-

As U.S. economic chaos intensifies, Bitcoin sees renewed demand, affirming its role as a potential global safe haven amidst market turbulence.

-

Declining BTC inflows to Binance signal reduced sell pressure and growing long-term investor confidence, pushing Bitcoin into a strategic accumulation phase.

-

“With trust in fiat fading, Bitcoin is increasingly regarded as a protective asset,” notes COINOTAG analysis, indicating a shift in investor sentiment.

Discover how Bitcoin is positioning itself as a safe haven amidst U.S. economic uncertainty, as rising demand reflects long-term investor confidence.

Bitcoin rises amid record-breaking economic turbulence

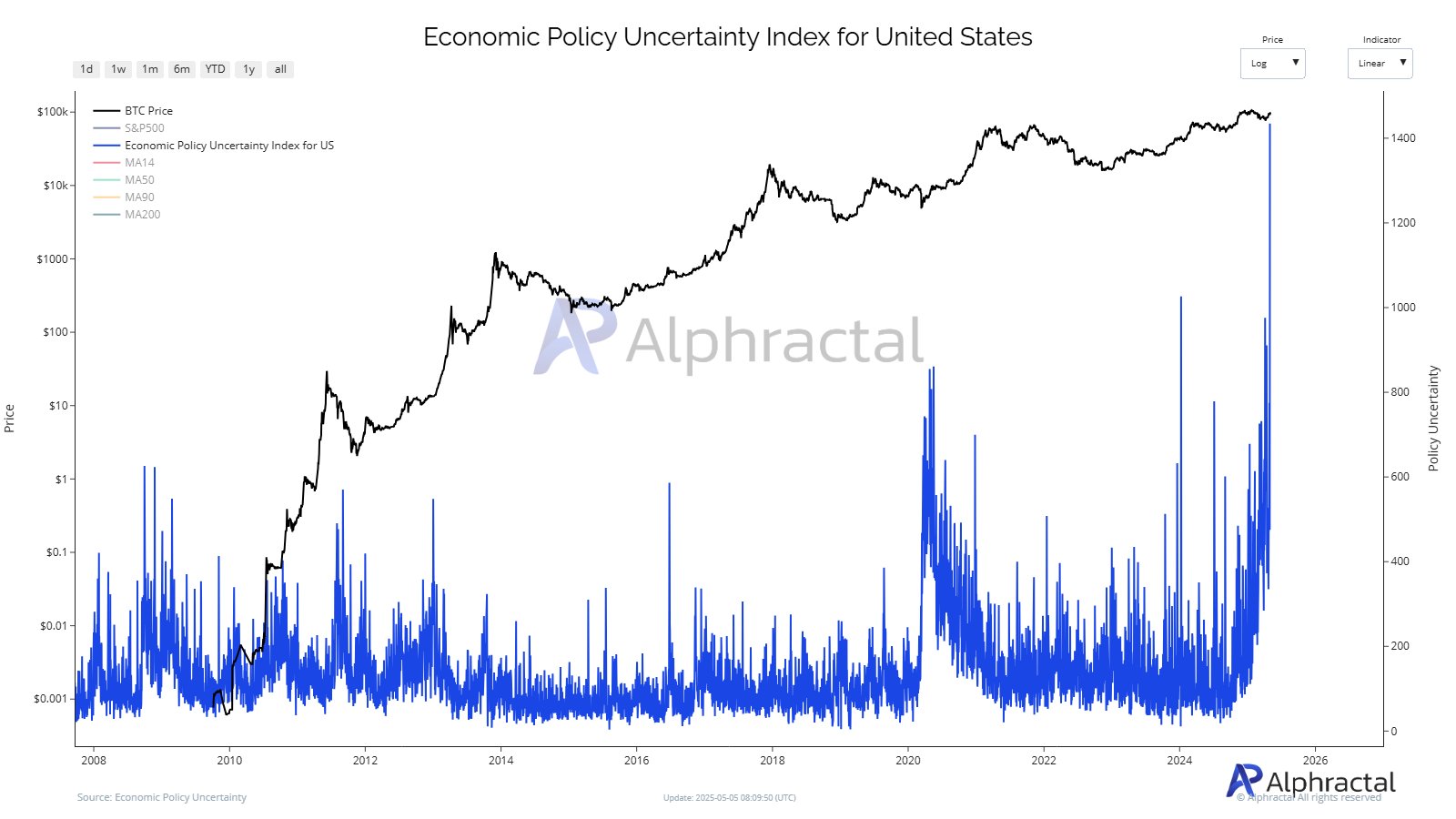

The U.S. economic policy uncertainty index has surged to an all-time high in 2025, creating a fertile ground for Bitcoin’s resurgence.

