Goldman Sachs Expands BlackRock Bitcoin ETF Exposure, Leads Institutional Positions With $1,4 Billion

- Goldman Sachs leads contributions to Bitcoin ETF IBIT

- BlackRock's IBIT reaches $62,8 billion under management

- Bitcoin ETF attracts $44 billion since January

Goldman Sachs reinforced its position in BlackRock's iShares Bitcoin Trust (IBIT) with a 28% increase in the number of shares acquired in the first quarter of 2025. The bank's stake now totals 30,8 million shares, valued at more than US$ 1,4 billion, surpassing the 24 million shares previously registered.

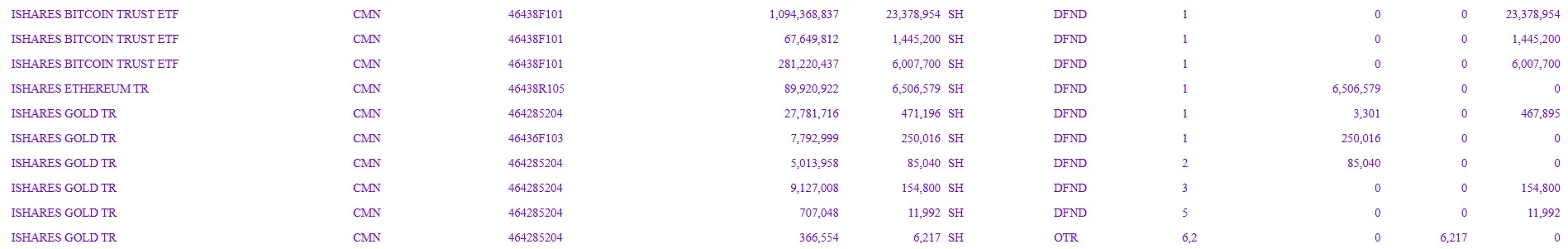

According to documents filed with the SEC, the institution is maintaining its strategy focused on spot Bitcoin ETFs, with no significant changes to its stake in Fidelity's FBTC fund. In February, Goldman had revealed a total of US$1,5 billion in stakes in the main US spot ETFs, with US$1,2 billion allocated to IBIT and US$288 million to FBTC.

Fintel data indicates that Goldman Sachs currently ranks first among the largest institutional holders of IBIT. Next in line is Brevan Howard with more than 25 million shares, worth approximately US$1,4 billion. Other big names on the list include Jane Street, Symmetry Investments and DE Shaw & Co.

In its December 2024 report, the bank had reported holding options positions tied to the performance of Bitcoin ETFs. This included $157 million in calls and $527 million in puts tied to IBIT, as well as $84 million in put options related to FBTC. However, these contracts are not included in the most recent report, indicating that they have been terminated or have ceased to be valid.

IBIT remains the largest Bitcoin ETF in operation, with around $62,8 billion under management. Since its launch in January, the product has attracted $44 billion in net inflows. This week alone, the fund moved $674 million, according to data from Farside Investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone