-

The ongoing rivalry between TRON (TRX) and Cardano (ADA) has intensified, with significant implications for market dynamics and investor strategies.

-

As both cryptocurrencies strive for dominance in the competitive landscape, metrics indicate a possible pivot in investor sentiment that could alter rankings.

-

A recent analysis from COINOTAG highlighted the fundamentals of both ecosystems, showcasing contrasting network activities that could influence capital flow.

This article explores the competitive landscape between TRX and ADA, analyzing on-chain metrics and market behavior to reveal potential shifts in dominance.

Exploring the Competitive Landscape of TRX and ADA

The landscape of cryptocurrency is ever-changing, and currently, TRON (TRX) and Cardano (ADA) are engaged in a compelling struggle for the ninth position in market capitalization. This contest is not just about numbers; it reflects deeper market sentiments as investors assess stability and growth potential. TRON’s robust performance metrics, particularly its transaction volume and liquidity inflows, contrast starkly with Cardano’s recent struggles.

Data-Driven Insights into Market Dynamics

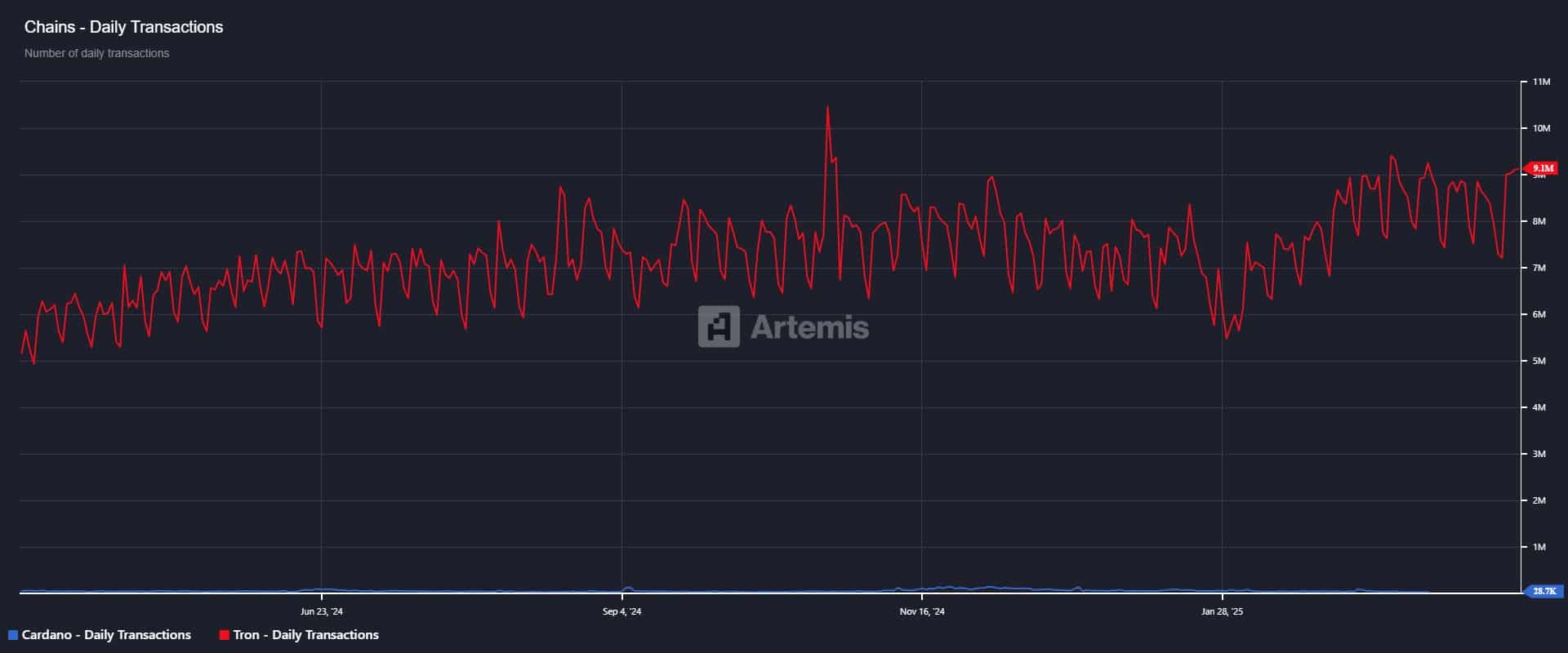

On-chain data from COINOTAG offers crucial insights into the evolving situation between TRX and ADA. The analysis reveals that while ADA has faced a 30.3% year-over-year decline in daily active addresses, TRX’s network activity appears to maintain resilience. This divergence indicates that capital may be shifting towards TRON as investors seek more stable options in a volatile market.

