Most Promising Meme Cryptocurrencies Through May 2025: Which Ones Could Lead the Next Rally?

With the recent imposition of trade tariffs by the United States under Donald Trump's leadership, the cryptocurrency market has been heavily impacted. Bitcoin, the main barometer of the sector, suffered a significant drop, dragging down a large part of digital assets with it. In this scenario, memecoins — cryptocurrencies inspired by memes and communities — were the ones that felt the pressure the most, accumulating sharp losses in recent weeks.

Still, in the event of a short-term recovery in the price of Bitcoin, which could return to trading above the $90 mark, there is an expectation that memecoins will react even more strongly.

Even amid an unstable macroeconomic environment, some of these meme cryptocurrencies continue to offer an attractive risk-reward ratio, especially for investors willing to accept high volatility in search of significant profits. It is worth noting that this article is for informational purposes only and does not constitute a purchase or investment recommendation.

In this article, we will discuss:

- Most Promising Meme Cryptocurrencies Until May 2025

- 1. Bonk (BONK)

- 2. Pepe Coin (PEPE)

- 3. KET (KET)

- 4. FLOKI (FLOKI)

Most Promising Meme Cryptocurrencies Until May 2025

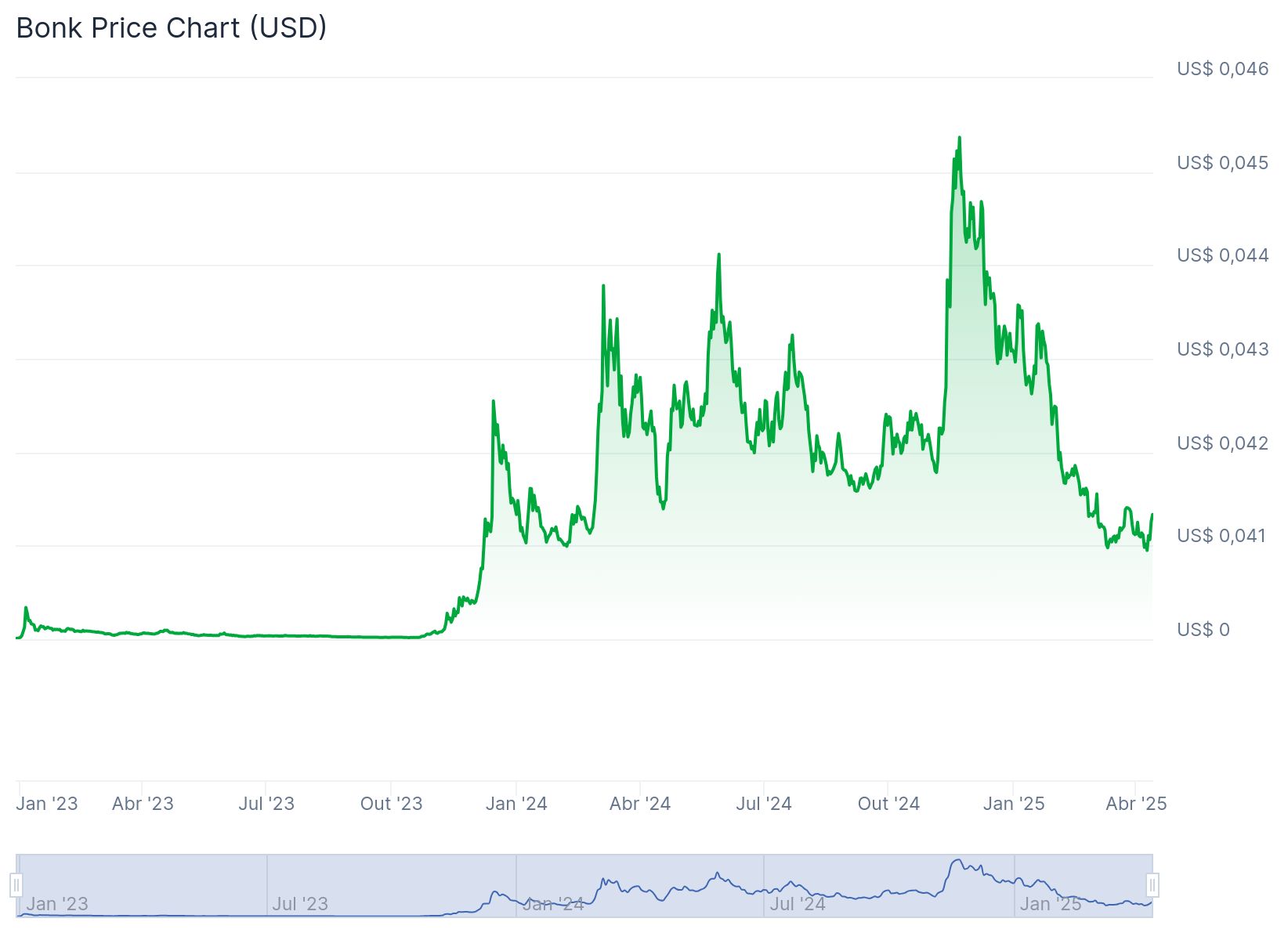

1. Bonk (BONK)

Bonk is seen as one of the most promising memecoins until May 2025. According to graphical analysis, if Bitcoin resumes its upward trajectory, BONK could be traded again in the $0,000022 range. At the moment, the token is trading close to $0,00001329. A consistent break of the $0,0000180 resistance could be the trigger for an accelerated recovery.

