Starknet (STRK) Eyes Recovery With Improving Indicators

Starknet (STRK) remains under pressure, but signs of stabilization are beginning to emerge. Despite releasing 127.6 million tokens into circulation in its next unlock, the project is pushing forward with adoption efforts, including enabling STRK payments in 15,000 shops worldwide.

Technically, the RSI is in neutral territory, and the CMF is showing reduced selling pressure, hinting at a potential shift in momentum. However, the EMA lines still reflect a downtrend, keeping the outlook cautious for now.

Starknet RSI Is Still Neutral

Starknet was one of the most anticipated token unlocks of the third week of April, releasing 127.6 million STRK tokens worth approximately $15.71 million into circulation.

Despite this major supply event, the project is trying to build long-term utility.

Recently, it announced that STRK can now be used for payments in 15,000 shops worldwide—a move aimed at boosting adoption and real-world use cases.

From a technical perspective, STRK’s RSI is currently at 42.92, recovering from 37.29 yesterday but slightly down from 44.76 earlier today.

The Relative Strength Index (RSI) measures momentum on a scale from 0 to 100, with readings above 70 typically indicating overbought conditions and below 30 signaling oversold territory.

An RSI around 43 suggests neutral-to-bearish momentum, with sellers still maintaining some control. If RSI continues to climb, it could signal a shift toward a recovery, but for now, STRK remains in a cautious zone.

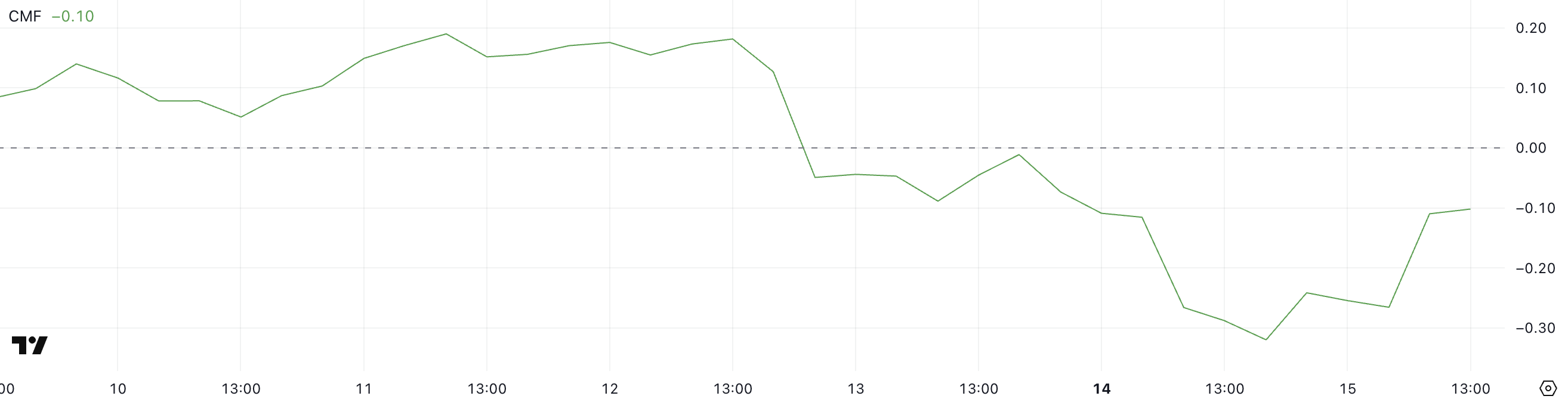

STRK CMF Shows Buyers Are Returning

StarkNet’s Chaikin Money Flow (CMF) has improved to -0.10, up from -0.32 yesterday, signaling a reduction in selling pressure.

The CMF is a volume-based indicator that measures the flow of money into or out of an asset over time. It ranges from -1 to +1, with values above 0 indicating buying (accumulation) and below 0 indicating selling (distribution).

Although still in negative territory, the rise toward the neutral line suggests that bearish momentum is weakening. A CMF reading of -0.10 points to moderate outflows, but the upward shift could hint at growing interest from buyers.

If this trend continues and CMF crosses into positive territory, it may support a short-term recovery in STRK’s price.

Will Starknet Fall Below $0.11?

Starknet’s EMA lines continue to reflect a downtrend, with short-term averages positioned below long-term ones—a classic bearish setup.

If this pattern holds and selling pressure increases, STRK could decline further to test the support level near $0.109.

However, if momentum shifts and STRK manages to reverse the current trend, it could begin retesting key resistance levels at $0.137 and $0.142.

A breakout above these zones may open the path toward $0.158, signaling a stronger recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

100% rebate for KYB users: Earn fee rebates on EUR bank deposits!

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone

Bitget Trading Club Championship (Phase 21)—Up to 1250 BGB per user, plus a ZETA pool and Mystery Boxes

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services