Bitcoin Pullback the Next Logical Move Amid Stiff Resistance, Says Crypto Analytics Firm – Here Are the Targets

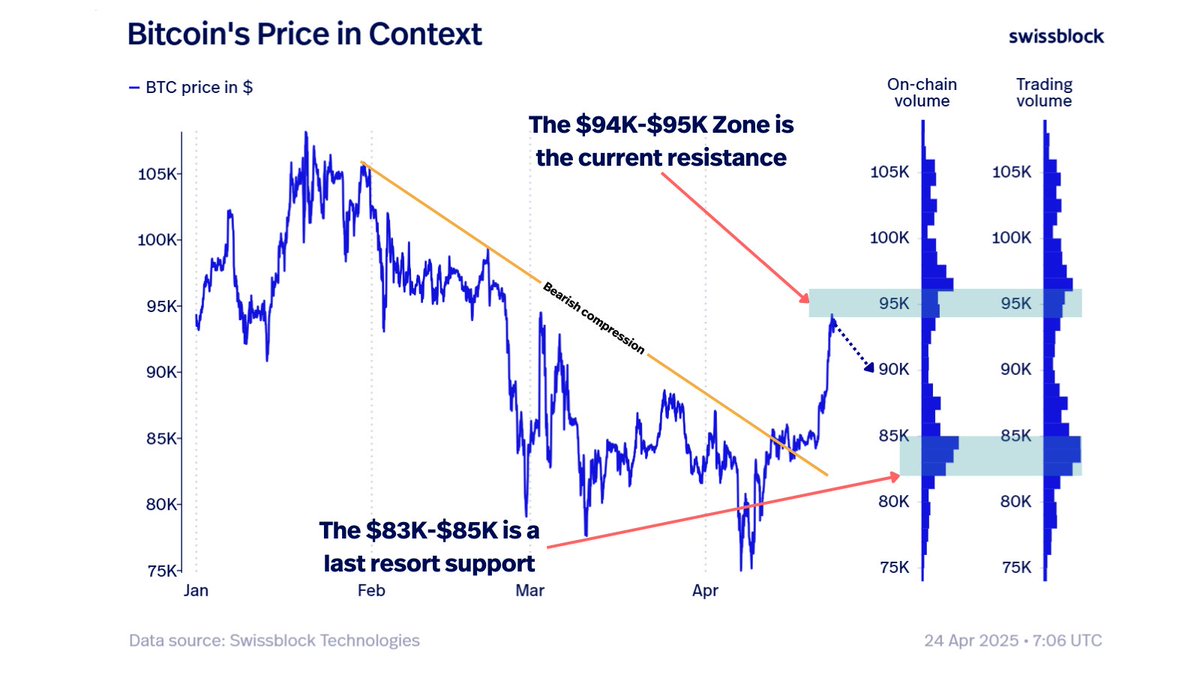

Prominent crypto analytics firm Swissblock says Bitcoin ( BTC ) may first pull back before heading higher after reclaiming the $90,000 range.

Swissblock says on the social media platform X that Bitcoin may correct to as low as $89,000 after running up against strong resistance in the mid-$90,000s.

“The $94,000-$95,000 zone is clearly the resistance to beat. A pullback to gain momentum seems like the next logical move, but how far? The $89,000-$90,000 zone could be next to test bulls, but with BTC’s structure strength, these dips are for buying.”

Source: Swissblock/X

Source: Swissblock/X

According to Swissblock’s chart, Bitcoin needs to hold support at $83,000 to remain in a bullish uptrend.