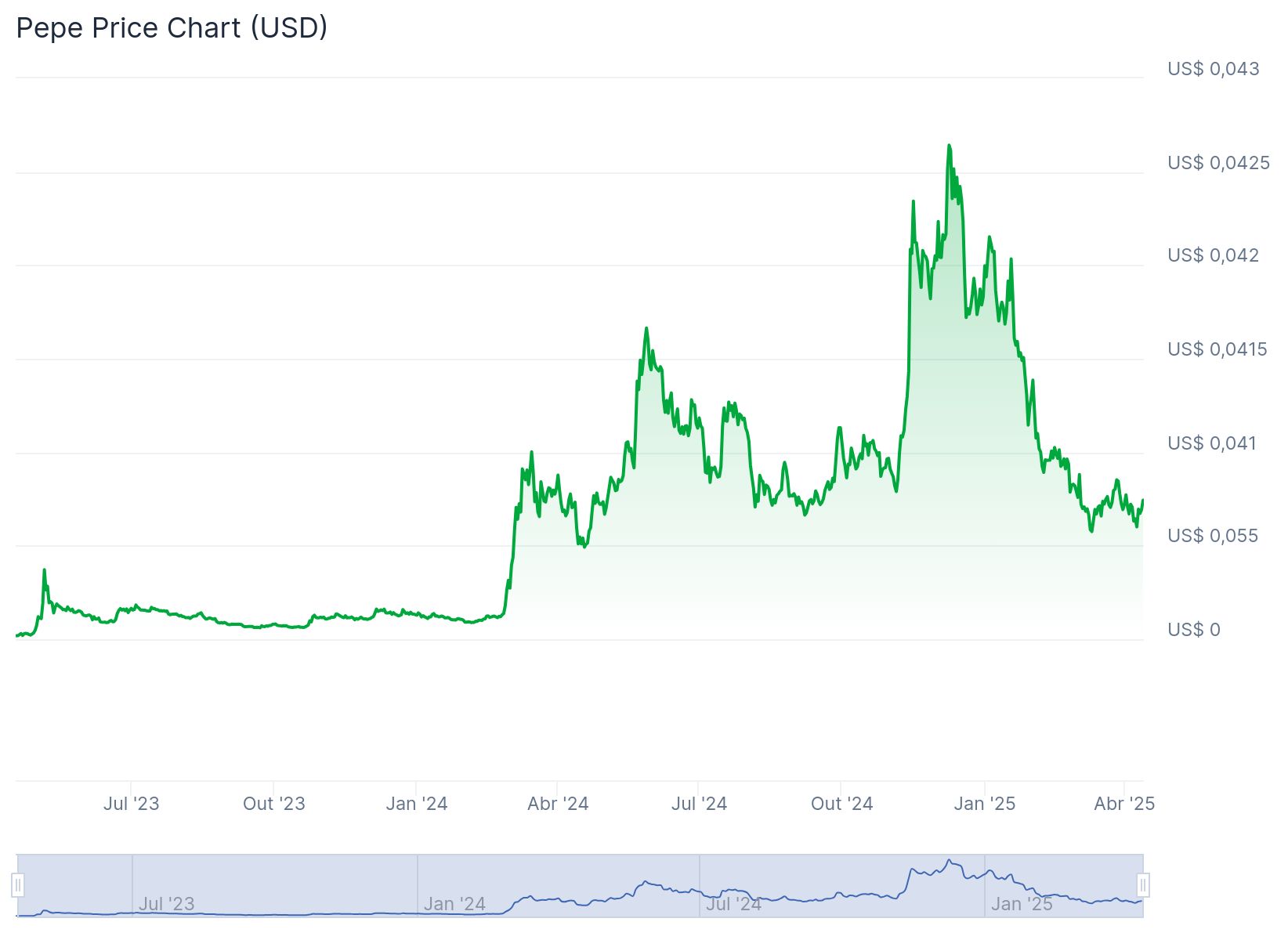

2. Pepe Coin (PEPE)

Another standout among memecoins is Pepe Coin, which has seen significant accumulation by large investors (the so-called “whales”). The short-term expectation is for a recovery above US$0,00001000, and if it surpasses the US$0,00001400 region, the asset could once again target its all-time high of US$0,00002803.

