Ethereum price action has been declining in the last 7 days as the tariffs-related onslaught extended its grip on the market.

However, some interesting developments were observed, including a massive spike in whale activity.

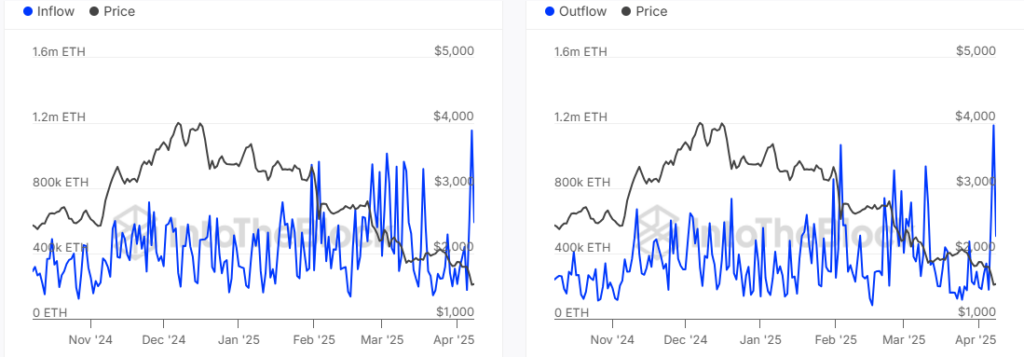

Ethereum whale activity was up considerably at the start of this week. For context, large holder inflows surged from 176,500 ETH on 5 April to 1.15 million ETH as of 7 April.

Ethereum large holder flows/ source: IntoTheBlock

Ethereum large holder flows/ source: IntoTheBlock

Large holder outflows also registered a massive spike from 178,140 ETH to 1.19 million ETH.

This spike for both inflows and outflows was the largest observed in the last 6 months.

The surge in whale activity could indicate that the whale cohort expects the current dip to be near or at its tail end.

However, the larger whale outflows may also indicate that the spike could have been an inducement scenario where whales were looking for some short term gains.

Whale holdings recently crossed 66.2 million ETH. Historical concentration data on IntoTheBlock revealed certain interesting details.

As per data, whales added 4.59 million ETH to their holdings since the start of February. This was equivalent to $6.77 billion at press time.

Ethereum Price Tanks to 2-year Low

ETH’s extended downside earlier this week resulted in a push below a key 2-year support level.

Extended downside risks pushing below its March 2023 lows, in which case the price could potentially push to the $1,000 price tag.

ETH price action/ source: TradingView

ETH price action/ source: TradingView

ETH was extremely oversold at its $1,487 price earlier today, which was actually a bit of a recovery from its 24-hour low of $1,383.

However, at press time it was seen making progress as it noted 11% gains, and was changing hands at about $1634.

Rising tensions this week over the U.S and China’s tariffs against each other raised the possibility of more downside.

However, the slight recovery in Ethereum price in the last 24 hours signaled a more diluted tariffs impact.

This likely had to do with the recent surge in whale activity, combined with the fact that the markets are already deeply oversold.

The cryptocurrency’s performance in the next few weeks will determine whether the oversold conditions will undercut the impact of tariff wars.

Network Activity Demonstrates Strength

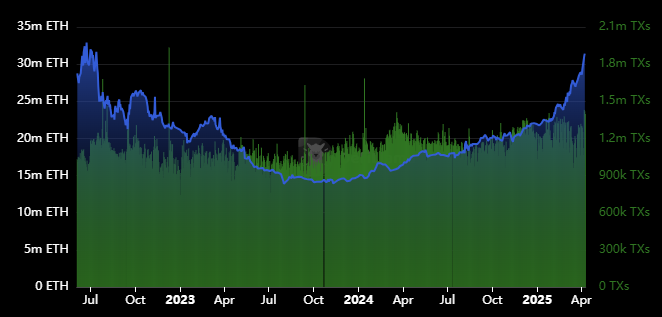

It appears that it was business as usual for the Ethereum network’s performance despite the market disruption.

Some metrics underscored improvements in the network’s performance. Daily transactions briefly dipped below 1 million TXs in mid-March but have since made sizeable recovery.

In fact, transactions surged to 1.42 million TXs on 8 April, which was the highest level observed since the start of 2025.

Ethereum transactions and TVL/ Source: DeFiLlama

Ethereum transactions and TVL/ Source: DeFiLlama

The transaction growth is however related to the surge in bearish activity at the start of the week. Ethereum TVL also managed to push to a multi-month high.

TVL has been recovering since October last year and its performance in 2025 underscores a parabolic run. It rallied to a new local high of 31.42 million ETH as of 8 April.

What Higher DEX Volumes Point To

Ethereum DEX volumes in March have notably been higher in the first 4 months of 2025 compared to their performance in 2024.

For example, DEX volume rallied to 2.33 million ETH as of 7 April. The last time that ETH DEX volume was higher than that was on 5 August.

Could the DEX volume surge signal the bottom for ETH’s price action after the latest crash? The two events have one thing in common.

DEX volumes rallied above 2 million ETH after a major bearish wave. Meanwhile, Ethereum also achieved robust stablecoin growth in the last few months.

This also underscores robust liquidity on standby in case the market enters recovery mode.

Stablecoin marketcap was down to $123.38 million as of 8 April which was down by $2.92 billion from its recent peak.