- Bitcoin closed April at $94,181, rebounding sharply from its earlier low of $74,000 this month

- PlanB’s Stock-to-Flow model remains on track as BTC posts 27% monthly gain in April’s final close

- On-chain data shows MVRV golden cross forming, reinforcing strong bullish momentum ahead

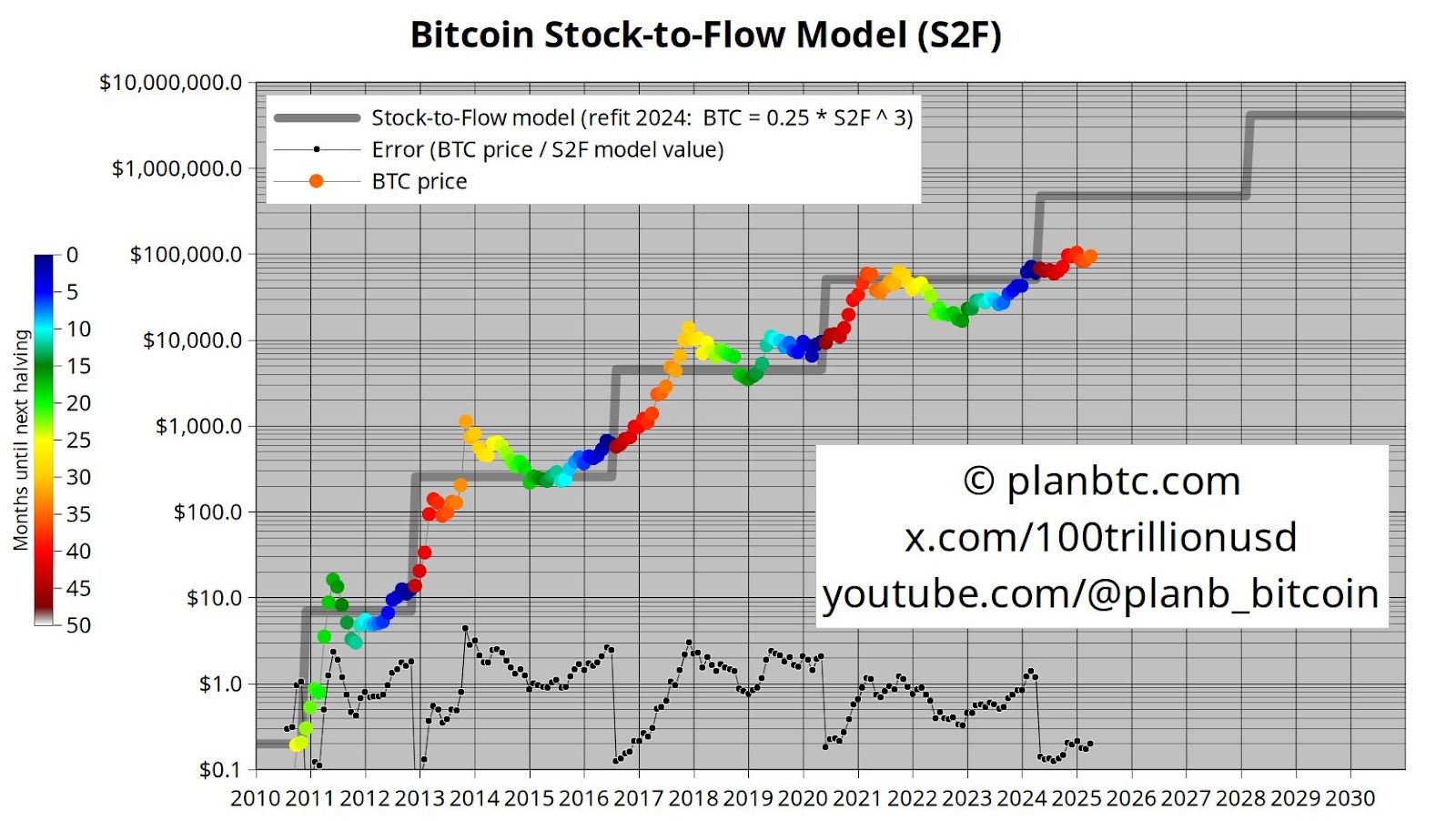

Bitcoin closed the month of April at $94,181, according to data shared by PlanB, creator of the Stock-to-Flow (S2F) model. The cryptocurrency’s rebound follows a major dip to $74K in April, forming what the analyst described as a “V-shaped recovery.” This price movement brings Bitcoin back in line with the long-term projections of the S2F model, which forecasts price based on Bitcoin’s programmed scarcity.

PlanB’s “Dump Before Pump” Prediction Validated

The April recovery notably aligns with a pattern PlanB highlighted on March 1, 2025. At that time, he referred to Bitcoin’s February close at $84,321 as “the dump before the pump,” predicting a dip before a surge. That prediction has since played out, with Bitcoin dropping in early April before surging toward the month’s close at $94,181.

PlanB’s colored-dot chart plotting monthly closes visually shows V-shaped recoveries are a recurring pattern in Bitcoin’s price history. This historical trend suggests such sharp rebounds are not anomalies but rather predictable features of Bitcoin’s cyclical behavior.

Related: Bhutan’s $1.1B Bitcoin Reserves Earn CZ’s Approval at TOKEN2049

Bitcoin April Performance and S2F Alignment

April’s close at $94,181 represents a 27% gain from the April 7 low of $74,000. This significant one-month performance brings Bitcoin closer to the projected S2F trajectory.

It also strongly reinforces the S2F model’s relevance and accuracy in forecasting during the current market cycle

Bitcoin Bull Run Not Over

PlanB, a respected analyst in the space, dismissed the notion of an incoming bear market in a prior analysis from March 19. He noted that Bitcoin’s 200-week arithmetic and geometric means have remained closely aligned for over a year, indicating low volatility and a steady upward trend.

He suggested that this consolidation phase could pave the way for further growth, possibly doubling from $80,000 to $160,000 in 2025. According to his market cycle analysis, a true bear market follows a strong bull rally, something he believes hasn’t fully occurred yet.

Reaffirming his bullish outlook in April, PlanB emphasized his on-chain indicators still reflect a bull market phase, describing the recent correction as a “normal bull market dip” rather than a transition into distribution or a bear phase.

Related: Report: $31 Trillion in U.S. Wealth Locked Out of Bitcoin ETFs

On-Chain Data Flashes Bullish Signal

Supporting PlanB’s perspective, on-chain data from Glassnode, shared by crypto analyst Ali Martinez, reveals that Bitcoin’s MVRV ratio has just formed a “golden cross” by crossing above its 1-year Simple Moving Average.

Historically, this specific technical formation has consistently preceded periods of strong bullish momentum for BTC price, pointing to a potential shift in broader market sentiment.

With Bitcoin’s price rebounding and technical indicators flashing bullish signals, market observers see a potential for an extended rally into the coming months.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.