Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

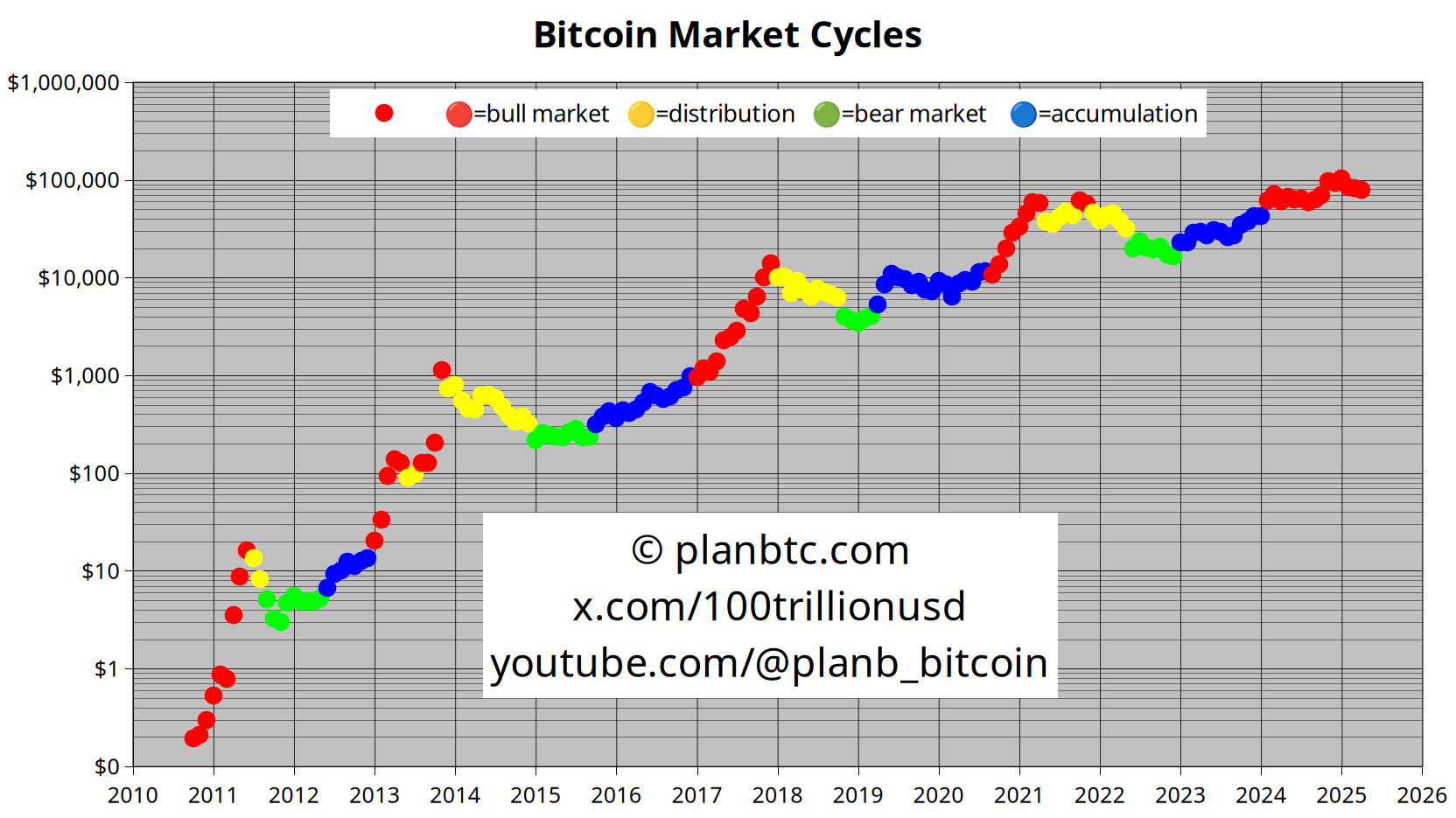

Widely followed on-chain analyst PlanB says that Bitcoin’s ( BTC ) current correction is part and parcel of regular bull market conditions.

The pseudonymous analyst tells his 2.1 million followers on the social media platform X that the indicators he watches are still signaling bullishness for the flagship crypto asset.

Says PlanB,

“Even with today’s low bitcoin prices my on-chain indicators still signal bull market. So in my opinion this is a normal bull market dip and not a transition from bull phase to distribution phase (and then bear phase).”

Source: PlanB/X

Source: PlanB/X

PlanB’s color-coded dot chart indicates the number of months until each halving – when BTC miners’ rewards are cut in half – with the red dots representing the beginning of the halving cycles.

In a recent video update, the analyst told his 209,000 YouTube subscribers that a combination of 200-week means suggests Bitcoin may soon enter an explosive uptrend based on historical precedent.

The analyst says that the 200-week arithmetic and the 200-week geometric are currently running close together on the chart, signaling a possible Bitcoin breakout.

“It might be that the bull market is still forming and that the [arithmetic mean] will separate again, will diverge again, from the geometric mean.

One more thing on those two lines. Notice that you can’t have a bear market or a big crash when the 200-week [arithmetic mean] and the geometric mean are together. The big crashes here [in 2021 and 2022] are happening when there’s a diversion between the two lines. Also, here in 2018, there was a big gap between the two [means]. Same here in 2014 and 2015.”

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Reddit is currently experimenting with verification badges

YouTube TV will introduce subscription packages based on genres starting in 2026

Overview Energy aims to transmit power from space directly to current solar power facilities