Time to move on: CT breakup guideThe Twitter addiction we won't admit toUnderstanding the real user journeyYour crypto project deserves better than T

The Twitter addiction we won't admit to

I've been thinking about this a lot lately. Crypto projects have become dangerously dependent on Twitter. We announce launches there, build communities there, every funnel starts there. But relying on a single platform is like putting all your eggs in a basket owned by a billionaire with mood swings.

Honestly, we've gotten lazy as fuck. Twitter's quick dopamine hits made us comfortable. We post a few tweets, interact with the same circle of crypto bros, and call it a day.

But just like any toxic relationship, this dependence is slowly killing your project.

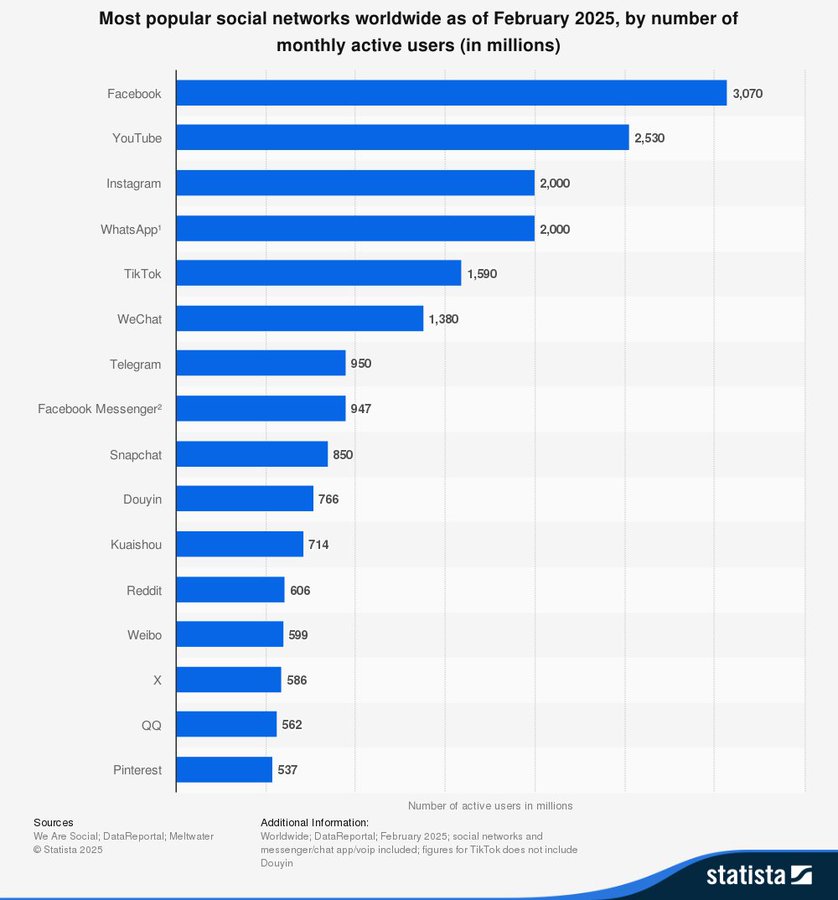

Real crypto users aren't just on Twitter. They're everywhere: Discord, Reddit, Tiktok, Telegram, and platforms you've been too comfortable to explore. The echo chamber of CT has created a false sense of security, making you believe your reach is wider than it actually is.

For most crypto teams, Twitter isn't just a platform: it's the entire marketing plan.

"We're crushing it on CT" really means "we have no idea how to reach actual users."

Here's the uncomfortable truth: Twitter is just a tiny town, not an entire city.

Understanding the real user journey

Think about it. How do we make even the simplest purchasing decisions? We ask people we trust or check social media.

Now imagine: someone wakes up and remembers their friend mentioning your project. Congrats! You’ve just unlocked the holy grail of marketing: word of mouth.But what happens next?

- They Google it, check out your website (which probably they can't understand shit), look for reviews, and news about you (yes PR matters)

- They dig deeper into your social channels to see what people are saying (they gonna check even your Linkedin)

- Only after all this do they decide whether to buy or get involved.

See the problem? This journey spans multiple platforms, but you've been exclusive with Twitter this whole time. You've been limiting your dating pool.

Your crypto project deserves better than Twitter

Here's my challenge to you: for the next 30 days, cut your project's Twitter posting frequency in half.

Use that time to build a presence on two other platforms you ever tried. (yes, even LinkedIn counts)Show up, experiment, and track what happens. If nothing changes, go back to Twitter and pretend this never happened.

What do you lose by taking this challenge? A few shitty engagement metrics on tweets nobody reads anyway.

What do you gain? A real brand that isn’t tied to a single platform, new users, and most importantly a killer case study you can talk about for a year.

The Twitter breakup will hurt for a minute. But trust me, the rebound relationships will be worth it.

Be the 1% that builds new

Your marketing strategy one algorithm change away from irrelevance

If Twitter disappeared tomorrow, would your project survive? Be honest.Don’t learn this the hard way, relying on one platform is like keeping all your crypto in a single wallet. It's reckless and unnecessary.

Diversification isn't just good advice for a crypto portfolio, it's essential for crypto marketing too. Yet we keep putting all our eggs in the Twitter basket, then act shocked when they break.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget Will List Almanak (ALMANAK). Come and grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone