Chainlink Climbs 8% Amid CCIP Expansion and Institutional Traction: Can $LINK Hold $11 Support?

Chainlink ($LINK) surges 8% after rebounding from near-2022 lows, fueled by its recent integration with Hedera's CCIP and increased institutional interest from major players like PayPal, Ripple, and WLFI.

Chainlink ($LINK) gained 8% this week following months of decline, after dropping nearly 40% year-to-date and narrowly avoiding a retest of its 2022 bear market lows.

The decentralized oracle protocol continues to prove useful by connecting blockchain applications with real-world data, reinforcing its role in the ecosystem despite broader market weakness.

CCIP Launch on Hedera and Institutional Integration

On April 8, Chainlink announced that its Cross-Chain Interoperability Protocol (CCIP) went live on the Hedera mainnet.

The launch allows developers on Hedera to build secure cross-chain applications and transfer tokens without relying on external bridges.

Chainlink’s CCIP has already been integrated across multiple blockchains and is now making progress within traditional finance channels.

On April 3, PayPal expanded its crypto offerings in the U.S. by enabling users to buy, sell, hold, and transfer Chainlink ($LINK) directly through its platform, removing the need for third-party services like MoonPay.

Ripple also announced in January that it had adopted Chainlink’s CCIP standard to bring its upcoming RLUSD stablecoin pricing data on-chain, highlighting its continued integration into institutional-grade systems.

As of early April, CCIP data showed that Chainlink’s cross-chain transaction value surpassed $33 billion.

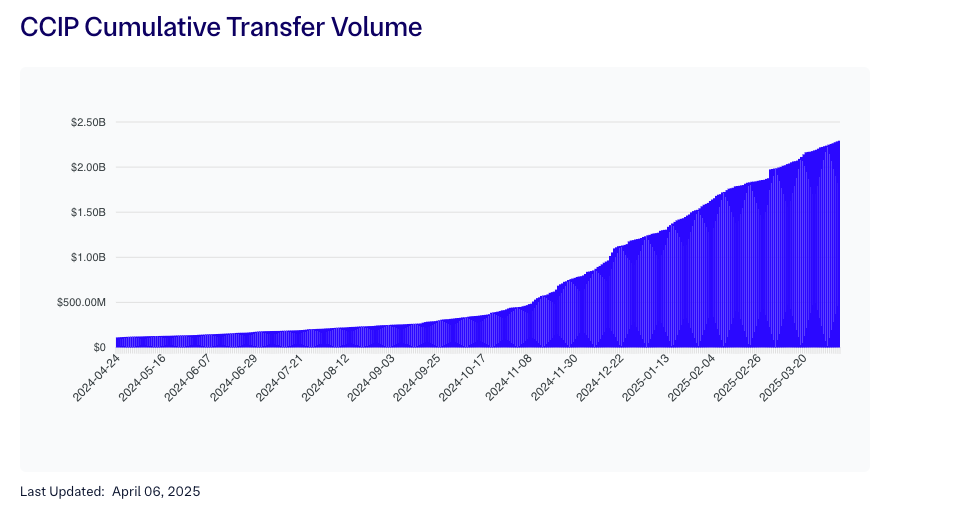

Chainlink cross-chain Transfer volume doubles in 4 months / Source: CCIP Metrics.

Chainlink cross-chain Transfer volume doubles in 4 months / Source: CCIP Metrics.

The cumulative cross-chain transfer volume has more than doubled since December 2024, reaching $2 billion as of April 6.

Chainlink has increased its reach in both DeFi and traditional finance through recent partnerships.

In November 2024, World Liberty Financial (WLFI), linked to U.S. President Donald Trump, announced a partnership with Chainlink to build DeFi infrastructure using its price feeds and Proof of Reserves services.

By December, a Trump-affiliated crypto wallet deployed $10 million in $USDC to acquire assets including Chainlink ($LINK), Ethereum ($ETH), and Aave ($AAVE), suggesting increased institutional exposure to Chainlink and related crypto assets.

Chainlink Price Analysis: Bulls Confront Resistance at $15

As of April 8, $LINK traded near $11.80, reflecting a daily gain of 7.56%.

The cryptocurrency bounced from a demand zone between $10.20 and $11.34, which had previously served as an accumulation base during Q3 2024.

$LINK Bulls holding the $11 support to validate a reversal / Source: TradingView

$LINK Bulls holding the $11 support to validate a reversal / Source: TradingView

The asset has repeatedly failed to break above this descending trendline over the past few weeks. Any sustained move beyond it could serve as a bullish signal.

The next major resistance remains near $15.46, a former support level that has now become a ceiling.

Above this, the $18.50–$20.00 range remains a heavy supply zone, historically tied to substantial selling pressure.

RSI hovered around 41.34, still below neutral territory, though slightly recovering from oversold conditions.

This suggests the potential for a short-term bounce, although bearish momentum persists.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!