Solana dApps generated more revenue than dApps on all other chains combined

Solana’s dApp ecosystem is outearning the competition, with more revenue than all other chains combined.

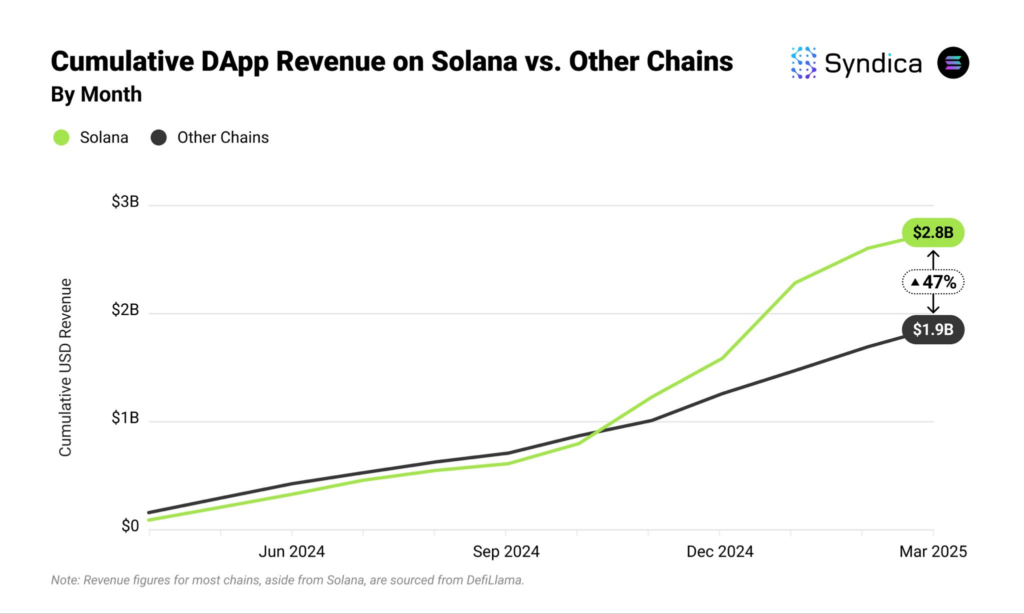

In the last 12 months, Solana (SOL) dApps generated more revenue than dApps on all other chains combined. According to a report by Syndica , published on April 18, Solana dApps earned $2.8 billion in revenue. That’s 47% more than the dApp revenue on all other chains combined.

Cumulative dApp revenue for Solana and all other chains | Source: Syndica

Cumulative dApp revenue for Solana and all other chains | Source: Syndica

Solana’s dApp earnings began outpacing all other chains in October of last year. Since then, the gap has only continued to widen. These figures show that Solana’s ecosystem remains highly attractive to both users and developers. Its low fees and focus on user experience appeal to end users, while developers benefit from the network’s accessible and developer-friendly infrastructure.

