New Aptos Governance Plan Proposes Halving Staking Rewards to Curb Network Inflation

The Aptos proposal includes a validator delegation program designed to support smaller operators and preserve community diversity.

The Aptos community is currently evaluating a new governance proposal, AIP-119, that could halve staking rewards over the next three months. It seeks to reduce the current annual staking yield from around 7% to 3.79%.

Aptos Labs senior engineer Sherry Xiao and network core developer Moon Shiesty introduced the proposal on April 18.

Aptos Eyes Trimming Staking Rewards to Fund New Initiatives

The proposal AIP-119 describes staking rewards as a “risk-free” benchmark, similar to the role of interest rates in traditional finance. According to the proposal, the current yield rate of 7% is too high and discourages productive use of capital within the ecosystem.

Instead, the authors aim to lower the yield to around 3.79%. They hope this change will encourage network users to pursue more dynamic economic activities beyond passive staking.

According to them, this could stimulate demand for more active strategies, such as restaking, MEV extraction, and participation in DeFi.

“I expect any lowered staking demand [to] be offset by the reduction in inflation from this AIP and new reward-generating opportunities launching in the next 6 months, and other sources of defi rewards,” Shiesty added on X.

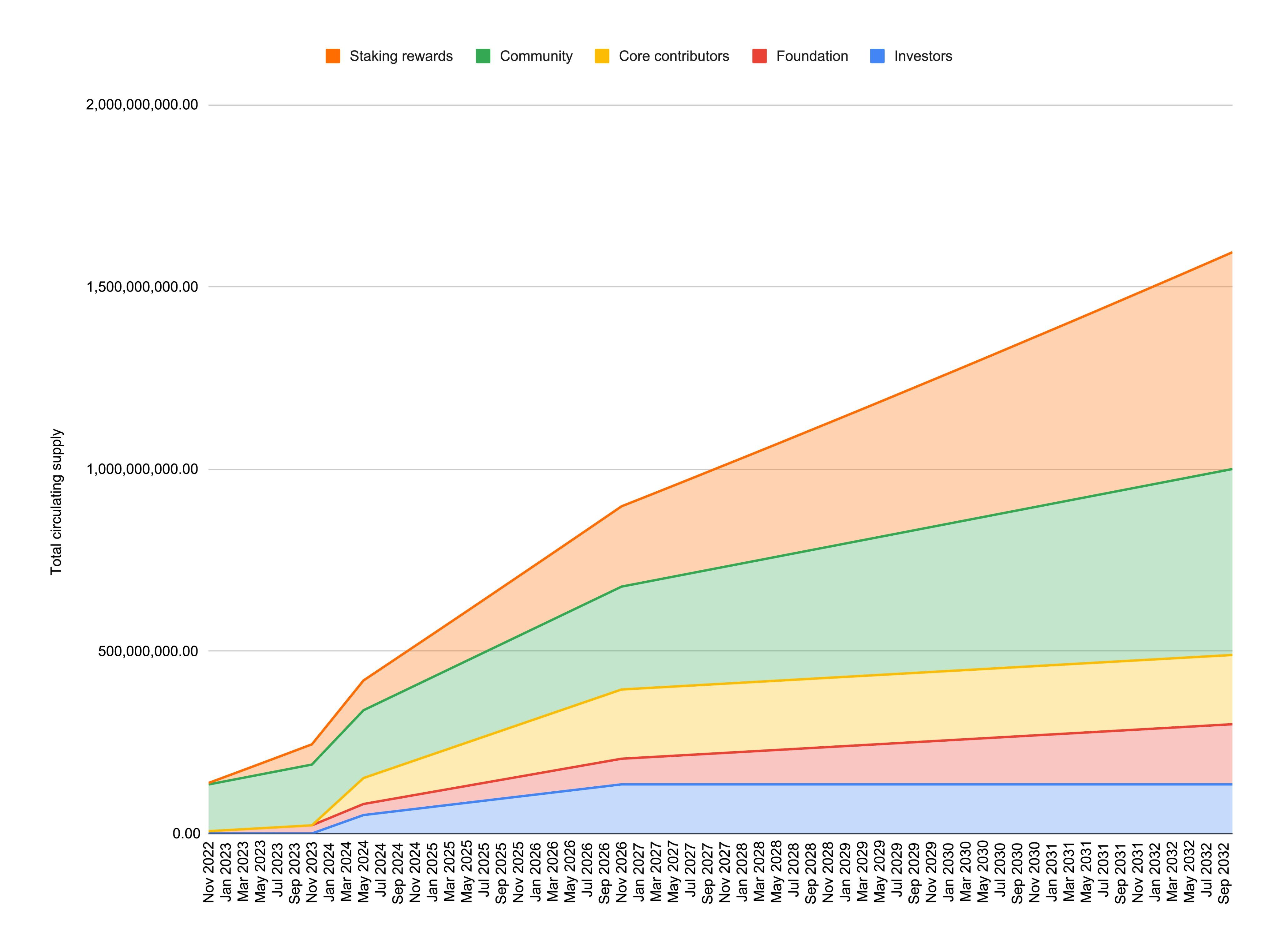

Aptos Total Circulating Supply. Source:

X/Shiesty

Aptos Total Circulating Supply. Source:

X/Shiesty

Moreover, Shiesty pointed out that a portion of the saved emissions could instead support initiatives like liquidity incentives and gas fee subsidies. He also mentioned that stablecoin-related programs may benefit, especially in early-stage Layer 1 experiments.

Despite the proposal’s broader ambitions, AIP-119 raises concerns about validator sustainability. Under the proposed changes, smaller operators with lower stake volumes could face financial strain.

Shiesty pointed out that operating a validator node in a cloud environment can cost anywhere from $15,000 to $35,000 per year. Currently, over 50 validators manage under 3 million APT each, accounting for around 9% of the total network stake.

Due to this, the proposal introduces a validator delegation program to support these smaller players. The initiative would allocate funds and delegate tokens to help maintain decentralization, geographic diversity, and community involvement.

Meanwhile, the community’s reaction to the proposal has been divided.

Yui, COO of Aptos-based Telegram game Slime Revolution, warned that smaller validators might be pushed out. The executive emphasized the importance of finding a balance that encourages innovation without sacrificing decentralization.

“While it could drive innovation, I’m concerned about the potential impact on smaller validators and decentralization. We need to make sure the move doesn’t push out smaller participants! Aptos should focus on balance and long-term resilience,” Yui wrote on X.

However, Kevin, a researcher at BlockBooster, argued that the shift could benefit Aptos in the long run. He noted that high inflation often masks weak product-market fit. Lower inflation, on the other hand, forces developers to build real demand.

Kevin also suggested that reduced token emissions might improve APT’s scarcity and boost its price, potentially balancing out the lower staking yield.

“We expect APT’s price to grow due to the reduced inflation rate, and validators’ actual returns may offset the APY decline through price appreciation, forming a positive cycle,” Kevin concluded.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."