Ark Invest Boosts SOL, Reduces Bitcoin Holdings in Portfolio

- Ark Invest has purchased 500,000 shares of the 3iQ Solana ETF for $5.2 million.

- The firm reduced its Bitcoin ETF holdings by 31,817 shares, worth $2.7 million.

- Growing interest in blockchain diversification is reflected in Ark’s relocation to Solana.

Ark Invest, led by Cathie Wood, has recently made notable changes to its investment portfolio. The firm bought 60,266 shares of Robinhood, sold 31,817 shares of its Bitcoin ETF, and acquired 500,000 shares of the 3iQ Solana Staking ETF (SOLQ.U), totalling $5.2 million. This shift reflects Ark’s continued strategy to diversify its cryptocurrency and equity exposure.

Ark’s Move into Solana via 3iQ ETF

Ark Invest’s strategic acquisition of 500,000 shares of the 3iQ Solana ETF marks a move into the Solana ecosystem. The shares were acquired through two of Ark’s funds: the ARK Next Generation Internet ETF (ARKW) and the ARK Fintech Innovation ETF (ARKF). The 3iQ Solana ETF, which was launched in Canada, began trading on April 16. Notably, it is the first Solana-specific ETF available in North America, allowing investors to gain exposure to Solana while receiving staking rewards.

Further, the investment represents a clear shift toward blockchain diversification beyond the well-established assets like Bitcoin and Ethereum, reflecting Ark’s confidence in Solana’s expanding ecosystem, including its growing developer community and decentralized applications.

Related: ARK Invest Purchases $13.3M in Coinbase Shares During Slump

Reduction in Bitcoin ETF Holdings

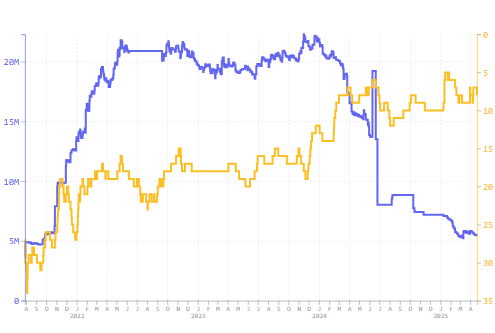

While increasing its Solana stake, Ark reduced its position in Bitcoin. The firm sold 31,817 shares of the ARK 21Shares Bitcoin ETF (ARKB), valued at around $2.7 million. This sale comes during a period of Bitcoin’s recovery, with the price hovering below $84,400. Despite this reduction, Ark’s Bitcoin ETF remains one of the largest in the market, with a total holding of $3.9 billion.

Source: Ark Holdings (Robinhood)

The sale of Bitcoin ETF shares may reflect a tactical rebalancing within Ark’s portfolio. By moving funds from Bitcoin to Solana and Robinhood, Ark has positioned itself for future growth in emerging blockchain technologies. This approach signals Ark’s commitment to adapting to market shifts while maintaining a diversified portfolio of digital assets.

Strategic Rebalancing and Portfolio Diversification

With strategic adjustments, Ark illustrates a broader trend toward diversification and flexibility in its portfolio management. While Bitcoin remains a significant component, Ark’s increasing investments in Solana and Robinhood underscore a commitment to exploring promising sectors. While Robinhood boosts its platform for retail investors, aligning with Ark’s focus on fintech, Solana highlights the firm’s willingness to engage with high-growth blockchain projects.

The post Ark Invest Boosts SOL, Reduces Bitcoin Holdings in Portfolio appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!