Ethereum, the world’s second-largest blockchain network by market capitalization, is facing a flat price trend in early 2025.

Still, many developers, investors, and analysts remain confident in its long-term value. From infrastructure upgrades to token standards and rising institutional interest, several key developments suggest Ethereum may be well-positioned for sustained growth.

Below are 5 reasons to be bullish on Ethereum over the long run.

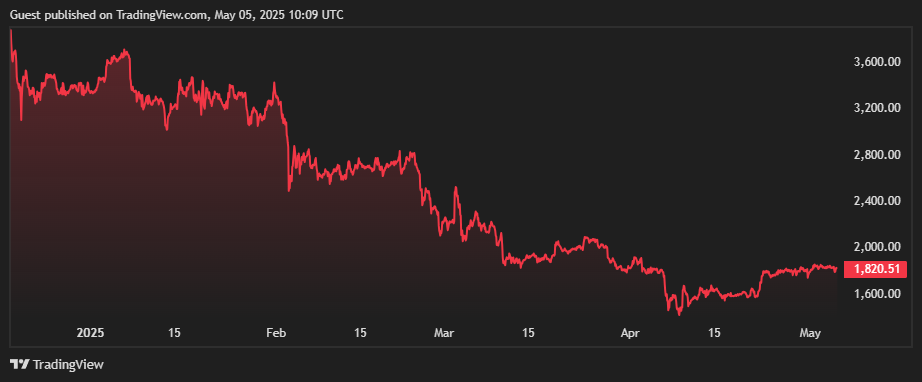

ETHUSDT CHART

ETHUSDT CHART

1. Vitalik Buterin’s Plan to Simplify Ethereum and Boost Performance

Ethereum co-founder Vitalik Buterin recently proposed replacing the Ethereum Virtual Machine (EVM) with a new execution environment based on RISC-V, an open-source processor instruction set. The goal is to make Ethereum’s codebase simpler, faster, and easier to maintain, while still supporting existing smart contracts.

Buterin believes this could lead to a 100-times increase in efficiency for zero-knowledge proofs, which are key to scaling and privacy. He also said the network could become “close to as simple as Bitcoin” within five years, helping Ethereum become more neutral and trustworthy as a global base layer.

Although the plan involves risks, such as breaking backward compatibility and requiring developer retraining, it signals a serious effort to reduce complexity and improve Ethereum’s long-term sustainability.

2. Ethereum’s Role in Tokenizing Real-World Assets

Institutional interest in Ethereum is growing. One example is BlackRock’s plan to tokenize $150 billion in U.S. Treasury assets, a move that would bring traditional financial products onto the blockchain. These trades are expected to happen onchain, and Ethereum is widely seen as the likely network of choice.

If this happens, it could increase Ethereum’s total value locked (TVL) by up to 4 times, from $52 billion to more than $200 billion. This would strengthen Ethereum’s lead in decentralized finance (DeFi), where it already far outpaces other networks like Solana.

More importantly, success by BlackRock could start a domino effect, encouraging other institutions to bring their assets onchain—and possibly on Ethereum.

3. Ethereum’s Growing Focus on Interoperability

Ethereum developers are actively working on improving cross-chain communication. Two new token standards, ERC-7828 and ERC-7930, are being developed to help applications, wallets, and block explorers understand token data more clearly.

ERC-7930 introduces a compact, binary format for cross-chain addresses, while ERC-7828 adds a human-readable version. These changes aim to create a simpler, unified user experience across Ethereum-compatible chains. This kind of interoperability is critical as the blockchain ecosystem becomes more interconnected.

If adopted widely, these standards could reduce user mistakes, improve wallet compatibility, and help Ethereum remain the dominant base layer for cross-chain applications.

4. On-Chain Metrics Point to Accumulation

Ethereum’s MVRV Z-Score, a key on-chain indicator, has returned to its historical accumulation zone, suggesting that ETH may be trading near its cycle bottom. In previous cycles, similar readings occurred just before multi-month or multi-year price increases, including in late 2018, March 2020, and mid-2022.

This does not guarantee price movement in any direction, but it shows that many long-term holders are accumulating ETH at current levels. Such behavior typically reflects growing confidence in the network’s future potential, regardless of short-term volatility.

5. Ethereum Layer 2 Projects Are Making Major Progress

Ethereum’s rollup-based scaling strategy continues to show results. This week, Layer 2 project Scroll announced that it has become the first zk-rollup to allow users to exit independently without relying on a central sequencer.

This milestone moves Scroll closer to full decentralization and improves user trust. Ethereum’s ecosystem now includes multiple Layer 2 solutions, such as Optimism, Arbitrum, zkSync, and StarkNet. Together, they are making Ethereum more scalable and affordable, while maintaining strong security from the Ethereum mainnet.

These developments are part of Ethereum’s broader effort to become the foundation for all types of digital activity—from finance to identity, gaming, and real-world asset settlement.