-

The current landscape for Ethereum (ETH) reflects significant sell-side pressure, reminiscent of the tumultuous bear market of 2022.

-

As major holders initiate aggressive distribution cycles, the call for a robust demand-side absorption becomes increasingly critical.

-

A recent report from COINOTAG highlights that without a shift to demand absorption, Ethereum’s price may remain constrained, pointing towards a potential for ongoing losses.

Ethereum faces heavy sell-offs reminiscent of the 2022 bear market, with significant losses triggering calls for demand-side absorption to stabilize the price.

Analysis of Ethereum’s Current Market Trends

The recent activities observed among Ethereum whales have clear parallels with previous market downturns. Ethereum’s price has seen a steep decline, with sell-side liquidity concentrated around the $1.4k–$1.6k range, which poses significant implications for future pricing dynamics. The sell-offs have highlighted the vulnerability of investors and the potential for further corrections unless a clear absorption point develops.

Market Sentiment and Price Movements

Current market sentiment is fraught with apprehension as macroeconomic conditions continue to exert pressure. Galaxy Digital’s recent liquidity offloading serves as a cautionary tale for many investors, indicating a trend where large players are moving to liquidate holdings. As the market grapples with loss realizations, the shift in sentiment could create a coiled spring effect, leading to sudden price rebounds if the right conditions are met.

Demand-Side Absorption: A Critical Factor

Ultimately, the crux of Ethereum’s recovery hinges on bid-side absorption overcoming persistent sell pressure. Historically, market recoveries have been anchored on impressive demand-side uptake, something that has yet to emerge in the current environment. A compelling indicator of this would be a positive shift in the Net Realized Profit/Loss (PnL) metric, which currently speaks to a landscape of unrealized losses.

Indicators to Watch for Price Recovery

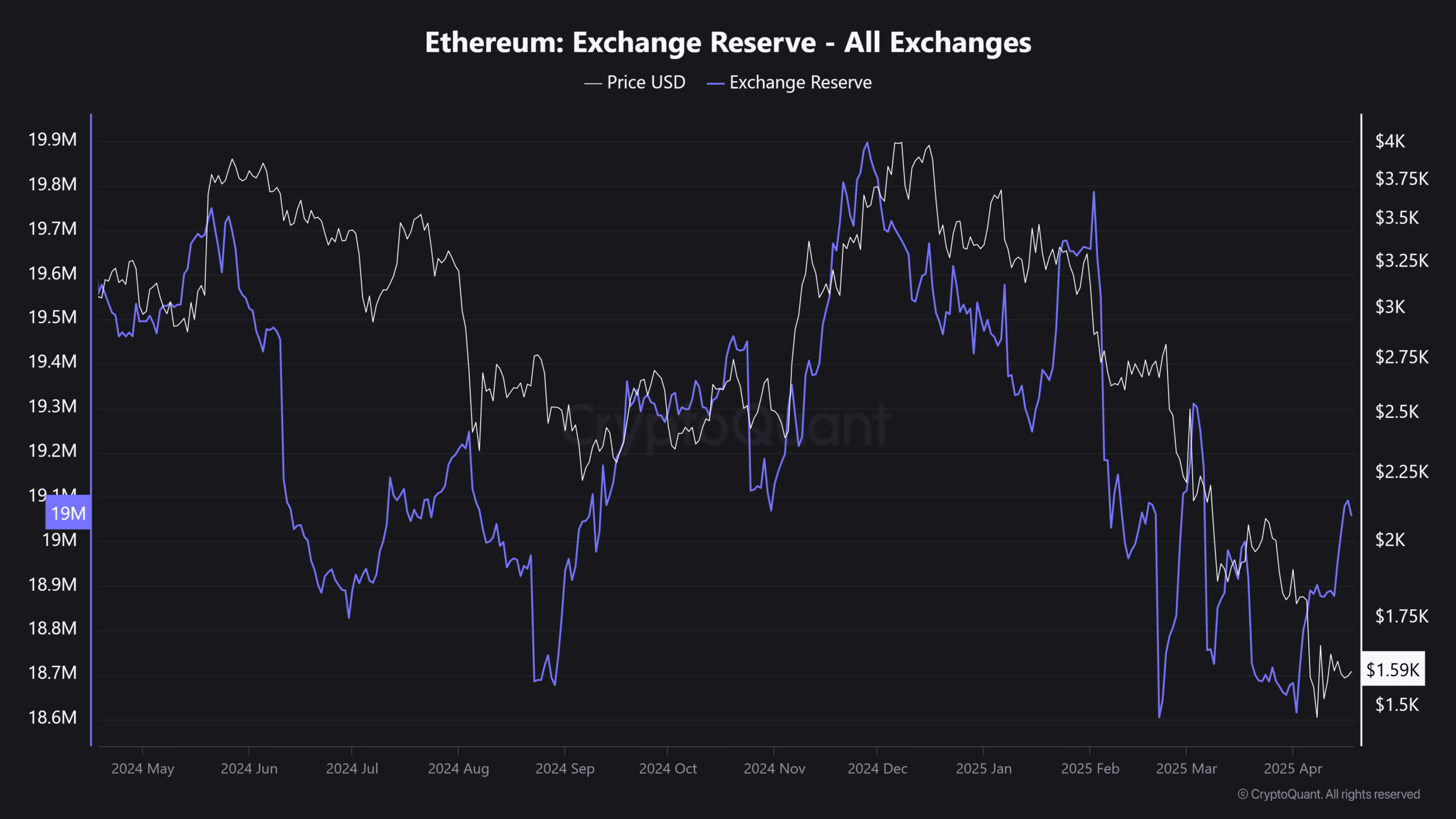

The Ethereum ecosystem has seen a surge in exchange reserves, with data demonstrating over 40 million ETH deposited onto exchanges since early April. Such movements usually coincide with heightened selling pressure, leading to bearish trends. To reverse this narrative, we are looking for critical price thresholds to be reclaimed, as those who invested at higher price points need reassurance that their holdings can soon recover.

Source: CryptoQuant

Conclusion

In summary, Ethereum’s current market phase reflects a critical juncture characterized by heavy sell-offs and unrealized losses. To catalyze a meaningful recovery, demand-side absorption must significantly outweigh ongoing sell pressure, allowing holders who are currently underwater some reprieve. The coming weeks will be pivotal for investors, as monitoring key price levels and liquidity behavior may provide essential insights into Ethereum’s trajectory.