- XRP finds solid support at $2.10 as traders monitor signs of a short-term rebound

- RSI and MACD suggest weakening selling pressure despite XRP’s recent 3.83% drop

- Rising trading volume hints at potential reversal if buying momentum gains strength

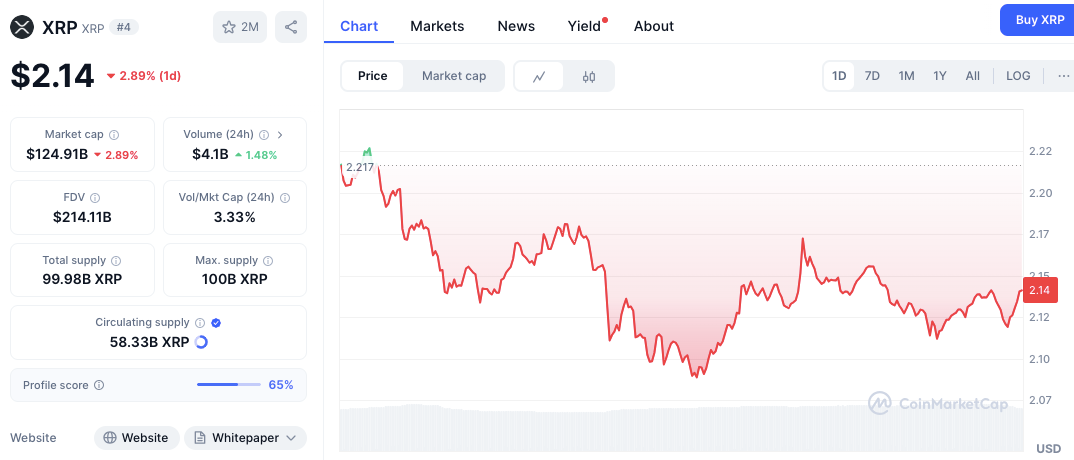

XRP is currently showing signs of short-term weakness, with prices falling during the April 14 trading session. The token opened the day at $2.217 but slipped to around $2.13 by close, marking a 3.83% decline.

This bearish movement raised concerns among traders, especially given XRP’s recent attempt to reclaim higher levels. However, certain technical indicators suggest a shift in momentum could be on the horizon.

While the immediate trend appears bearish, XRP’s momentum isn’t straightforward. Key support and resistance levels face pressure, while RSI and MACD indicators subtly hint at strength. This suggests selling pressure may be easing, possibly setting up a trend reversal.

What Are XRP’s Key Support and Resistance Levels?

On the downside, XRP is finding consistent support around the $2.10 level. This price point acted as a cushion during multiple intraday dips. Additionally, the $2.08–$2.09 zone is emerging as a critical buffer. These levels have been tested several times, which strengthens their importance for short-term traders.

Source: CoinMarketCap

Source: CoinMarketCap

On the upside, resistance builds near $2.17, where the price briefly peaked before pulling back. Today’s $2.22 opening price also acts as a key hurdle, marking the day’s high before sellers stepped in. Breaking these resistance levels is crucial for XRP bulls in the upcoming sessions.

Related: Whales Accumulate XRP: Are They Betting on This Bullish Chart Signal?

What Do XRP’s Technical Indicators Show?

Despite the price drop, XRP’s 24-hour trading volume actually rose 3.79% to $4.13 billion. Increased volume during price corrections can sometimes signal traders are positioning for more volatility and might precede a reversal if buying interest picks up.

XRP/USD daily price chart, Source: TradingView

XRP/USD daily price chart, Source: TradingView

The Relative Strength Index (RSI) is currently near 49.66, just below the neutral 50 mark. Importantly, the RSI stayed above 40 during recent dips, suggesting sellers might be losing control. A cross above the 50 level could signal returning bullish momentum.

Meanwhile, the MACD line recently crossed above the signal line. This bullish crossover is a subtle but significant development. It suggests a possible shift in sentiment that could turn the current downtrend around if supported by buying activity.

What’s the XRP Price Outlook for April 15?

Looking ahead to April 15, traders should watch if XRP can hold above the key $2.10 support level.

Related: XRP Network Grows Stronger: Holder Addresses Now At Record 6.26 Million

Pushing back above $2.17 would be a positive sign. Momentum indicators hint at underlying strength, so a bounce from current levels could spark short-term gains. However, losing the $2.10 support might invite further declines toward lower levels.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.