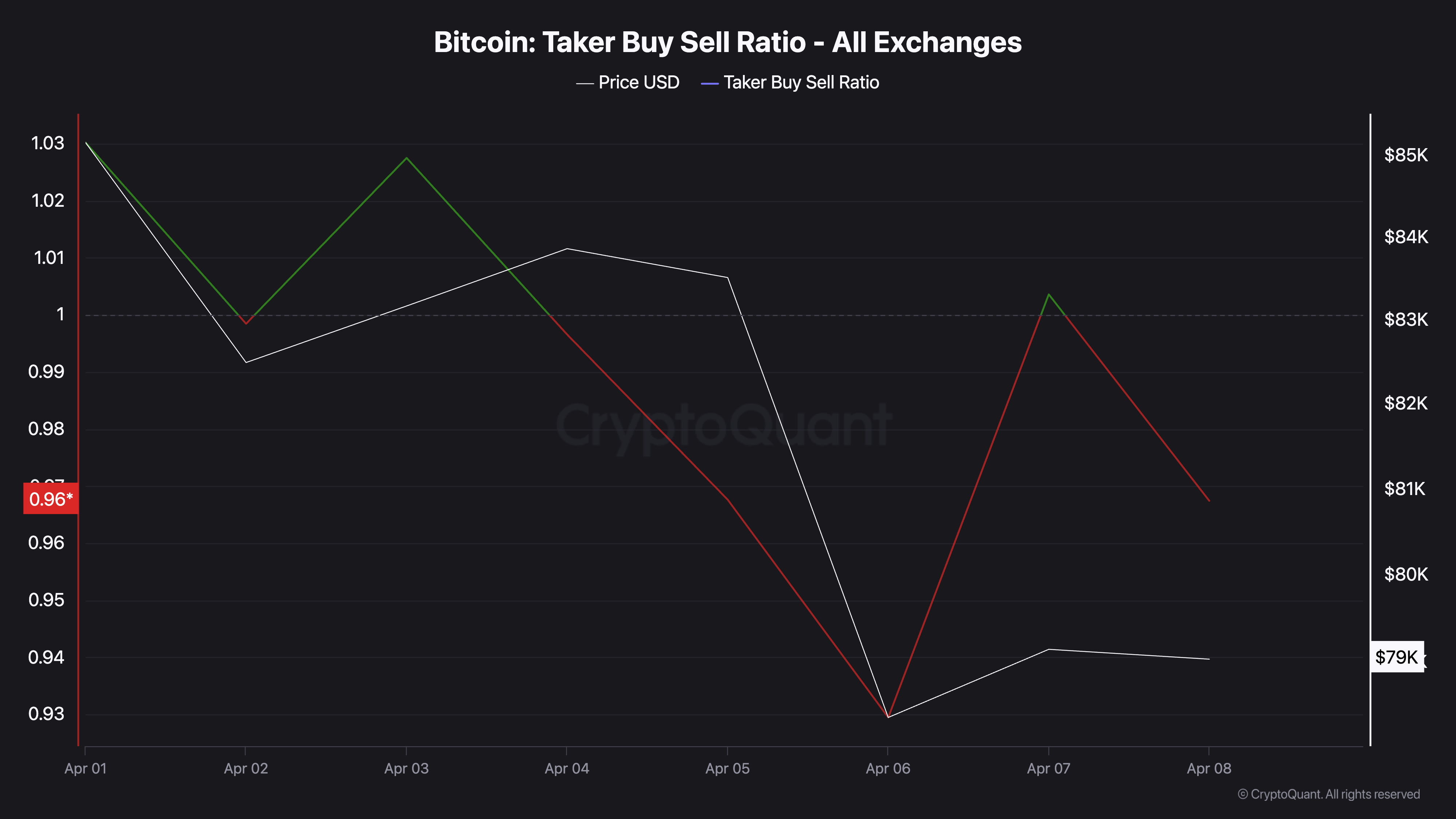

The sell-side momentum is also reflected in the derivatives market. BTC’s taker buy-sell ratio is currently below one, indicating that sell orders outweigh buy orders on futures and perpetual contracts.

Bitcoin Taker Buy Sell Ratio. Source:

CrytpoQuant

Bitcoin Taker Buy Sell Ratio. Source:

CrytpoQuant

This suggests that the coin’s derivatives traders are positioning themselves for further downside, amplifying the current bearish sentiment.

BTC Rally Faces Resistance as Buying Power Weakens

The market has attempted a modest recovery in the past few hours, with the total crypto market cap adding $48 billion over the last day. This uptick in activity has driven BTC’s price up by 4% in the past 24 hours.

However, the coin’s plummeting Chaikin Money Flow (CMF) is flashing a warning sign, forming a bearish divergence. At press time, the CMF has dropped below the zero line to -0.15 and continues to trend downward.

A bearish divergence emerges when an asset’s price rises while its CMF declines. This signals that buying pressure is weakening beneath the surface despite the price rally. If this continues, BTC could shed recent gains to trade at $74,389.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if the coin witnesses a resurgence in new demand, it could maintain its rally and climb toward $80,776.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!