- Open interest jumps 20% to $3.89B in 24 hours.

- RSI climbs to 58, signalling bullish momentum.

- Risk remains if XRP loses $2.00 key support level.

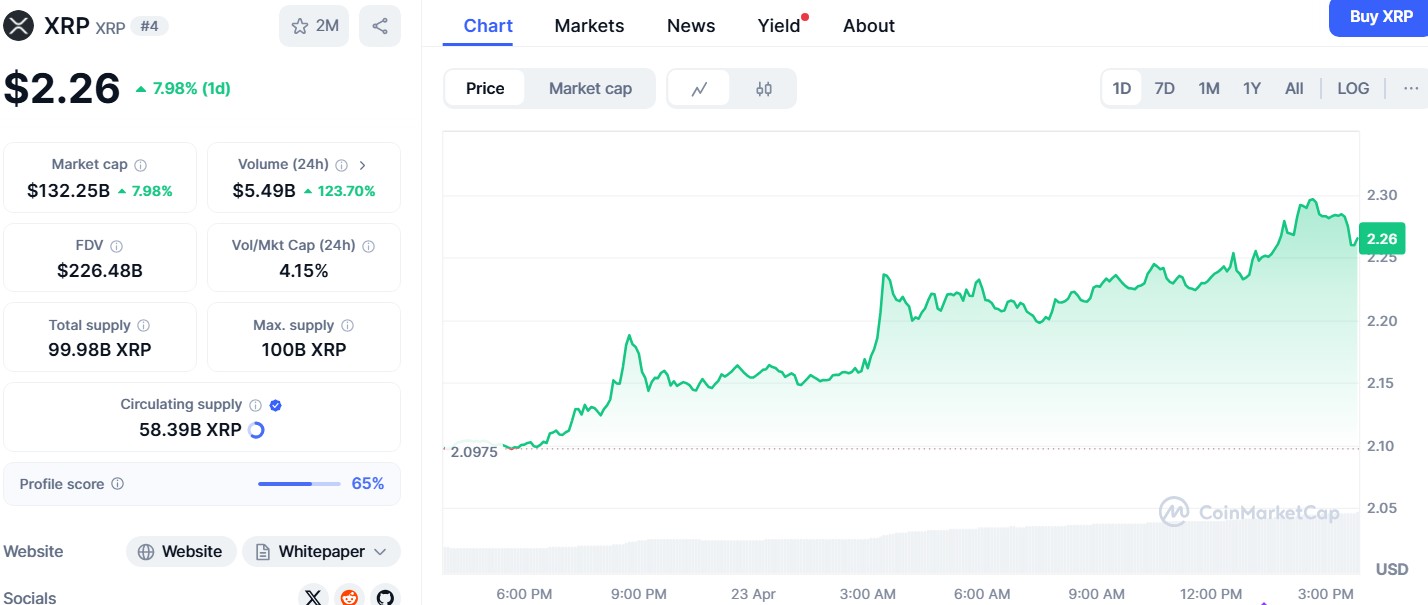

Ripple’s XRP is gaining traction again, climbing steadily above the $2.00 mark after a volatile start to April. As of Wednesday, the token was trading at $2.26, buoyed by a renewed wave of risk appetite across crypto markets.

The upswing aligns with a broader shift in macroeconomic sentiment, driven in part by President Donald Trump’s softened stance on Federal Reserve Chair Jerome Powell and a fresh call for rate cuts.

The President’s pivot has sent ripples across asset classes, including Bitcoin, Ethereum, and Solana—bringing renewed optimism to the altcoin sector, with XRP front and centre.

Trump’s Fed policy pivot lifts risk sentiment

US President Donald Trump’s recent remarks—clarifying he has no intention of removing Fed Chair Jerome Powell—helped calm investor nerves.

Trump’s earlier criticism, which accused Powell of being slow to cut rates, had fuelled speculation of a shake-up at the central bank.

However, on Tuesday, Trump told reporters that the media had exaggerated his stance, stating, “Never did. The press runs away with things.”

Despite standing by his earlier concerns, Trump’s softened tone came alongside a renewed push for the Fed to lower interest rates.

That aligns with ongoing discussions around tariff negotiations, with the administration reportedly aiming for a temporary deal with China in the short term, followed by a comprehensive agreement within two years.

Markets responded positively. Bitcoin, Ethereum, and Solana posted intraday gains, reflecting the return of risk-on appetite. XRP also capitalised on the moment, continuing its uptrend and gaining technical strength near its short-term resistance levels.

XRP climbs above key moving averages

XRP’s price is holding firm around $2.22–$2.26, bolstered by support from both the 50-day and 100-day Exponential Moving Averages.

Source: CoinMarketCap

These indicators have acted as a confluence resistance zone, but XRP’s consistent testing of this level points to an attempt at a sustained breakout.

Momentum indicators are confirming the bullish bias. The Relative Strength Index (RSI) rose above 58 at the time of writing, heading towards overbought territory.

A continuation of this trend could allow XRP to challenge the descending trendline and make a run for the $3.00 psychological resistance.

Open interest and liquidations suggest trader confidence

XRP’s derivatives market data shows a clear tilt towards bullish positioning. According to Coinglass, open interest surged by over 20% in the past 24 hours to reach $3.89 billion.

That uptick confirms a renewed interest in the asset, with short positions liquidated to the tune of $8.46 million—vastly outpacing the $2.63 million in long liquidations.

The long-to-short ratio stood at 1.0243, indicating more traders are betting on continued upside.

Such a surge in leverage often raises the potential for short-term corrections. If profit-taking follows, XRP could revisit support levels. A confirmed close above the 50 and 100-day EMAs would be necessary to validate a longer-term breakout.

Caution if XRP slips below $2.00 support

If the bullish momentum stalls, XRP risks falling back toward its next key support level at $2.00. A break below this zone could invite further declines, potentially targeting the 200-day EMA around $0.96 and the $1.80 demand zone.

These levels remain crucial for maintaining XRP’s broader uptrend structure.

With macroeconomic sentiment shifting and Trump’s messaging turning less combative, XRP appears well-positioned to benefit from increased risk appetite in the short term.

However, confirmation through price action and technical closes above resistance will be essential before any sustainable push to $3.00.