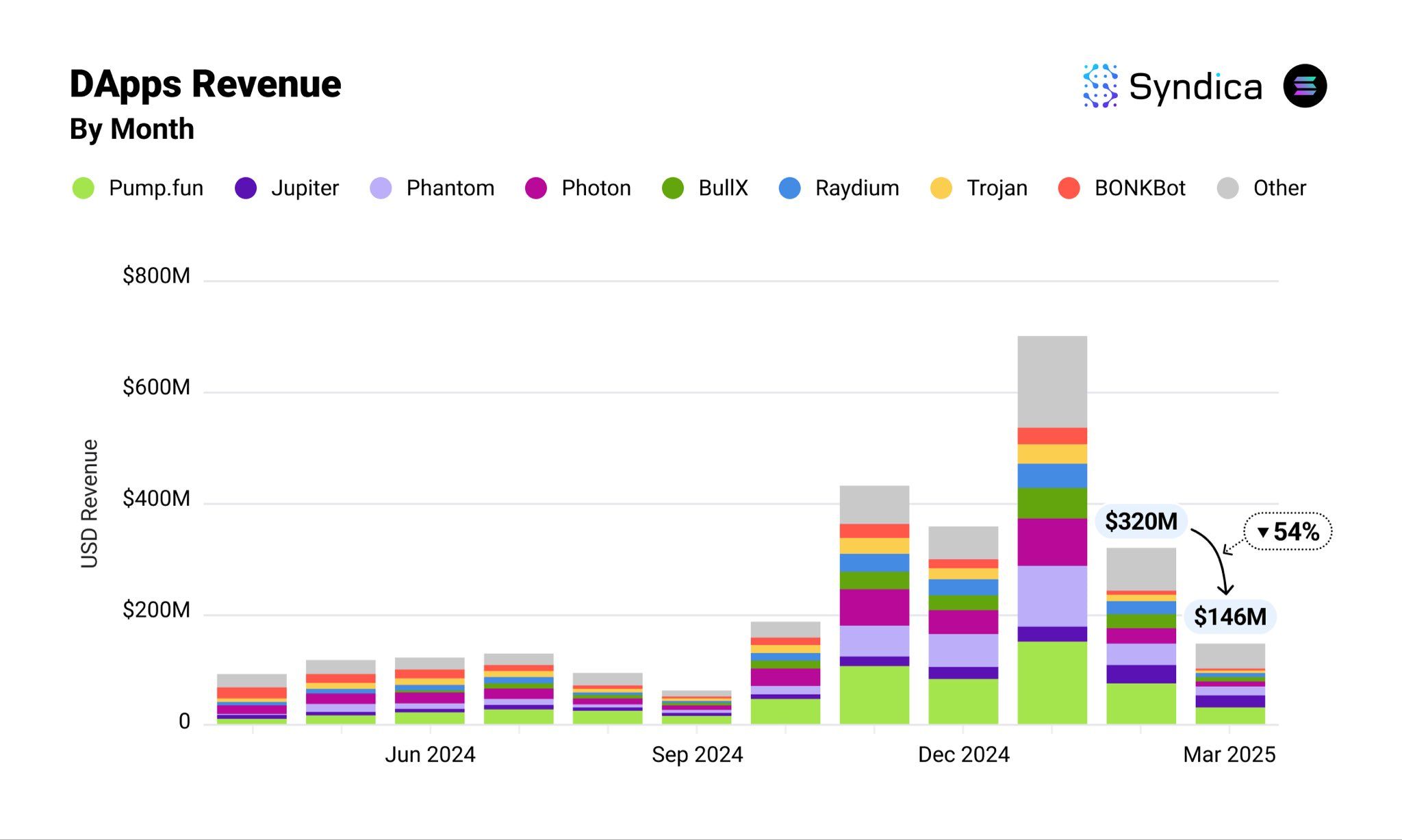

Still, Solana’s dApp revenue is largely driven by crypto trading applications, which makes earnings highly volatile. For example, revenue peaked in January at $701 million, coinciding with Solana’s all-time high of $294.33.

Solana dApp revenue each month, by category | Source: Syndica

Solana dApp revenue each month, by category | Source: Syndica

Since that peak, dApp revenue has declined significantly, dropping to $146 million in March. This highlights how closely dApp earnings correlate with high trading volumes and elevated asset prices.

