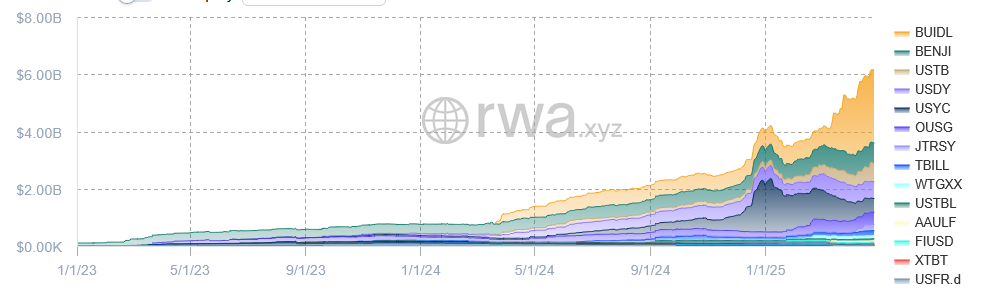

Tokenized treasuries products enjoyed significant growth during April, with investors injecting more than $1 billion into the sector since April 1.

The funds are enjoying a banner year, with the TVL of tokenized treasuries sitting at nearly $6.16 billion after jumping 78% from late January’s local low of $3.47 billion.

TVL of tokenized treasuries. Source: rwa.xyz.

TVL of tokenized treasuries. Source: rwa.xyz.

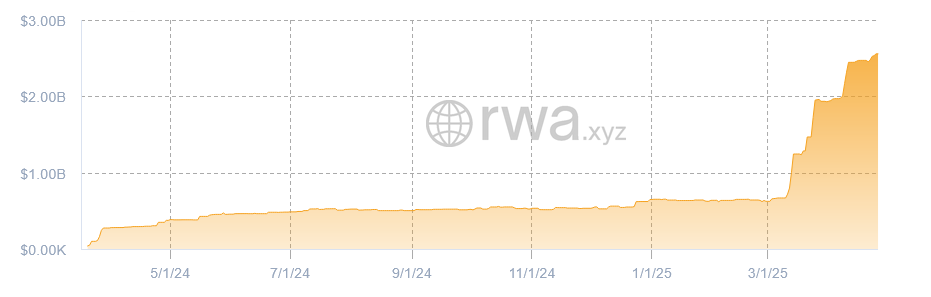

BUIDL’s dominance grows

The dominance of BlackRock’s BUIDL fund continues to grow, driving 64% of inflows over the past 30 days with $621.7 million , according to rwa.xyz. BUIDL now boasts a TVL of nearly $2.56 billion and accounts for 41.5% of the sector’s combined TVL.

BUIDL’s TVL is up 303% from $635.7 million on January 22, while its dominance over the sector has more than doubled from 18.3% over the same period.

Despite BUIDL expanding onto new chains in recent months, Ethereum accounts for more than 95% of the fund’s TVL with almost $2.44 billion. BUIDL went live on Aptos, Arbitrum, Avalanche, OP Mainnet, and Polygon on November 17 and deployed on Solana on March 25. Each alternative chain hosts between $20 million and $55 million in TVL.

BUIDL TVL. Source: rwa.xyz.

BUIDL TVL. Source: rwa.xyz.

While Larry Fink, BlackRock’s CEO, praised tokenization as a vehicle for democratization in his annual letter to shareholders published on March 31, only four wallets hold nearly 80% of BUIDL’s assets.

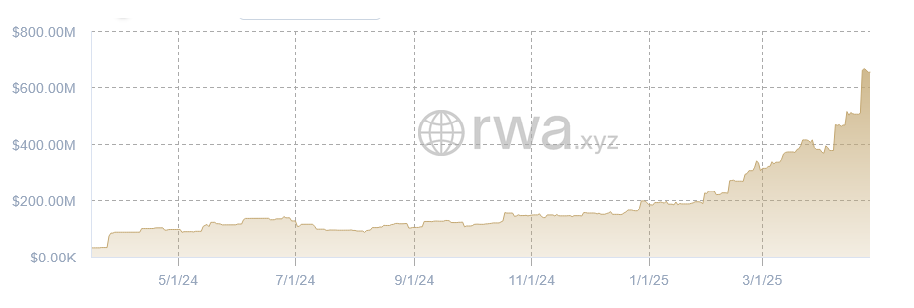

Superstate’s USTB emerges among leading tokenized treasuries funds

Superstate’s USTB fund continues to climb the tokenized treasuries rankings. The fund now boasts a TVL of $652.6 million after growing by $292 million or 81% in 30 days. USTB’s TVL is also up 182% since the start of the year.

USTB TVL. Source: rwa.xyz

USTB TVL. Source: rwa.xyz

USTB is rapidly closing in on Franklin Templeton’s BENJI fund, which ranks as the sector’s second-largest product with $707.8 million. BENJI’s TVL has trended sideways since March, growing by just 4.39% in the past six weeks.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More