Nexo to reenter US market after two-year regulatory exit and $45 million settlement

Quick Take The crypto lender announced its U.S. comeback at a private event attended by Donald Trump Jr., son of the President, among others. Nexo previously exited the United States due to multi-agency investigations and eventually paid $45 million to settle charges with federal and state watchdogs.

Crypto lender Nexo is reentering the U.S. market , nearly two years after halting services for American clients due to regulatory scrutiny of its Earn Interest Product.

The company revealed its return during a closed-door business event, where it announced plans to reintroduce crypto savings accounts, asset-backed loans, and other core offerings for both retail and institutional customers.

Zug-based Nexo left the U.S. market in 2022 amid centralized lenders like BlockFi, Celsius, and Voyager declaring bankruptcy. Unlike competitors, Nexo’s retreat stemmed from regulatory probes rather than insolvency. The company started halting access to its Earn Interest Product in several US states in 2022.

Agencies like the Consumer Financial Protection Bureau (CFPB) and the Securities and Exchange Commission (SEC) accused Nexo of failing to register the offer and sale of its Earn product to retail clients. The company officially ceased U.S. operations in December 2022 and later agreed to a $45 million settlement in January 2023 without admitting wrongdoing.

Now, under President Donald Trump’s administration, which has signaled a shift in crypto oversight and a pivot away from the enforcement action style adopted by former SEC Chair Gary Gensler, Nexo is staging a comeback. The Trump administration has signaled intentions to reduce regulatory hostility toward crypto, including withdrawing some SEC investigations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.

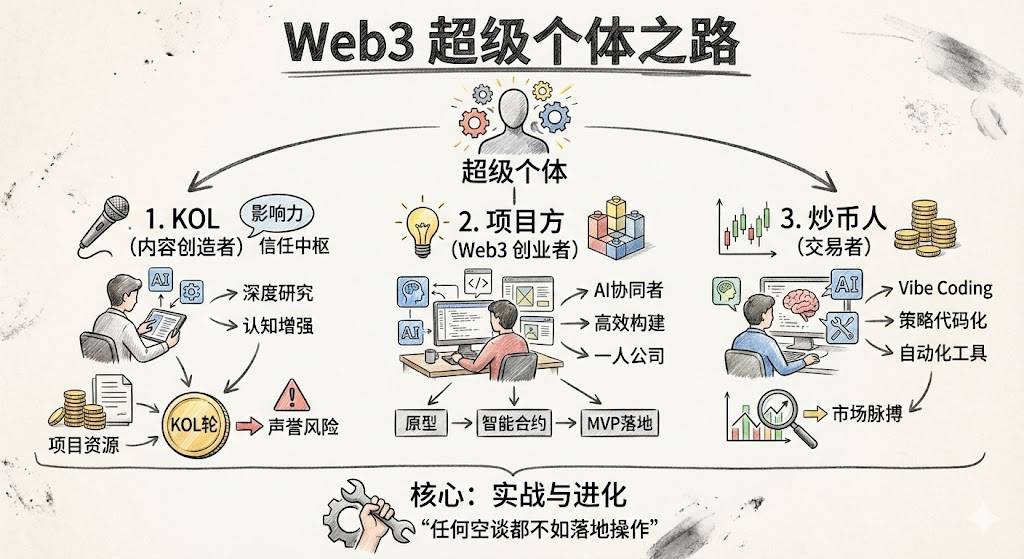

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.