Pump.fun leads in Solana revenue

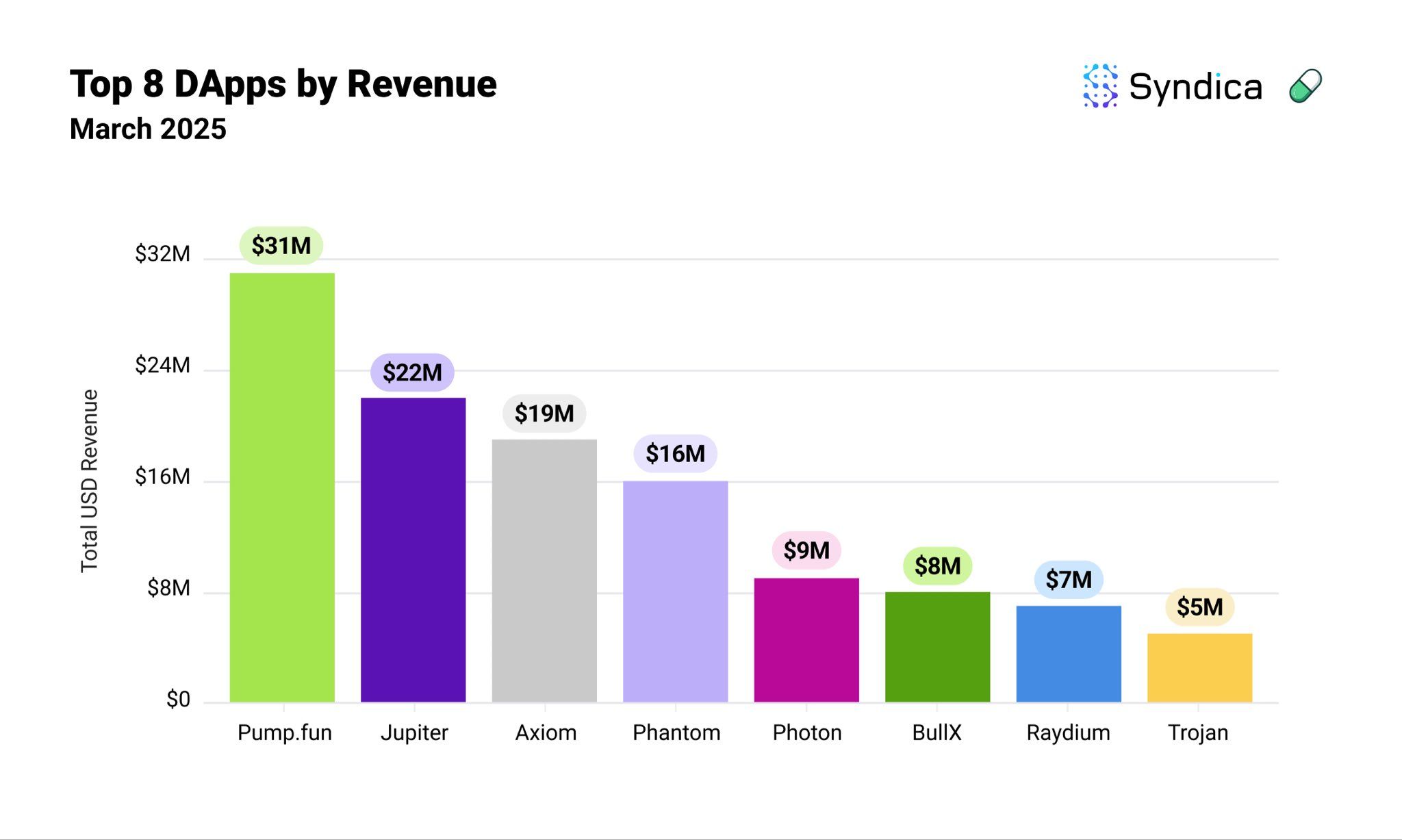

Exchanges, wallets, and other trading-focused platforms dominate Solana’s top-earning dApps. The biggest contributor in March was memecoin launchpad Pump.fun, which brought in $31 million, surpassing platforms like Jupiter and Phantom.

Solana dApps by revenue | Source: Syndica

Solana dApps by revenue | Source: Syndica

Pump.fun is now facing rising competition from Axiom, a memecoin launchpad backed by Y Combinator. Axiom has quickly gained traction, capturing 29% of the memecoin dApp market and generating $19 million in revenue.

Meanwhile, Jupiter remains the dominant force among Solana DEXs, earning 93% of total DEX revenue on the network. It maintained strong performance in March, bringing in $22 million despite the cooling market—alongside consistent results from Kamino Finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...