Crypto Stocks Plunge As Trump’s 104% China Tariffs are Set to Go Live

As President Trump's tariffs against China take effect, the crypto market faces massive liquidations. Despite the chaos, Bitcoin's rising long positions may signal potential recovery.

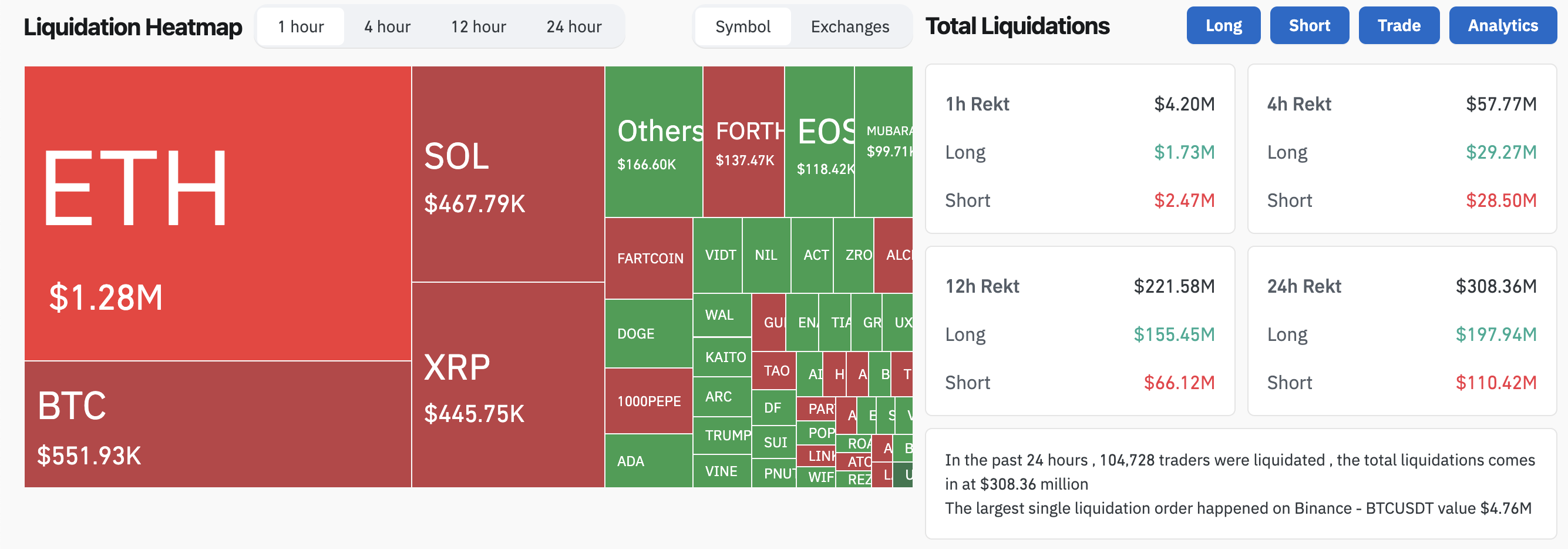

The White House confirmed that 104% tariffs against China will go live at midnight tonight, much to the woe of the crypto market. After a brief recovery to $79,000, Bitcoin fell to $76,000 amid $300 million in total crypto liquidations.

There are a few points of optimism, as Bitcoin’s long positions rose to 54%. Tomorrow will be a critical day to follow; it may bring chaos to TradFi, but crypto could potentially weather the storm.

Trump’s Tariffs Massacre Crypto Market

Trump’s tariffs are about to take effect, and the markets are in a profound moment of uncertainty. Yesterday, over $1 billion was liquidated from the crypto market, but optimism about a potential deal buoyed prices today.

