April 14th Market Key Insights, How Much Did You Miss?

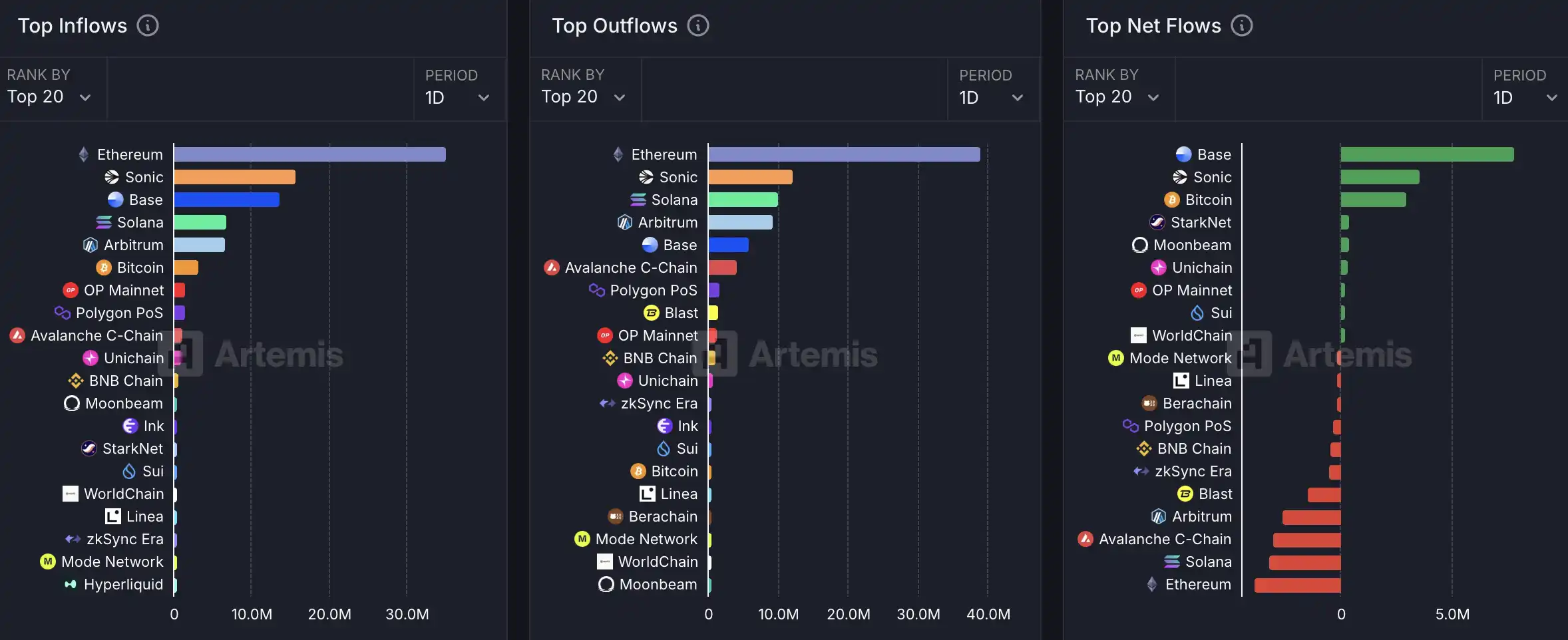

1. On-chain Funds: $7.8M USD inflow to Base today; $3.9M USD outflow from Ethereum 2. Highest Price Swings: $AERGO, $OM 3. Top News: VC Insider Reveals: OM Scheme Involves OTC Push, Volume Reaches $500M USD

Featured News

1.Current mainstream CEX, DEX funding rates indicate the market is no longer universally bearish

2.OKX releases announcement on MANTRA (OM) price volatility

3.Odin.fun platform has halted trading and withdrawals to assess the scope of a hack

4.VC practitioner reveals: OM model targets OTC market, with a scale of $500 million

Featured Articles

1.《The TPS Scam in the Crypto Industry》

The article criticizes the crypto industry's blind pursuit of high TPS (transactions per second), viewing this competition as false advertising that overlooks real user needs. Projects exaggerate laboratory data to attract funding and attention, sacrificing decentralization, security, and practicality. They often claim to solve problems that nobody cares about. The author calls for a focus on truly meaningful blockchain applications, building according to actual use case scales, rather than chasing hollow digital dreams.

McDonald's is set to hold a shareholder meeting next month. A shareholder of the company—the U.S. conservative think tank "National Center for Public Policy Research"—recently submitted a proposal suggesting that McDonald's include Bitcoin as a reserve asset in the company's financial reports. However, it appears that this proposal has not received support from the company's management.

On-chain Data

On-chain Fund Flow on April 14

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!