Bitcoin's Realized Market Cap Reaches New High, but Short-Term Holders Remain at a Loss, Risk Aversion Dominates the Market

Odaily reports that data shows Bitcoin's realized market cap has reached $872 billion, a record high. However, Glassnode data indicates that investors remain unenthusiastic about the current Bitcoin price levels. Despite the historical high in realized market cap, its monthly growth rate has dropped to 0.9%, suggesting a market sentiment of "risk aversion."

The realized market cap measures the total value of all Bitcoins calculated at the price they were last transferred, reflecting the actual amount of capital invested. The slowing growth indicates that while capital inflow remains positive, it has significantly decreased, implying a decline in new investors or reduced activity among existing holders.

Additionally, Glassnode's realized profit and loss chart recently showed a sharp 40% decline, indicating a significant amount of profit-taking or stop-loss activity in the market. The market value-to-realized value ratio for short-term Bitcoin holders remains below 1, a level historically associated with buying opportunities, further proving that short-term holders are in a loss position. (Cointelegraph)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

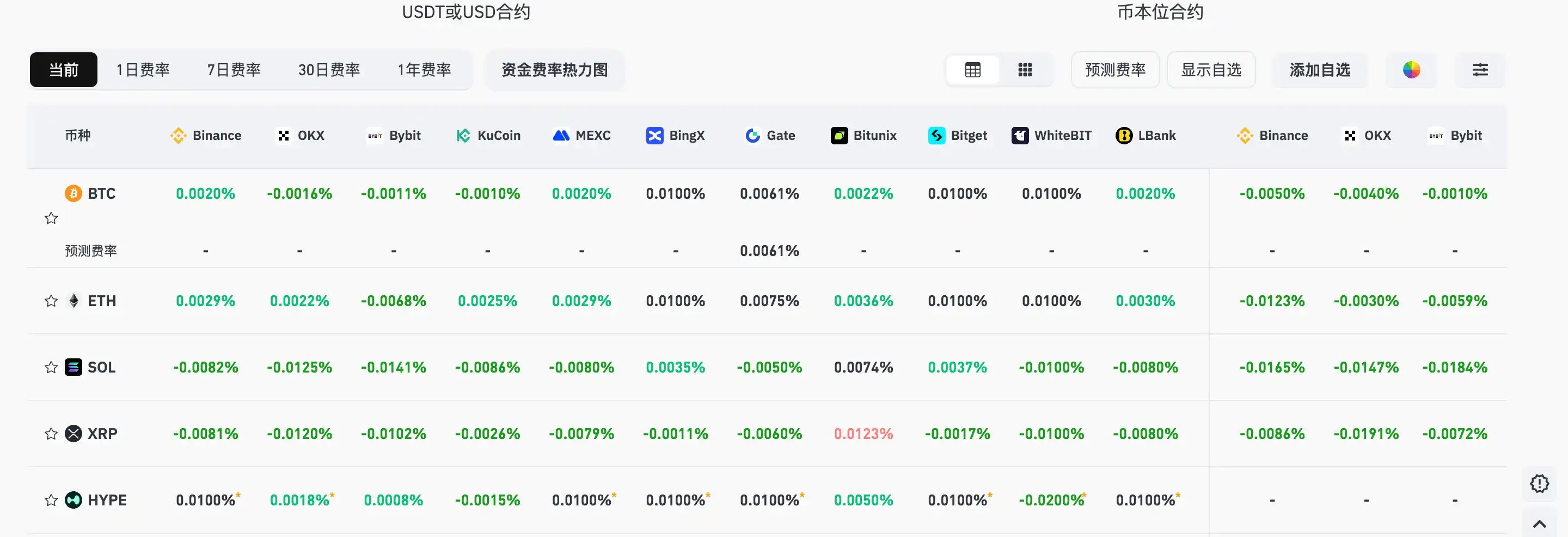

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.

Some Meme coins continue to rise during the market pullback, with JELLYJELLY surging 37% against the trend.