The White House subsequently confirmed that 104% tariffs against China would take effect at midnight, prompting crypto to drop again:

Crypto Liquidation Heatmap. Source:

Coinglass

Crypto Liquidation Heatmap. Source:

Coinglass

China is America’s largest trading partner, and these sweeping tariffs could devastate the markets. Crypto, however, has been especially devastated. Publicly listed crypto companies faced another day of harsh drops after the tariff confirmation, as MicroStrategy’s MSTR slumped over 11%.

Additionally, Coinbase, Robinhood, and publicly traded Bitcoin miners all approached a 5% drop.

MicroStrategy MSTR Stock Price. Source:

Google Finance

MicroStrategy MSTR Stock Price. Source:

Google Finance

Bitcoin might be in a particularly dangerous position. Although a recent report claimed that it has been one of the crypto sector’s most tariff-proof assets, its risk profile might be changing.

It dropped 2.6% today, approaching the $75,000 price mark as more than $300 million was liquidated from crypto. If Bitcoin falls below this point, it could trigger further price routs.

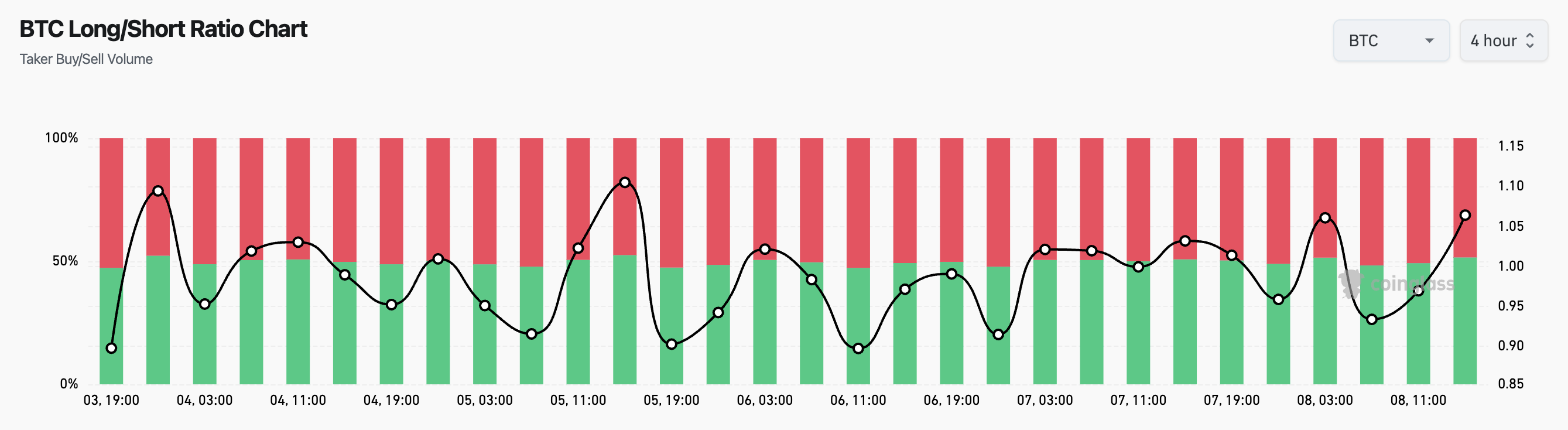

Bitcoin Long-Short Ratio Fuels Optimism

As this morning’s price gains clearly demonstrated, the market still has a lot of remaining optimism. This could help all of crypto withstand tariff threats, including Bitcoin.

Its long positions have surged to 54%, showing that most traders are betting on BTC to rebound back to a higher price point.

Traders Go Long on Bitcoin Despite Tariffs. Source:

Coinglass

Traders Go Long on Bitcoin Despite Tariffs. Source:

Coinglass

Ultimately, tomorrow will be a very critical day for tariffs, crypto, and TradFi markets as a whole. It’s probably too late to hold out hope that Trump will decide not to escalate with China.

However, it remains to be seen whether the crypto market will continue to co-relate with the stock market after the tariffs are live or at-risk assets will reverse course and hedge against potential inflation fears.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!