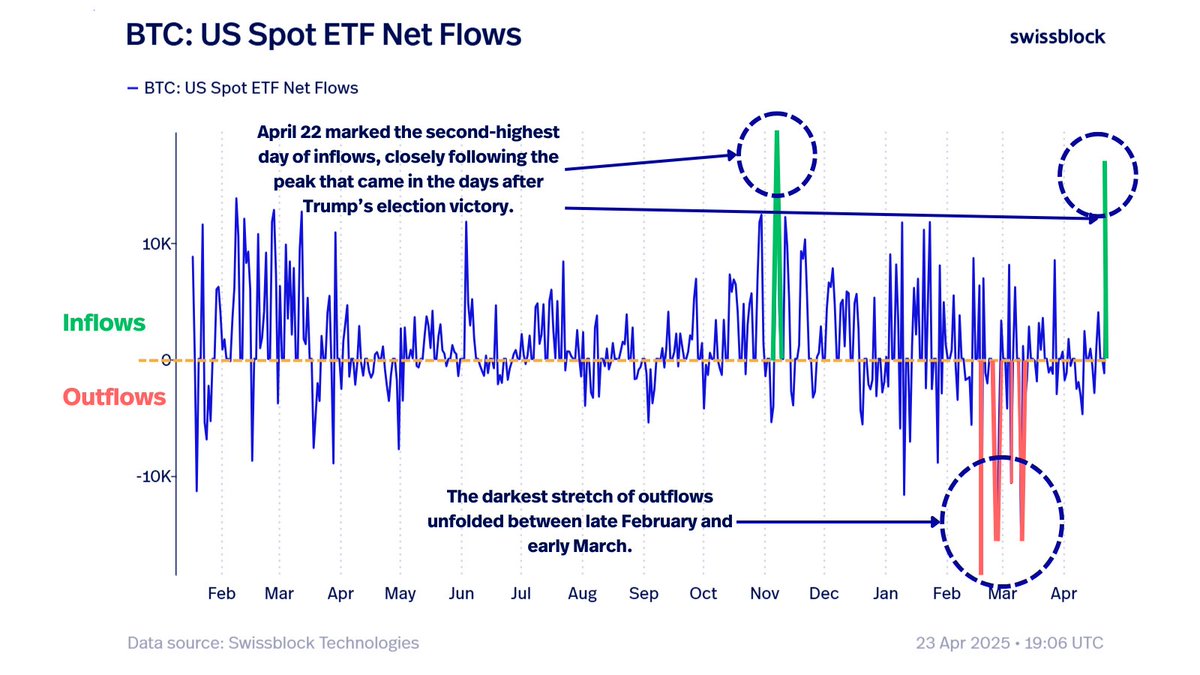

Next up, Swissblock says that the buying of spot Bitcoin exchange-traded funds (ETFs) surged this week as the flagship crypto asset began breaking out.

“Everyone’s bullish as Bitcoin pumps to $94,000. Institutional ETF investors joined the pump, [April 22nd] saw the second-largest inflow day with 17,000 BTC bought, after 62,000 in outflows during February and March. Is this the start of a buying spree?”

Source: Swissblock/X

Source: Swissblock/X

Swissblock is also keeping a close watch on the Bitcoin Fundamental Index (BFI), a metric that combines liquidity and network growth.

According to Swissblock, the BFI needs to gain strength in order for Bitcoin to keep rallying.

“BFI is weakening! It means the upside could not be sustainable. We need to monitor this indicator… If it doesn’t strengthen, prepare for downside pressure.”

Source: Swissblock/X

Source: Swissblock/X

Bitcoin is trading for $93,312 at time of writing.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/StockStyle/Redshinestudio

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Virtual asset venture capital loosens restrictions—Is a spring for crypto startups coming in South Korea?

The amendment to the "Enforcement Decree of the Special Act on Fostering Venture Businesses," passed by South Korea's Ministry of SMEs and Startups and the Cabinet on September 9, removes "blockchain/virtual asset (cryptocurrency) trading and brokerage" from the list of "restricted/prohibited investment" industries. The amendment will officially take effect on September 16.

US Bitcoin ETFs Record $741M Inflows Amid Market Optimism

Ethiopia is Turning Hydropower Into Bitcoin Mining

Whale Sits on $9M Profit After Leveraged Bets on BTC & Memecoins