‘Don’t Let Your Guard Down’: Crypto Analytics Firm Says Bitcoin Not out of the Woods Yet After Tariffs Pause

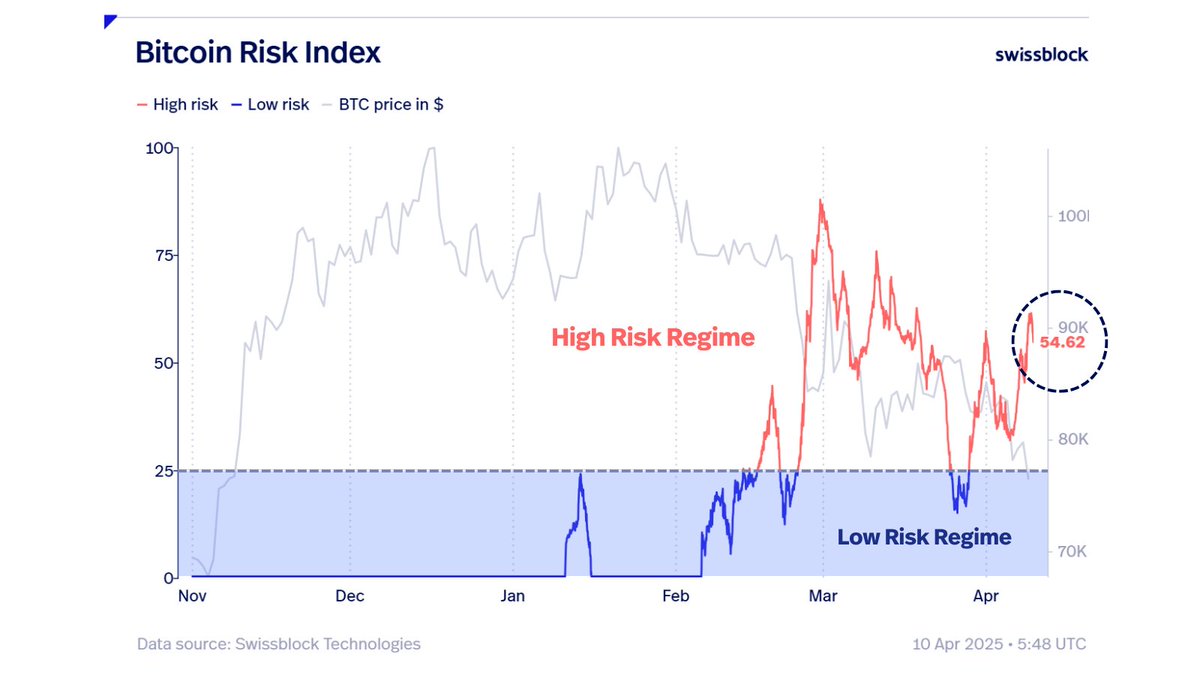

Prominent crypto analytics firm Swissblock says Bitcoin ( BTC ) may have yet to find a market bottom despite the US enacting a 90-day tariff pause.

Swissblock says on the social media platform X that Bitcoin’s momentum to the upside is not yet a sign of a convincing breakout.

“Don’t let your guard down yet! The 90-day trade war extension eases tensions, but we’re not out of the woods. Bitcoin breaks $78,000-$79,000, now holding above $80,000. Are we in the clear?”

Swissblock says the Bitcoin Risk Signal – which uses several indicators, including price data, on-chain data and a selection of other trading metrics to gauge whether BTC is at risk of a major drawdown – is not yet indicating a market bottom has been reached.

“Market risk must ease for a true bottom. It’s under control but still elevated, not in a low-risk regime yet. We need to see a clear decline in risk.”

Source: Swissblock/X

Source: Swissblock/X

According to Swissblock, Bitcoin remains in a downtrend.

“For the bottom to progress, market trend must signal formation.

We’re in a downtrend phase, normal in bottoming cycles: bottom-downtrend-uncharted.

The bottom is close, but not confirmed.”

Source: Swissblock/X

Source: Swissblock/X

Swissblock says that for Bitcoin to confirm a bullish reversal, the flagship crypto asset needs to hold $80,000 as support.

“Bitcoin must hold $80,000 and consolidate to break the downward compression. Strength and volume are key for a bullish shift.”

Bitcoin is trading for $83,221 at time of writing, up 4.7% in the last 24 hours.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!