Hedera’s (HBAR) Long/Short Ratio Hits Monthly Peak as Traders Anticipate Price Reversal

Hedera’s Long/Short ratio has reached a 30-day high, reflecting rising bullish sentiment despite market volatility. Traders are positioning for potential gains in the near term, although profit-taking could limit a sustained rally.

Hedera’s Long/Short ratio has soared to a 30-day high, signaling a bullish shift in market sentiment.

This comes amid severe market volatility and huge long liquidations across many assets. With growing bullish sentiment, HBAR could reverse its downward trend and record gains in the near term.

HBAR Shows Bullish Signs as Long Positions Surge

Despite a broader market downturn that has weighed on altcoin prices, HBAR is bucking the trend in terms of investor positioning.

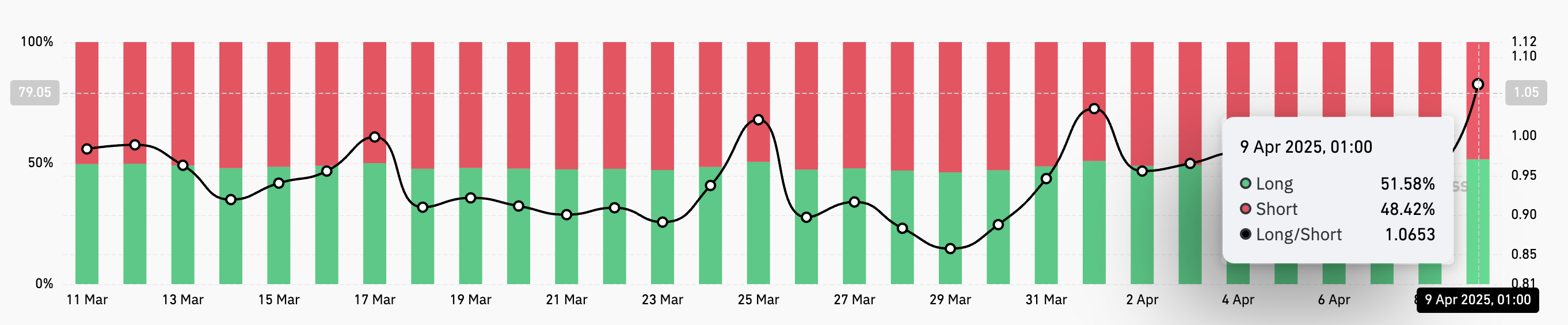

Coinglass data shows that many traders are entering long positions on the token, indicating growing confidence in a potential upside move. This is reflected by its Long/Short, which currently sits at a 30-day high of 1.06 at press time.

HBAR Long/Short Ratio. Source:

Coinglass

HBAR Long/Short Ratio. Source:

Coinglass

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market. A ratio below one means there are more short positions than long positions.

Conversely, as with HBAR, when an asset’s long/short ratio is above one, more traders are holding long positions than short positions, indicating a bullish market sentiment.

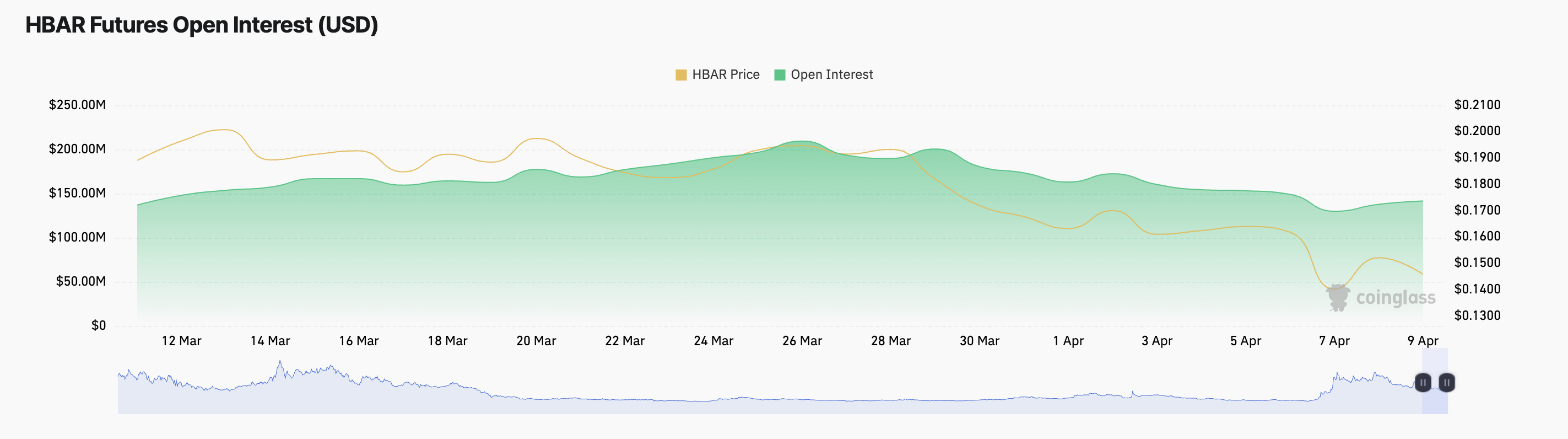

Further, HBAR’s open interest has climbed, supporting this bullish outlook. As of this writing, it is at $142 million, rising 3% in the past 24 hours. Notably, during this period, HBAR’s price is down 2%.

HBAR Open Interest. Source:

Coinglass

HBAR Open Interest. Source:

Coinglass

When an asset’s price falls, but open interest rises, it suggests that traders are still actively entering new positions, potentially anticipating a future price rebound despite the current decline.

A combined reading of HBAR’s long/short ratio and rising open interest amid falling prices signals that the majority of its traders have a bullish outlook. This indicates that even with price declines, HBAR traders anticipate an upward trend in the near future.

Profit-Taking Threatens HBAR’s Rally

At press time, HBAR exchanges hands at $0.15. The gradual resurgence in bullish sentiment and new demand could reverse its current downtrend and push HBAR toward $0.17.

HBAR price Analysis. Source:

TradingView

HBAR price Analysis. Source:

TradingView

However, if profit-taking continues and bullish pressure becomes subdued again, HBAR could contain its decline and fall to $0.11.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!