Floki (FLOKI) has been facing price fluctuations within a broad descending channel since mid-2024.

As hope for potential recovery continues to grow for the crypto market, several analysts maintain that Floki may be looking at a turning point.

FLOKI Price Current Market Conditions and Support Levels

Floki’s price has recently been trading near the 0.000053973 level, a significant Fibonacci retracement zone.

This level, known for its role as a support area, may provide the foundation for a potential price reversal.

According to analysts the cryptocurrency is nearing the lower end of its ascending channel, a structure it has followed since mid-2022.

The support from this channel suggests that a reversal could be likely. Analyst MasterPlan opined that Floki has all the indications of the formation of the bottom.

According to the analyst, this is just a normal market move. A major pump action follows a moderate pullback each year.

In his estimation, the Floki’s reversal could take price back to that channel to produce a huge potential move.

Source: X

Source: X

Additionally, the main Fibonacci numbers, such as 0.618 at the level of 0.000053973, correspond to the lower boundary of the upward channel.

These support levels indicate that the price may move up and create an upward movement for the bulls to thrive.

Fibonacci Projections and Potential Price Targets

For a reversal to take place, the price of Floki should drop and therefore Fibonacci extension levels can be applied to determine where the price could go.

An important level of support, after the possible reversal, may be determined at 1.272 extension at the level of 0.001167078.

Following that, there are targets at 1.414 (0.002163123) and 1.618 (0.005248901) which embody substantial price boosts.

Source: X

Source: X

CryptoELITES another popular analyst also shared their target of potential price on Floki and had an upward projection of up to 18X.

This price level forms a good support level and the analyst is expecting a big rally. At the same time, interest in Floki derivatives has been increasing as well.

Currently, the open interest is at $14.18 million and this has been up by a rise of 6.18%.

This increase in the open interest indicates that traders are gearing up for a higher prices trend, with most of them trading in the hope that the price will go up.

Bullish Indicators and Market Sentiment

There are several buy indicators that have formed in the Floki market to boost the likelihood of rising prices.

One of the signals is a cup-handle pattern, which is often referred to as a continuation pattern.

The rounded bottom formation is known as the “cup” and the “handle” refers to a consolidation phase.

If price action continues to hold above this support and the ‘handle’ portion is completed, Floki could be set for an upward breakout.

Moreover, the TD Sequential indicator, that depicts the potential exhaustion of a particular trend, provided a buy signal.

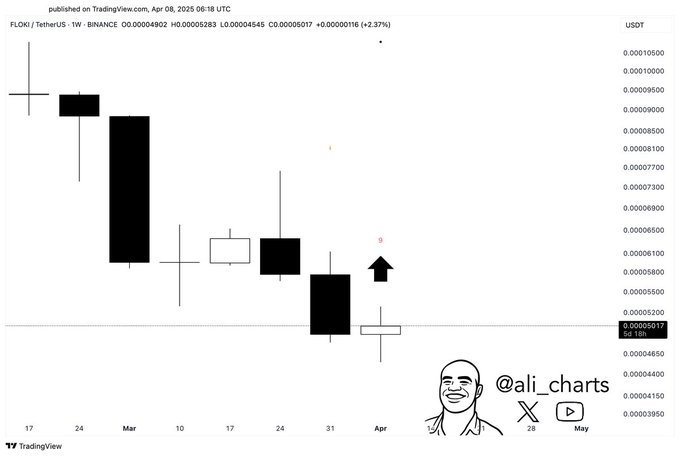

Market analysts like ali_charts have suggested this as the indication that the bear trend is shifting.

The “9” signal on the weekly chart means that divergence is likely in the near term, which indicates diminishing bearish strength.

If this signal remains intact, the cryptocurrency could experience a bounce that shifts the trend towards bullish territory.

Source: X

Source: X

However, attention should be paid to the volume in the future days as the volumes are on the rise.

The presence of a large trading volume when such a reversal occurs would enhance the legitimacy of the buy signal.

If volume fails to support the price, then the upward movement may stall and a reversal might be short lived.