Analysis: BTC Traders Seek Downside Protection Ahead of Fed Chair Speech, Options Market Shows Mild Risk Aversion

Before Federal Reserve Chairman Jerome Powell's upcoming speech on a potential rate cut in June, the Bitcoin options market is showing mild risk-averse sentiment. According to Deribit CEO Luuk Strijers, although the market generally expects rates to remain unchanged this week, there has been only slight demand for protective put options, reflecting limited caution among seasoned traders.

Currently, the spot price of Bitcoin has fallen to around $94,000, and Deribit's implied volatility index DVOL is at a level of 45, the lowest since June 2024, indicating a market sentiment leaning towards mild risk aversion. Meanwhile, traders on the decentralized trading platform Derive.XYZ have purchased put options with strike prices of $82,000, $78,000, and $76,000, showing concerns that the Federal Reserve might not cut rates or could even raise them. Although the expectation for a rate cut in June has dropped to 30%, Bank of America believes Powell may keep an open stance on future rate cuts in his speech, emphasizing that policy will depend on upcoming economic data. (CoinDesk)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

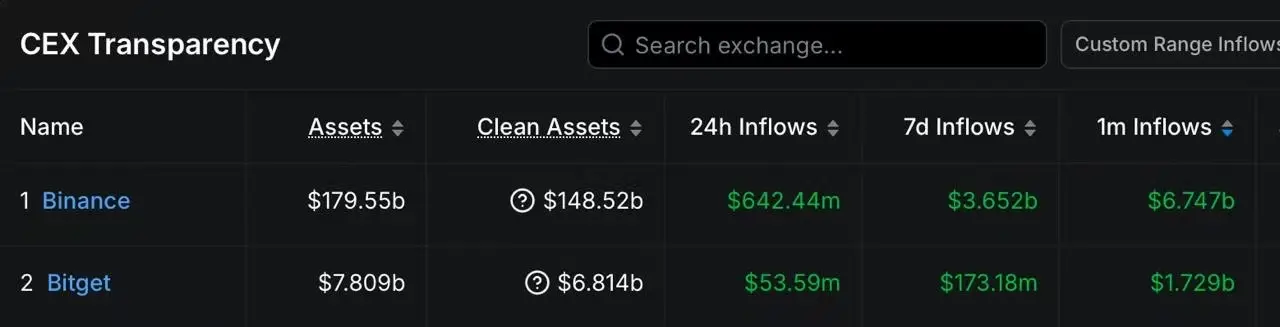

Data: In the past 30 days, the main capital inflows have been to a certain exchange and leading CEXs such as Bitget.

Analysis: Bitcoin’s next key support level is $99,000