3. KET (KET)

KET is a memecoin that runs on the Avalanche blockchain and stands out because it is still listed on a few exchanges, which suggests potential for appreciation as it gains more exposure in the market. Its current price is around US$0,2144, well below its all-time high of US$0,5305 — a devaluation of over 60%. This gap could represent a good entry window for speculative investors.

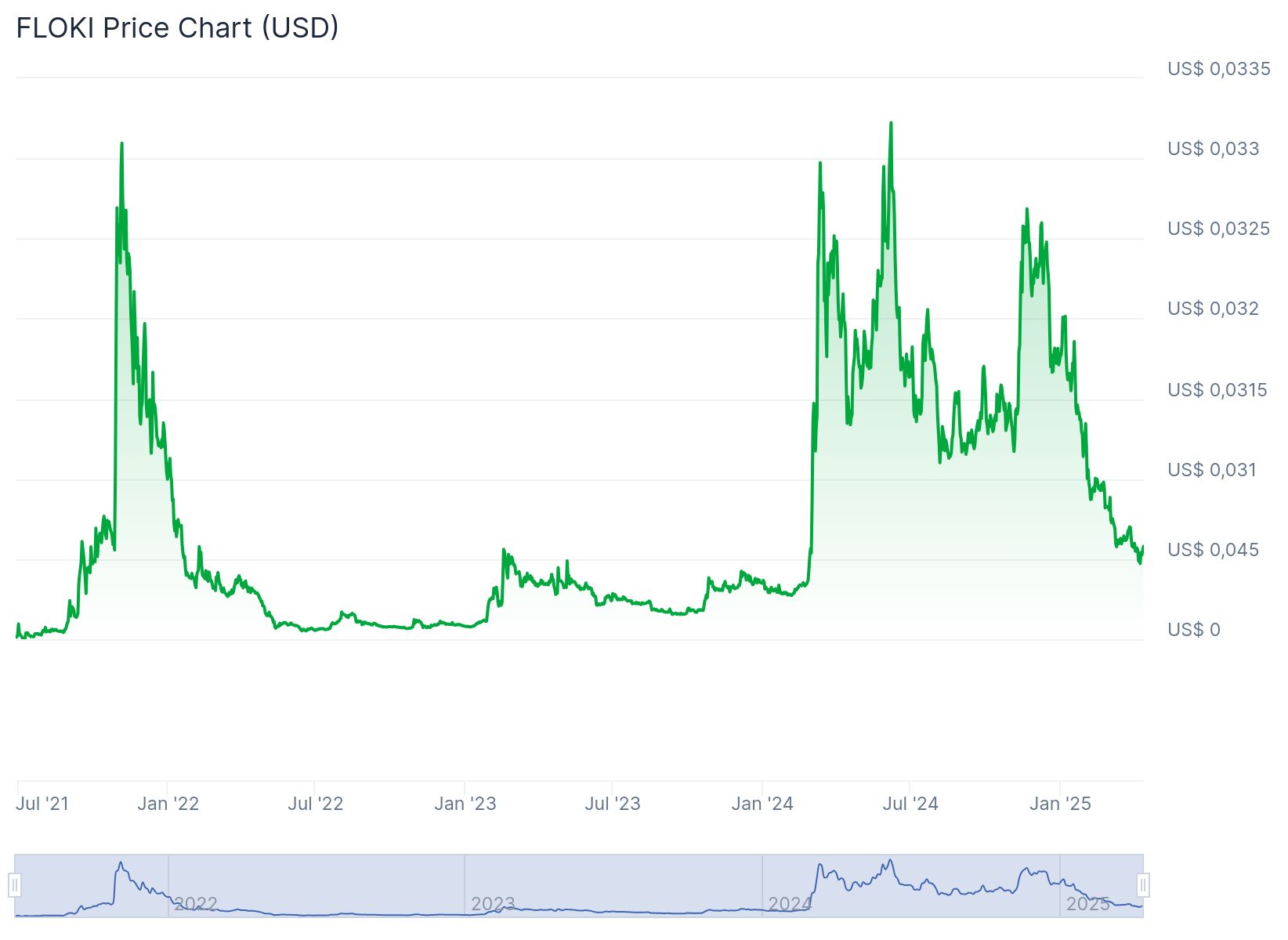

4. FLOKI (FLOKI)

Finally, FLOKI also appears to be a strong candidate for appreciation in the coming months. Priced at around $0,00005795, the token has already successfully tested the $0,00013 resistance on other occasions. If this barrier is broken with volume, FLOKI could start a new bullish rally, driven by its strong community presence and listings on major platforms.

Despite the turbulent moment, these memecoins show technical and market movement signs that justify increased attention from investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services

STABLEUSDT now launched for futures trading and trading bots

Martingale bot upgraded–simpler setup, more flexible features

Stock Futures Rush (phase 9): Trade popular stock futures and share $240,000 in equivalent tokenized shares. Each user can get up to $5000 META.