-

Despite a death cross on April 14, HBAR surged 20% in two weeks, defying bearish expectations amid a broader market rebound.

-

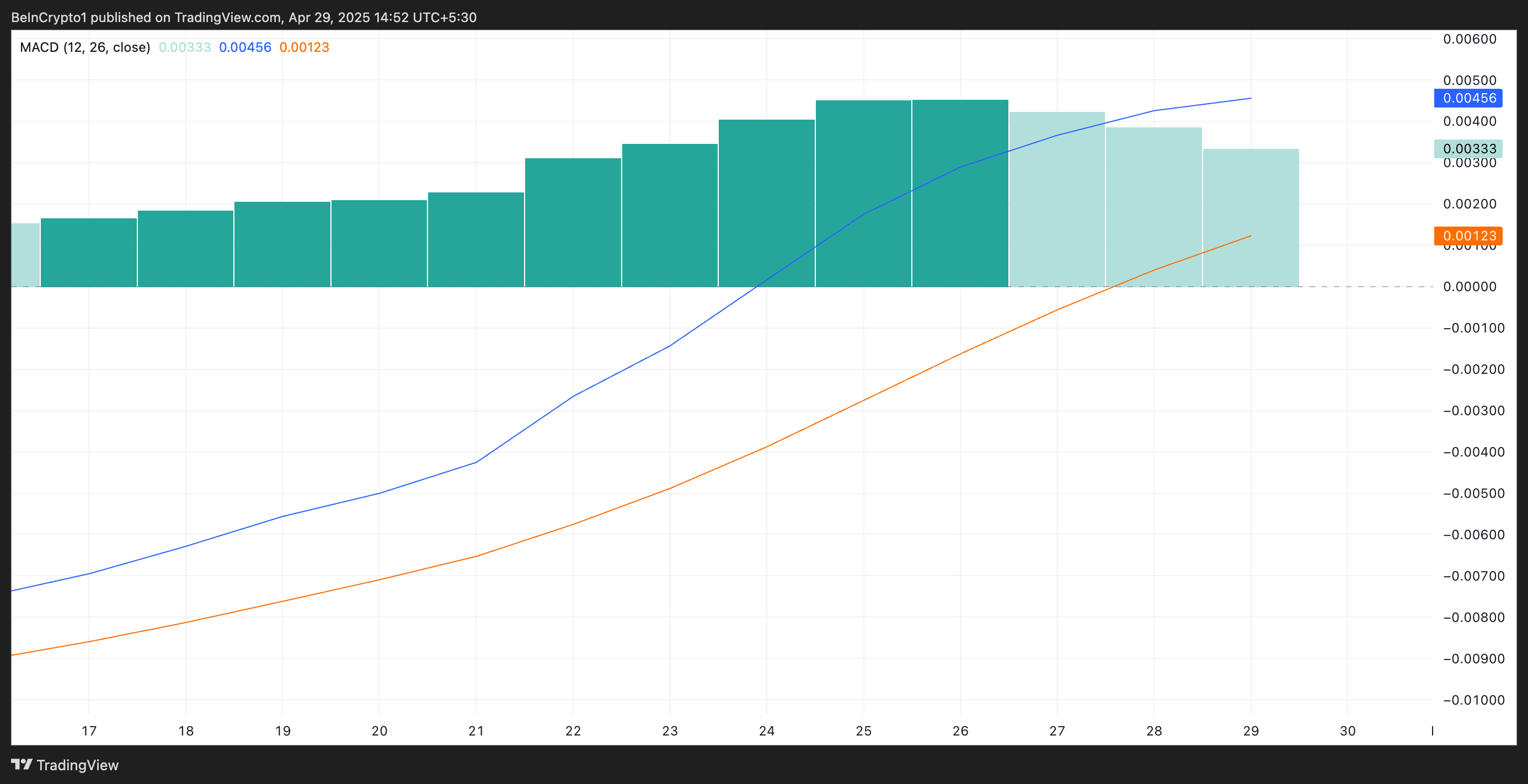

MACD readings confirm buying pressure still prevails, suggesting more potential upside if demand increases further.

-

HBAR has followed an ascending trend line since April 16, indicating sustained upward momentum and potential for further gains.

HBAR’s surprising resilience post-death cross signals potential for increased gains as bullish momentum persists amidst market fluctuations.

HBAR Bulls Stay in Control After Death Cross

A death cross occurs when an asset’s short-term moving average—typically the 50-day—crosses below its long-term moving average, usually the 200-day.

This crossover means the asset’s recent price momentum is weakening, and a longer-term downtrend may take shape. The pattern often signals increased selling pressure as traders generally interpret it as a marker of a negative shift in market sentiment.

HBAR Death Cross. Source: TradingView

However, this is not always the case, especially in volatile or recovering markets where price action can defy traditional technical signals. For instance, HBAR’s value rocketed 20% in the past two weeks.

Although the bullish momentum has eased slightly over the last three trading sessions, the bulls remain firmly in control. Readings from HBAR’s Moving Average Convergence Divergence (MACD) indicator confirm this.

HBAR MACD. Source: TradingView

While the bars that comprise this indicator have diminished over the past three days—reflecting a slowdown in bullish momentum amid broader market consolidation—the MACD line remains above the signal line, indicating that buying pressure still prevails among traders.

This setup hints at the likelihood of further price gains despite the death cross.

HBAR Climbs Steadily—Will It Hold the Line or Slip Back to $0.15?

Since April 16, HBAR has traded along an ascending trend line, a bullish pattern formed when an asset consistently posts higher lows over time. This indicates growing investor confidence and sustained upward momentum, even amid short-term pullbacks.

For HBAR, this trend suggests buyers are stepping in at increasingly higher price points, reinforcing support levels. If the trend holds, it could pave the way for further gains, especially if market sentiment remains positive.

HBAR’s price could break above the $0.19 resistance in this scenario and rally toward $0.23.

HBAR Price Analysis. Source: TradingView

Conversely, if selloffs resume, the price of the HBAR token could fall to $0.15.

Conclusion

In conclusion, HBAR’s recent performance underscores the resilience of its bullish momentum despite traditional signals suggesting caution. Investor confidence remains strong, indicating a potential upward trajectory if market conditions continue to favor the asset. Monitoring support and resistance levels will be crucial for traders moving forward.