The U.S. SEC releases new guidelines, requiring crypto projects to enhance token information disclosure

The U.S. Securities and Exchange Commission (SEC) issued a statement on Thursday, suggesting that crypto companies potentially involved in security tokens provide more detailed information disclosure. The guidance emphasizes that companies need to clearly explain their business models and the specific roles of tokens, but does not explicitly define which cryptocurrencies fall within the scope of securities. This non-mandatory statement points out that information disclosure should include whether the company is developing crypto or blockchain networks, development milestones, network uses, technical architecture (such as whether it is based on open-source technology), etc. The SEC stated that these suggestions are based on observations of past corporate disclosures, including details such as token holder rights and technical specifications. The statement specifically mentions that token assets involving "investment contracts" (i.e., tokens that may constitute securities) require additional disclosure. This guidance is one of the efforts made by the SEC to clarify how federal securities laws apply to crypto assets and aims to lay a foundation for its newly established Crypto Working Group's subsequent work. The SEC also emphasized that this statement does not constitute formal rules and "has no legal effect."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

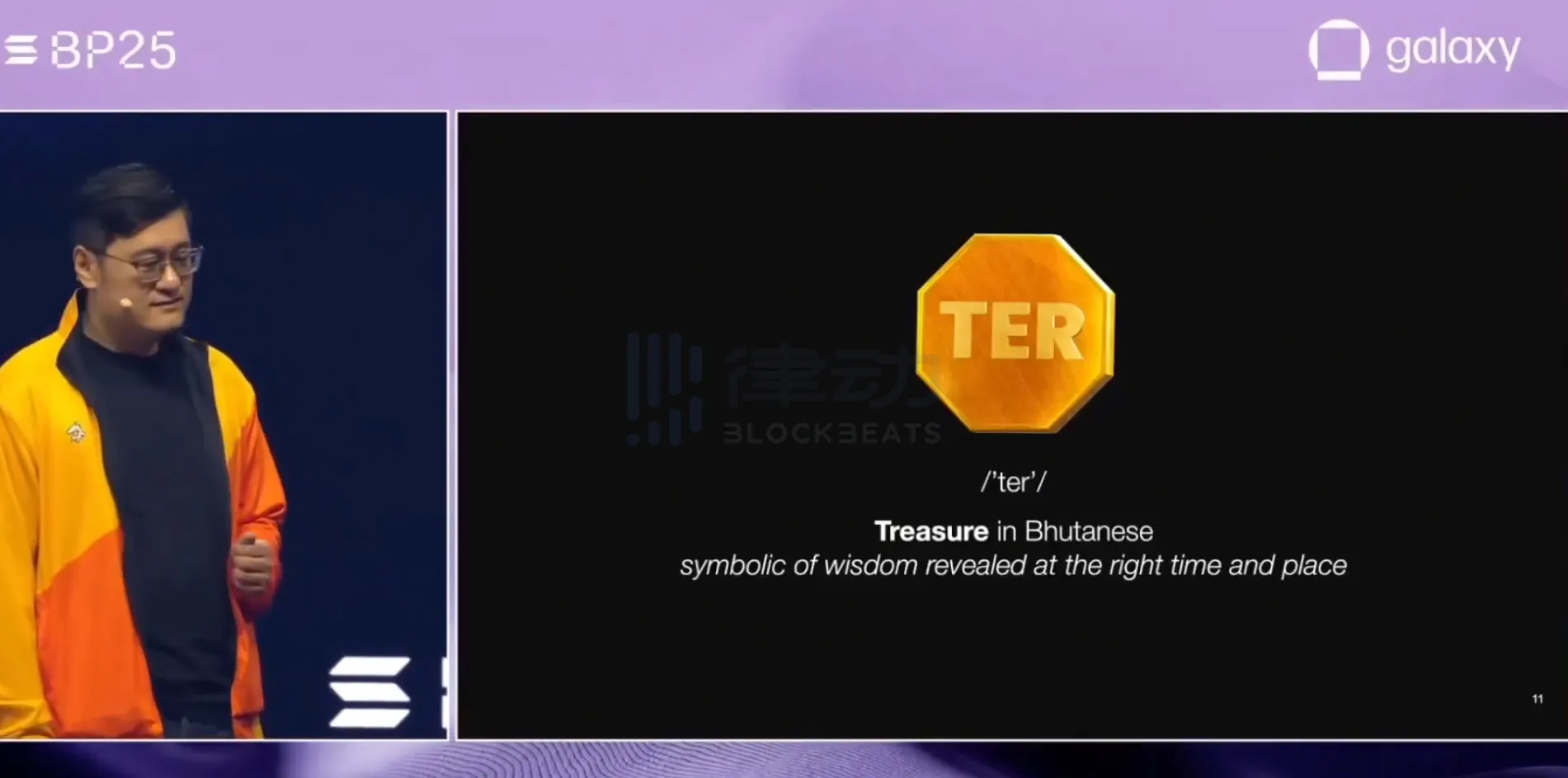

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network