Ethereum Has a Bullish Case Despite Rising Levels of Bearishness, Says Crypto Analytics Platform Santiment

The crypto analytics platform Santiment says there may be a bull case for Ethereum ( ETH ) in 2025, even as it continues to display rising levels of bearishness.

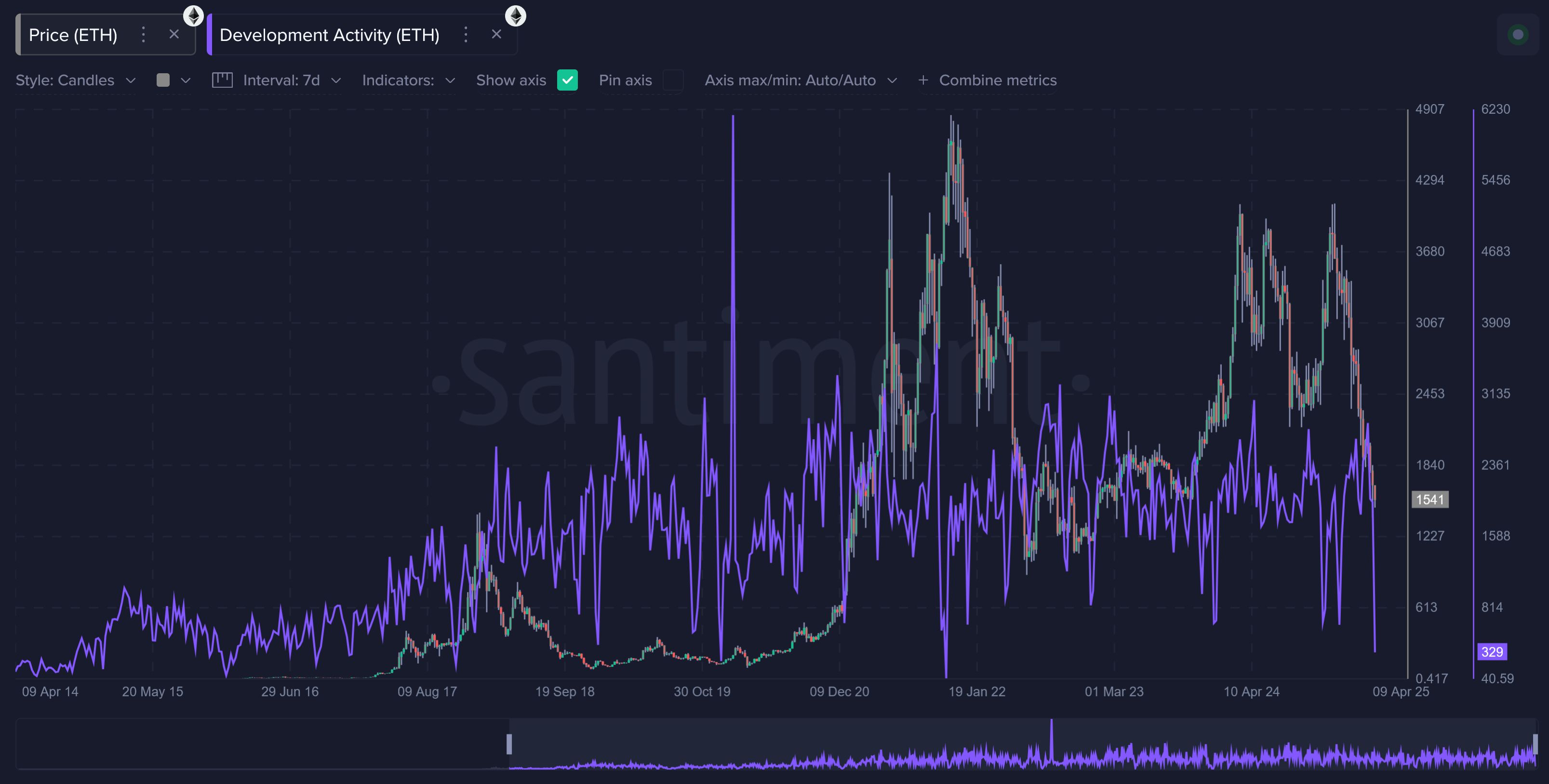

In a new strategy session, Santiment says that negative market sentiment adds to the bull case for the top smart contract platform by volume, noting that Ethereum is rife with development activity, meaning that it’s not going away anytime soon.

“Remember that there are cases for Ethereum to be a good buy in 2025. With the crowd showing an increased level of bearishness, this adds to the bullish case. Markets always move the opposite direction of the crowd’s expectations, and the logic of ‘it has underperformed for so long, therefore it will continue to do so’ is typically not a strong enough argument to be taken seriously.

Other cons we have listed (revolving mainly around ETH’s speed and cost) are more legitimate reasons, but remember that there is quite the dedicated team that is innovating and improving the project on a daily basis. And that usually doesn’t lead to a coin’s demise.”

Source: Santiment

Source: Santiment

Santiment’s data indicates that Ethereum is the seventh-ranked digital asset in terms of the most development activity during the last 30 days.

According to the market intelligence platform, even though ETH is struggling against Bitcoin ( BTC ), it is being carried by ETH bulls who are consistently countering major selloff events.

“Yes, there are still plenty of believers in Ethereum… If there weren’t people buying others’ consistent selloffs, the asset likely would have lost its #2 market cap position long ago.”

The top smart contract platform by volume is trading for $1,561 at time of writing, a 2.3% increase during the last 24 hours.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!