The chart indicates that previous spikes in uncertainty have historically coincided with bullish momentum for Bitcoin — and the latest surge marks the most significant uptick yet.

Source: Alphractal

Factors such as the second Trump administration’s tariff hikes, reinstated debt ceiling, and stalled Federal Reserve policies have all contributed to increasing investor anxiety. Coupling these with geopolitical risks and regulatory changes has created a highly volatile environment across traditional markets.

Bitcoin, however, continues to showcase a structural resilience against such chaos. Trust in fiat currencies is waning, prompting a reframing of BTC from a speculative asset into a recognized hedge — one that appears to be entering an accumulation phase as it readies for potential major breakthroughs.

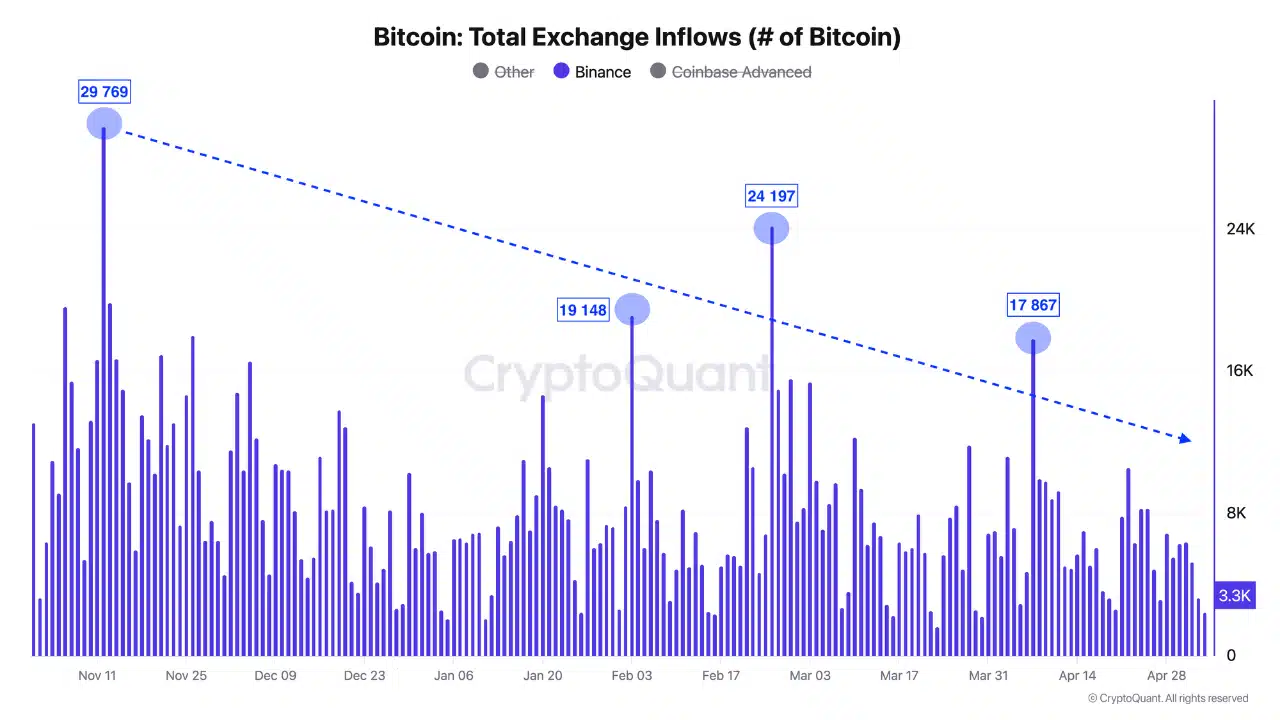

BTC: Easing selling pressure

Since late 2024, Bitcoin inflows to Binance have consistently declined, indicating a substantial decrease in immediate selling pressure from investors.

Although there were sporadic spikes exceeding 17,000 BTC, the long-term trend underscores that fewer coins are being moved to exchanges for liquidation.

Source: CryptoQuant

This ongoing trend mirrors a rising conviction among investors regarding Bitcoin’s long-term value as a protective asset in the face of macroeconomic risks.