Transaction Trends Favoring TRON

Recent figures highlight a significant contrast in transaction activity: TRON’s daily transactions reached 9.1 million, marking a staggering year-on-year growth of 76.8%. In contrast, Cardano experienced a slump, with daily transactions falling to only 28.7k, associated with its declining user engagement. This shift indicates a potential pivot among initiatives, with TRX’s transaction metrics reflecting a healthier network activity.

Source: Artemis Terminal

Market Sentiment and Future Outlook

Despite TRON’s impressive growth in liquidity, its Total Value Locked (TVL) has seen a slight decrease, indicating challenges in DeFi expansion. However, a 179.4% surge in trading volume signals that market demand for TRX remains strong, even amidst broader DeFi sector challenges. In comparison, Cardano’s TVL increase suggests rising interest in its decentralized finance ecosystem, even as transaction metrics reveal ongoing struggles.

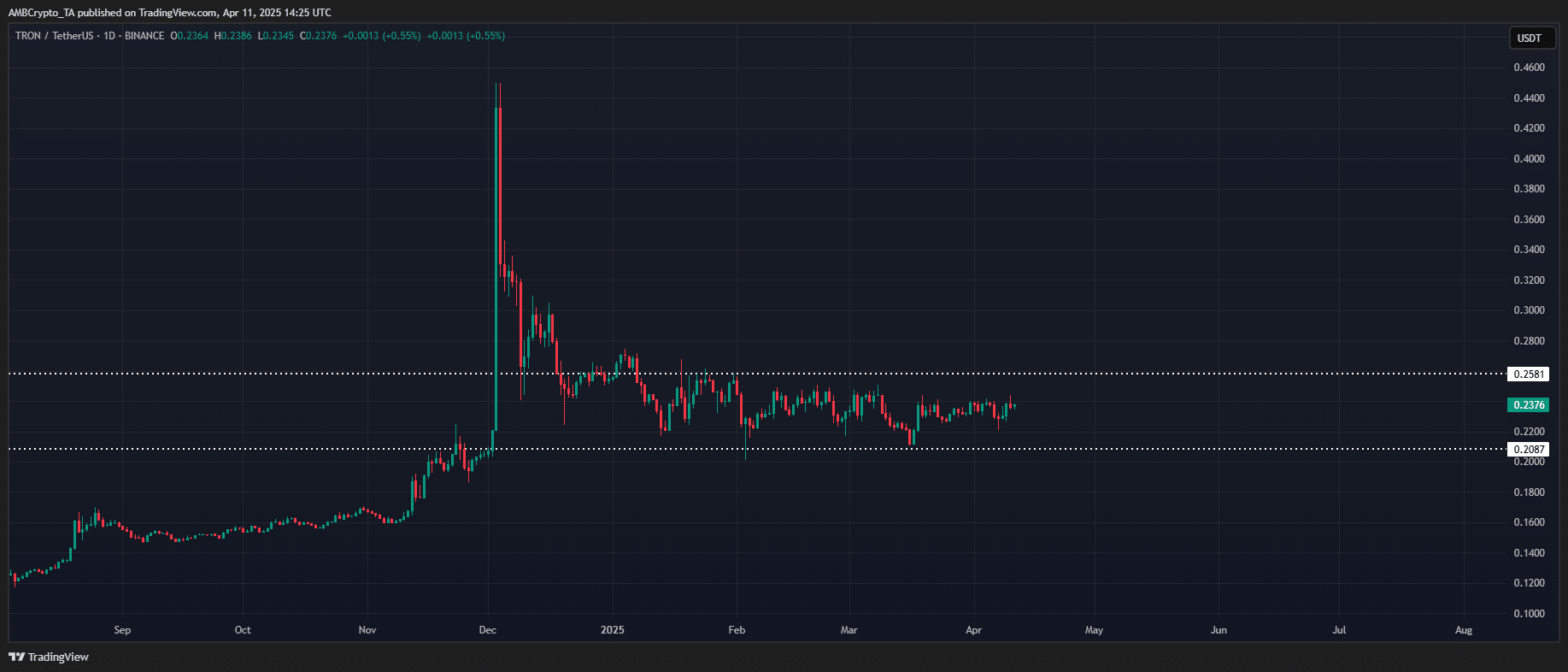

Deciphering Price Action and Market Positioning

The price movements of TRX and ADA reflect their underlying market sentiments. TRX demonstrated relative stability with limited losses, while ADA’s recent performance underscored persistent sell-side pressure. This divergence may indicate a shift in how investors view these two assets amidst evolving market conditions.

Source: TradingView (ADA/USDT)

Conclusion

The ongoing contest between TRX and ADA reflects broader trends in investor behavior and market sentiments. TRON’s capacity to maintain a solid price structure and transaction volume, coupled with a potential shift away from Cardano’s recent challenges, suggests a foundational change in market positioning. If these trends continue, TRX may not only solidify its claim to the ninth position but also challenge higher market caps moving forward.