Fed's Mussallem: Growth to be Below Trend, Inflation Risks to Rise

According to Golden Ten, the Fed's Mussallem said US economic growth could fall ‘sharply’ below trend, and that the unemployment rate will rise over the year as businesses and households adjust to prices pushed up by new import tariffs.

I don't have a baseline for a recession, but I think growth could be well below trend," Mussallem said, estimating growth at around 2 per cent.

‘There are risks in both directions that will materialise,’ he said, with higher-than-expected tariffs putting pressure on prices, falling confidence and the recent sharp fall in the stock market likely to dampen spending, hitting household wealth, and price rises set to take their toll, which together will lead to slower growth. Mussallem, who has a vote on interest rate policy this year, said the response of monetary policy will depend on how inflation and unemployment evolve in the coming months, whether price shocks persist and whether inflation expectations are in line with the Fed's 2 per cent inflation target.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

American Federation of Teachers: Senate cryptocurrency bill will endanger pensions and the overall economy

U.S. stock market opens with the Dow Jones flat

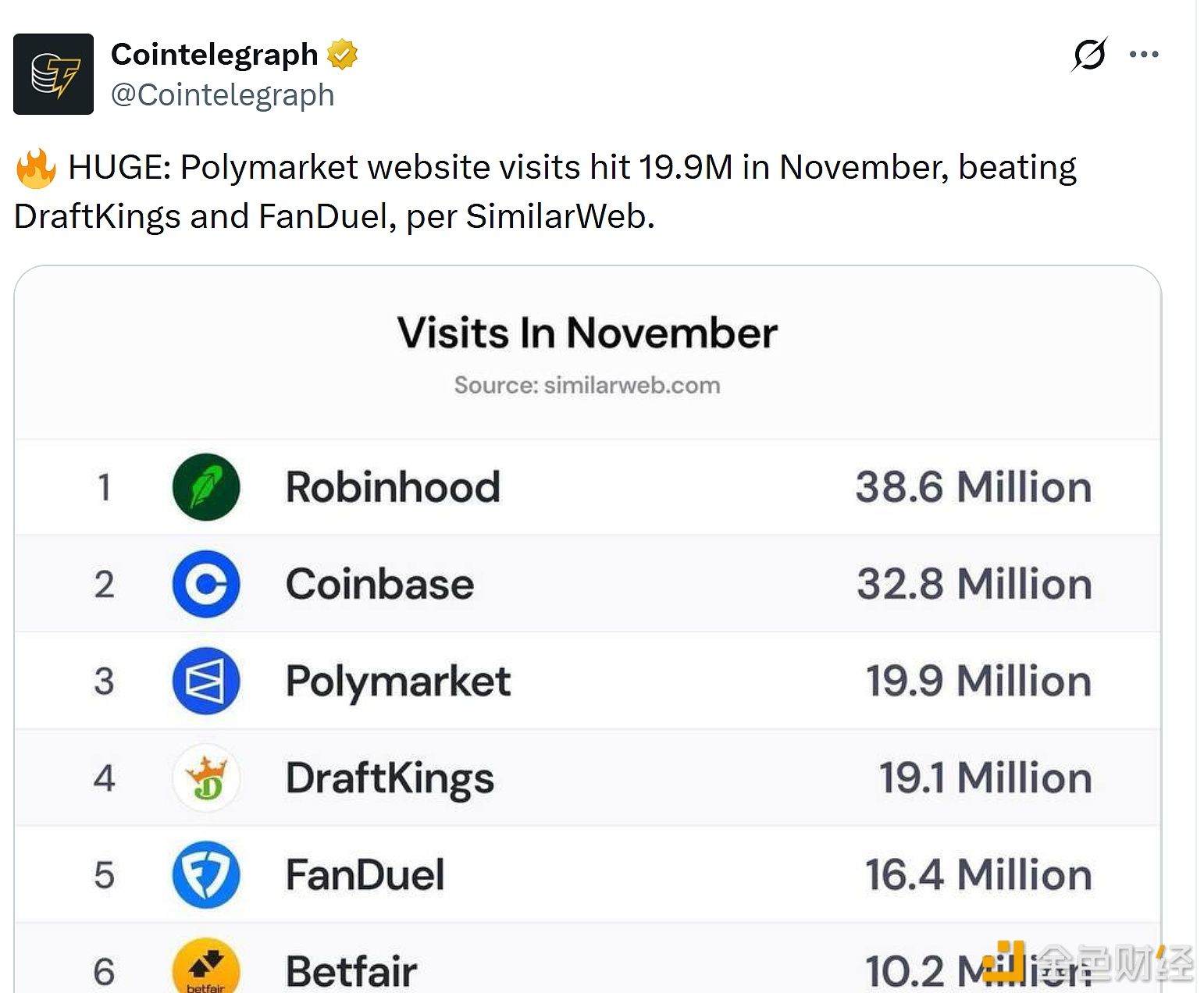

Polymarket website received 19.9 million visits in November