XYO pulls off 50% rally amid Bithumb listing and ecosystem growth

XYO surged by as high as 50% today, ahead of its listing on a leading South Korean exchange, Bithumb.

XYO network (XYO) spiked to an intraday high of $0.015 during morning hours in Asia on April 25, more than doubling from its monthly lows and lifting its market cap past $207 million.

Today’s rally was triggered by Bithumb ’s announcement that it will launch a KRW trading pair for XYO later in the day at 5:00 PM KST.

The listing price is set at 15.30 KRW (around $0.0107), and trading will go live shortly after, with deposits and withdrawals opening two hours later, exclusively on the Ethereum network.

There’s also growing excitement around XYO’s tech developments. The network recently launched a public beta of its own Layer-1 blockchain, XYO Layer One, along with a new utility token called XL1.

The new token will handle transaction fees, gas, contract execution, and user rewards, while the original XYO token will focus on governance and staking.

On-chain metrics also show strong growth in its position within the DeFi space, with TVL climbing to over $91 million, up from $37 million on April 8. This was accompanied by a nearly 300% spike in daily active addresses, suggesting rising user engagement.

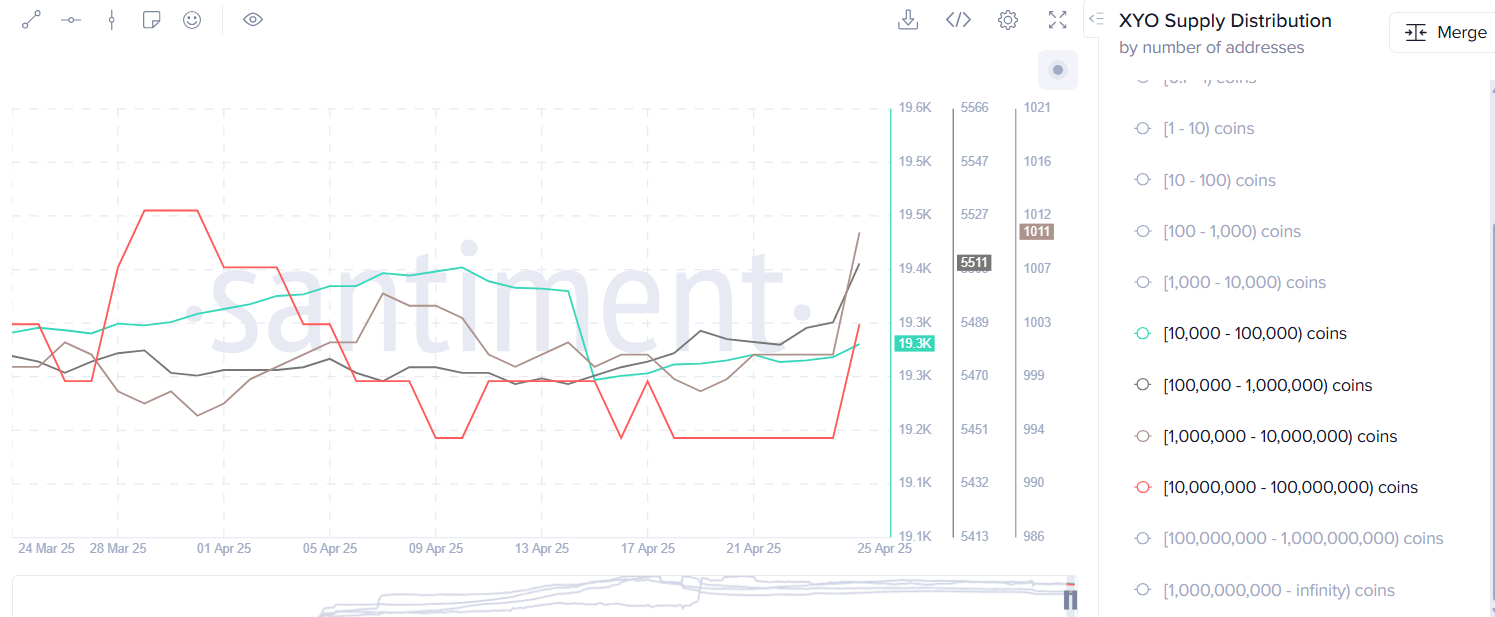

Santiment data backs this up, showing a steady climb in the number of wallets holding between 10,000 and 100 million XYO tokens. That suggests whales and mid-sized holders are accumulating, possibly expecting more upside.

Source: Santiment

Source: Santiment

XYO price analysis

On the 1-day/USDT price chart, XYO has broken out of a long-term descending trendline, signaling a clear bullish reversal.

XYO price, 50-day and 200-day EMA chart — April 25 | Source: crypto.news

XYO price, 50-day and 200-day EMA chart — April 25 | Source: crypto.news

It’s now trading above both its 50-day and 200-day moving averages, which is a strong sign that bulls are in control.

XYO MACD and RSI chart — April 25 | Source: crypto.news

XYO MACD and RSI chart — April 25 | Source: crypto.news

Indicators like the MACD and RSI are also flashing green, showing growing strength behind the rally.

Based on this setup, the next potential target for XYO is $0.025, which marks its yearly high so far. However, with the RSI now above the overbought zone, a short-term pullback could occur before the rally resumes.

Market commentators share similar expectations, with some eyeing even higher targets. According to analyst Javon Marks, XYO could be gearing up for a major move. He sees the token heading toward a target of $0.06949, a potential 360% gain from current levels, now that altocin is forming lower highs and momentum is picking up fast.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!