$IMX Soars 24% in 4-Hour Rally – Can Immutable Lead the Next Web3 Gaming Boom?

Immutable’s native token, $IMX, surged from $0.550 to an intraday high of $0.6748, marking a dramatic 24.5% spike within just four hours on Thursday night.

This rally has propelled $IMX’s market capitalization above $1.1 billion, making it the 65th-largest cryptocurrency by market cap.

The price action was accompanied by a 292% jump in trading volume, with over $164 million in $IMX tokens exchanged in the past 24 hours.

Immutable Dominates Web3 Gaming with Over 400 Titles and $300M Raised

Launched in 2018, Immutable is an Australian-based Web3 company developing blockchain games and NFTs.

Its technology stack is powered by Immutable zkEVM, an Ethereum-compatible ZK-rollup built using Polygon’s Chain Development Kit (CDK).

The platform offers zero or near-zero gas fees for NFT minting and trading, alongside scalable infrastructure designed for game developers.

Over the years, Immutable has dominated the Web3 gaming space, capturing over 70% of the market share and supporting more than 440 games.

The company has raised over $300 million from top-tier investors, including Bitkraft, King River Capital, and Galaxy Digital.

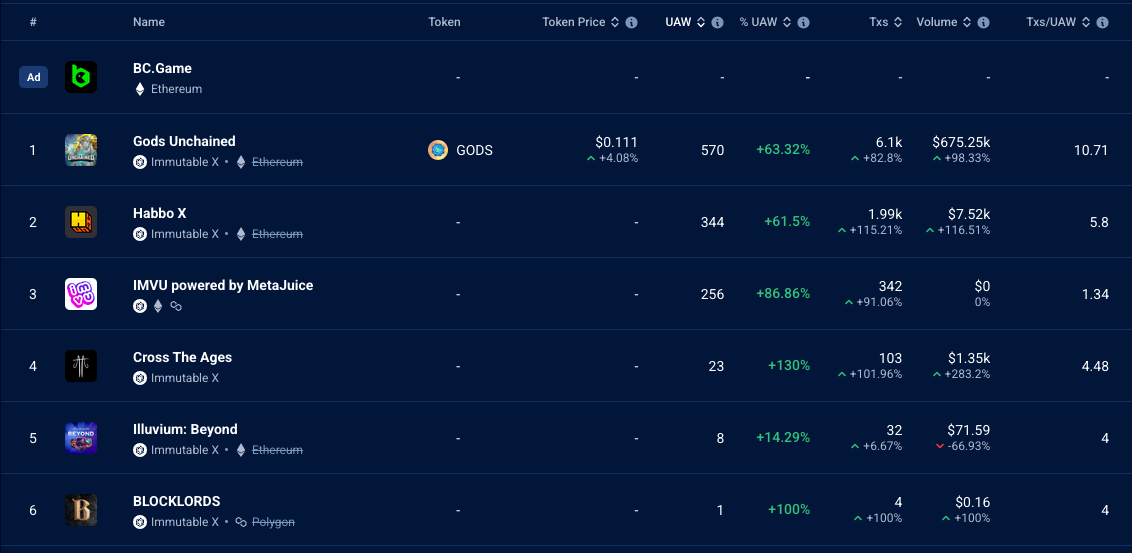

User activity across Immutable’s gaming ecosystem is also on the rise.

According to DappRadar, games like Gods Unchained, Immortal Rising 2, and Raven Quest have seen user activity increase by between 15% and 130% over the past 24 hours.

Immutable games seeing increased user engagements — Source: Dappradar

Immutable games seeing increased user engagements — Source: Dappradar

In Q3 2024, Immutable zkEVM saw impressive growth, with daily active transactions increasing 80.5% quarter-over-quarter (QoQ) to reach 595,000 and daily active addresses growing 80% QoQ to 267,000.

Co-founder Robbie Ferguson noted that monthly active users grew 619% year-over-year and that Immutable signed 344 well-funded games, while its Passport wallet solution surpassed 5 million sign-ups.

Despite the robust ecosystem, the $IMX token remains down over 93% from its November 2021 all-time high. On-chain data also shows weakness in NFT activity.

According to Messari, daily NFT sales on Immutable fell 9.6% QoQ in Q3 2024, dropping from $560,000 to $506,000.

Daily buyers and sellers declined 74% and 68% QoQ, respectively, reflecting a broader downturn in the NFT sector, mirrored by declining activity on platforms like OpenSea.

NFT sales plunge below $1M on Immutable/ Source: Messari

NFT sales plunge below $1M on Immutable/ Source: Messari

Nevertheless, Immutable continues to build. In November 2024, the company i ntroduced Pre-Approved Transactions , a new in-game signing feature to create a more seamless Web2-like user experience in blockchain gaming.

This eliminates the need for users to interact with external wallets, a long-standing hurdle in Web3 gaming adoption.

This innovation followed regulatory pressure. In October 2024, Immutable received a Wells notice from the U.S. SEC for alleged securities violations.

However, by March 2025, the SEC dropped the investigation , choosing not to pursue enforcement. Immutable hailed the outcome as “a win for all builders, creators, and gamers advocating for true digital ownership.”

$IMX Breaks Out of Falling Wedge, Eyes on $1.061 and $2.033

On the technical front, $IMX has bounced from a local support level near $0.415, forming a bullish engulfing weekly candle that closed around $0.641, up 11.7% on the week.

The weekly chart reveals an ABCDE corrective wave pattern, with the most recent dip at point (E) potentially marking the end of the correction.

$IMX chart shows the end of the ABCDE wave correction/ Source: TradingView

$IMX chart shows the end of the ABCDE wave correction/ Source: TradingView

Importantly, price action has also broken out of a falling wedge, which is typically seen as a bullish reversal pattern in technical analysis.

Looking ahead, the next major challenge for $IMX lies at $1.061, which now acts as immediate resistance.

This level was previously a key support zone and may take a few attempts to break through.

If bulls push above this level, the next major resistance comes in at $2.033, a level that peaked in Q4 2024.

Failure to clear $1.061 could result in sideways consolidation or a potential retest of support around $0.415.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

As the crypto market recovers in 2025, Digital Asset Treasury (DAT) firms and protocol token buybacks are drawing increasing attention. DAT refers to public companies accumulating crypto assets as part of their treasury. This model enhances shareholder returns through yield and price appreciation, while avoiding the direct risks of holding crypto. Similar to an ETF but more active, DAT structures can generate additional income via staking or lending, driving NAV growth. Protocol token buybacks, such as those seen with HYPE, LINK, and ENA, use protocol revenues to automatically repurchase and burn tokens. This reduces circulating supply and creates a deflationary effect. Key drivers for upside include institutional capital inflows and potential Fed rate cuts, which would stimulate risk assets. Combined with buyback mechanisms that reinforce value capture, these assets are well-positioned to lead in the next market rebound.

Data: Bitcoin spot ETF saw a net inflow of $741.79 million yesterday