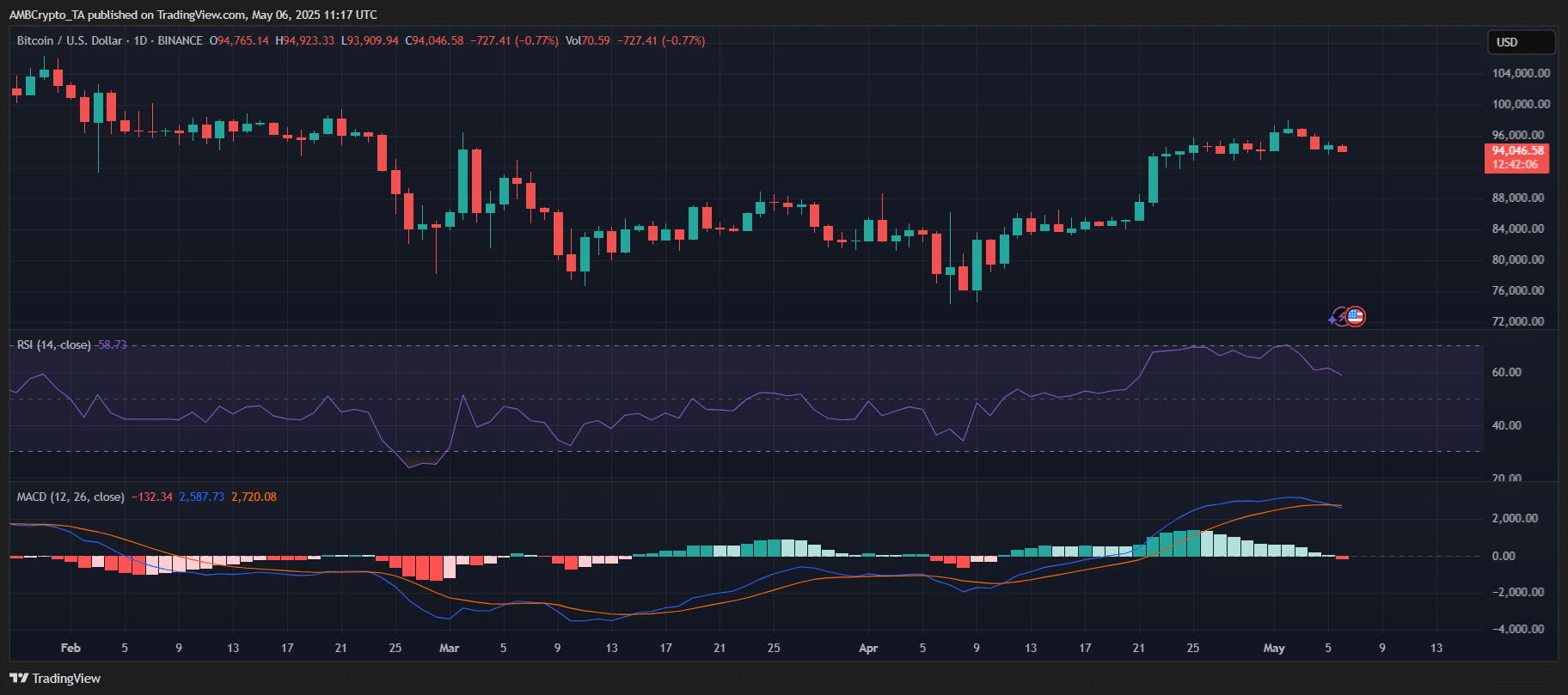

Bitcoin’s price outlook

At the time of writing, BTC was trading near $94,000, showing a minor pullback after attempting to breach the $96,000 mark. The Relative Strength Index (RSI) has retreated from overbought conditions to around 58, reflecting a cooling momentum without indicating oversold conditions.

Source: TradingView

Additionally, the Moving Average Convergence Divergence (MACD) is approaching a bearish crossover, potentially indicating short-term consolidation or weakness. However, the price structure remains robust above previous resistance levels, which now act as support.

If the price stabilizes above the $91,000-$92,000 range, bulls could swiftly regain momentum and control of the market.

Conclusion

In summary, Bitcoin’s current trajectory amidst U.S. economic uncertainty symbolizes a critical moment for investors. With reduced selling pressure and a focus on long-term holding strategies, the cryptocurrency is repositioning itself as a viable hedge. As market dynamics evolve, Bitcoin’s resilience could pave the way for its next significant move, catapulting it into the forefront of safe-haven assets.