Ethereum Charts Signal Breakout Amid Ongoing Liquidations

- Ethereum could break higher if the daily chart closes above the $1,950 price level.

- Liquidations above $330 million on February 5 marked the biggest wipeout this year.

- ETH liquidations ranged from $20M–$40M over the last 14 days, signaling high market tension.

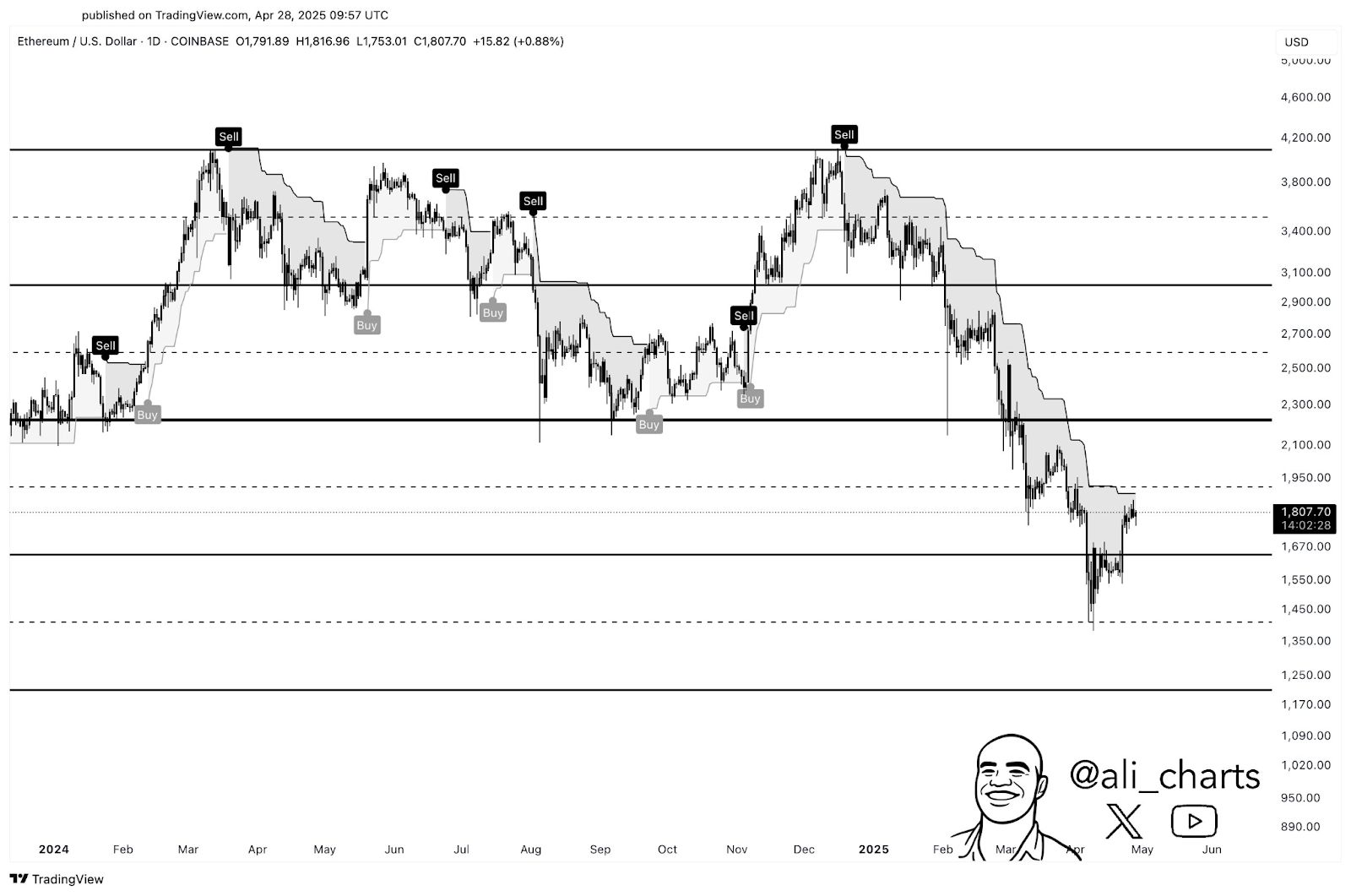

Ethereum (ETH) is nearing a crucial technical level, with $1,950 now in focus after a notable analysis by Ali Martinez on April 28, 2025. The crypto analyst posted a chart on X revealing that ETH is trading near $1,807 with a +0.88% gain that day. His SuperTrend-based chart outlines resistance zones, with a daily close above $1,950 highlighted as a potential trigger for a new buy signal.

Source:

X

Source:

X

The SuperTrend indicator, used to spot trend reversals, has consistently marked highs and lows on ETH’s daily chart. After a sharp decline from the $4,200 range, Ethereum rebounded from a $1,550 support zone and began consolidating. Now hovering between $1,670 and $1,950, it faces an inflection point, where a breakout could target $2,300 or even $2,700 if buying momentum follows.

Moreover, historical SuperTrend signals show that major “buy” triggers occurred around structural supports, while “sell” signals coincided with peaks such as $3,800 and $4,200. ETH is currently pressing against the lower edge of the SuperTrend cloud, raising speculation over whether bulls can reclaim dominance at this level.

Heavy Liquidation Events Add Pressure

Alongside Ali’s technical outlook, Coinglass data reveals intense liquidation trends that align closely with price volatility. On February 5, ETH saw its largest liquidation event, with over $330.6 million wiped out in a single day. The majority came from long positions, as ETH plunged from local highs.

Additionally, multiple sessions in January and March recorded liquidation volumes surpassing $100 million, also driven by long-side leverage. Conversely, shorts were caught off-guard in mid-March and early April, with daily liquidations exceeding $75 million as ETH briefly surged.

Coinglass’ ETH Total Liquidations Chart visually supports this behavior, showing daily volumes diverging between long (green) and short (red) positions. Meanwhile, ETH price (yellow line) fell steadily from $2,700 in December 2024 to $1,800 by late April 2025.

Related: Ethereum EIP-9698 Proposal Aims for 100x Gas Limit Increase

Can Ethereum Break Through $1,950?

For the last fourteen days, the amounts liquidated have ranged between $20-40 million, suggesting ongoing tension in the market. Both bulls and bears have been overexposed quite often, making this moment ripe for some high-stakes ETH price discovery. If Ethereum manages a daily close above $1,950, the key question is whether this will trigger sustained bullish momentum or simply lead to another liquidity trap.

The post Ethereum Charts Signal Breakout Amid Ongoing Liquidations appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!