Key takeaways:

-

Bitcoin broke above $105,700 after the US and China agreed to slash tariffs.

-

A confirmed bull flag breakout on the weekly chart projects a $150,000.

-

Bitwise's sentiment index warns of potential short-term overheating.

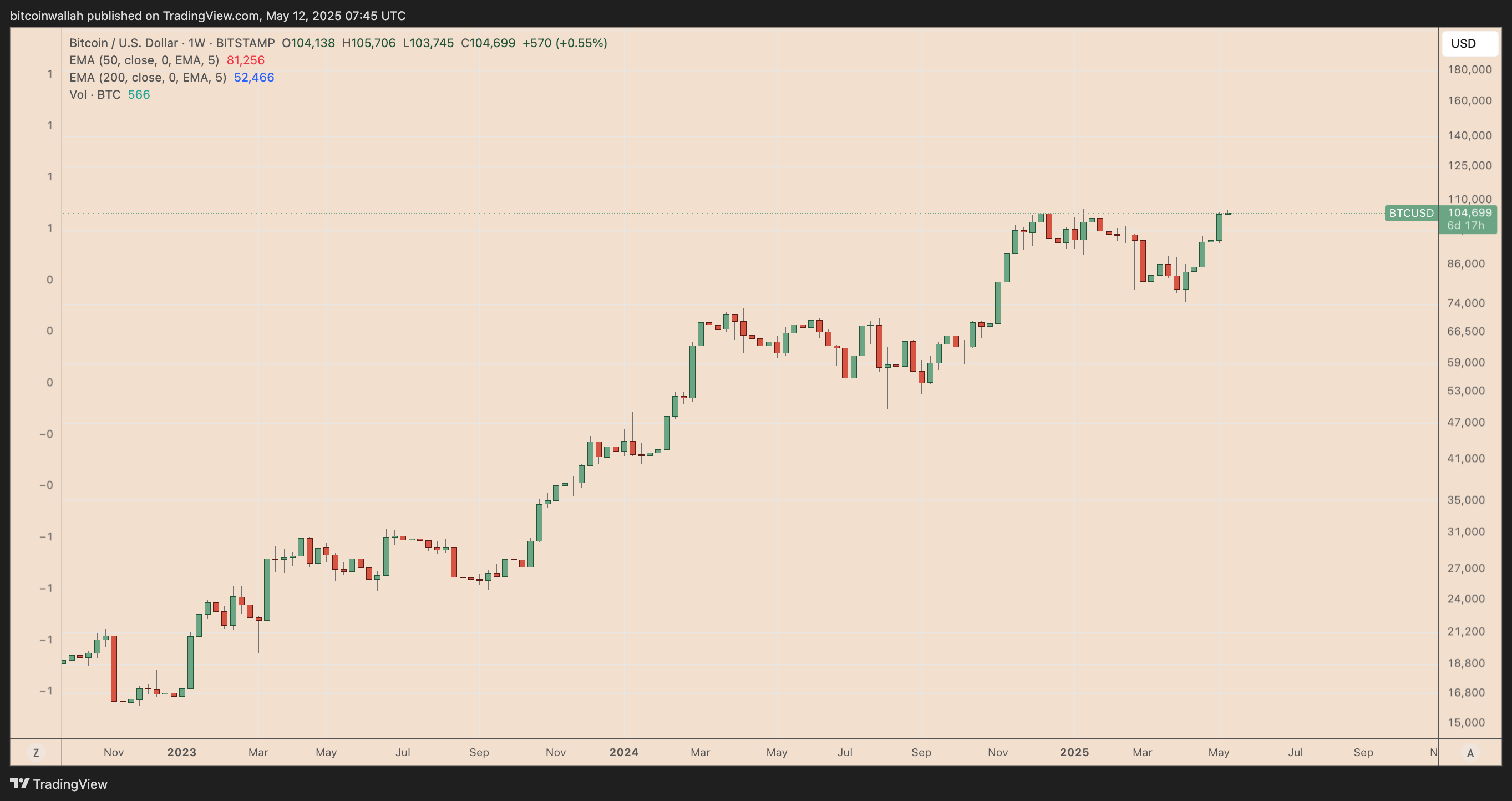

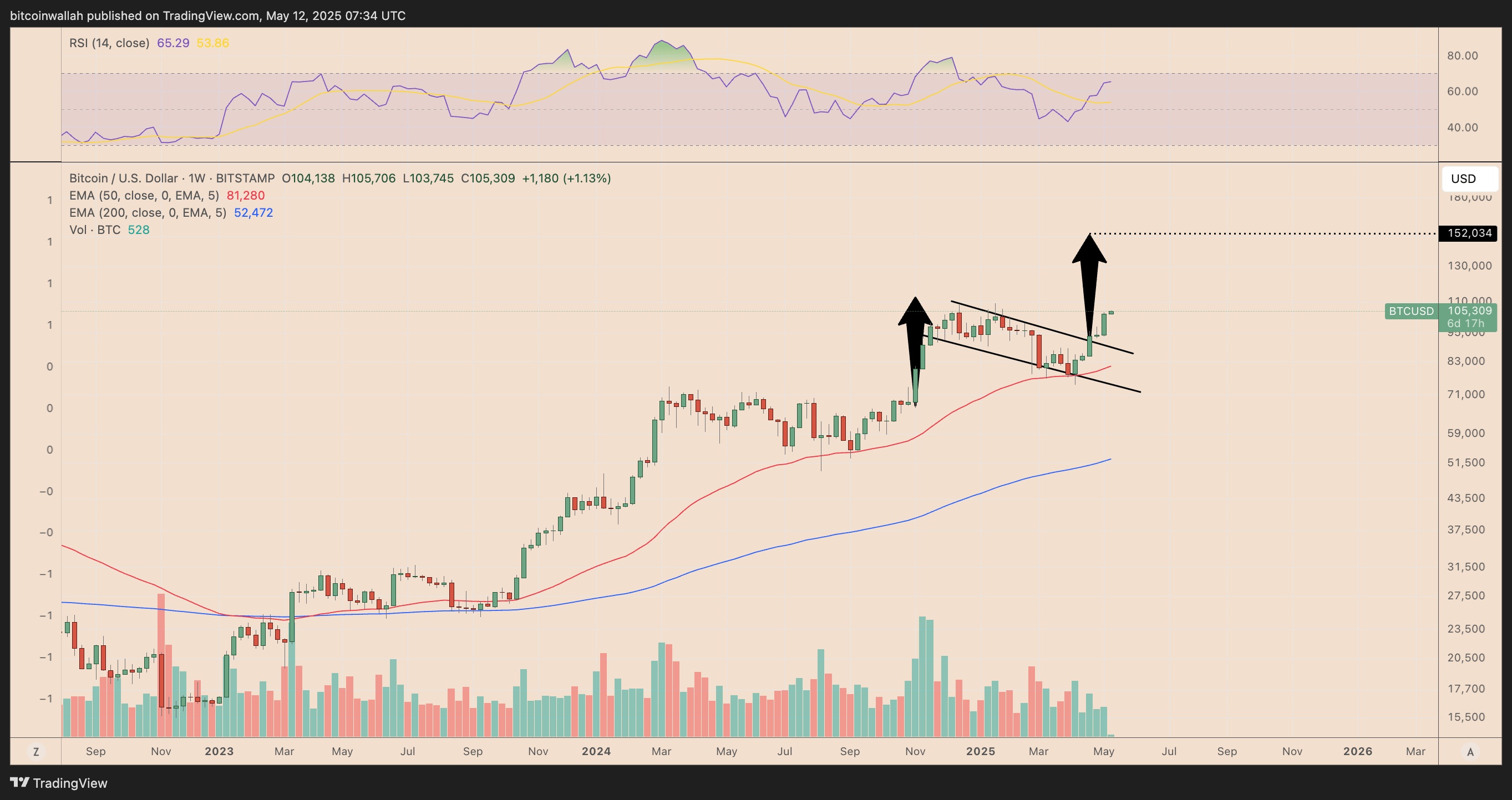

Bitcoin ( BTC ) bulls cheered a major development in the ongoing US-China tariff talks, with the cryptocurrency climbing over the $105,700 mark on May 12 for the first time in four months, further confirming a bullish continuation setup with a $150,000 price target.

BTC/USD weekly price chart. Source: TradingView

US-China trade truce fuels Bitcoin boom

The catalyst behind Bitcoin’s breakout appears to be de-escalating trade tensions between the US and China .

Over the weekend, US Treasury Secretary Scott Bessent and Chinese Vice President He Lifeng struck a deal in Geneva to reduce tariffs that had crippled bilateral trade for months.

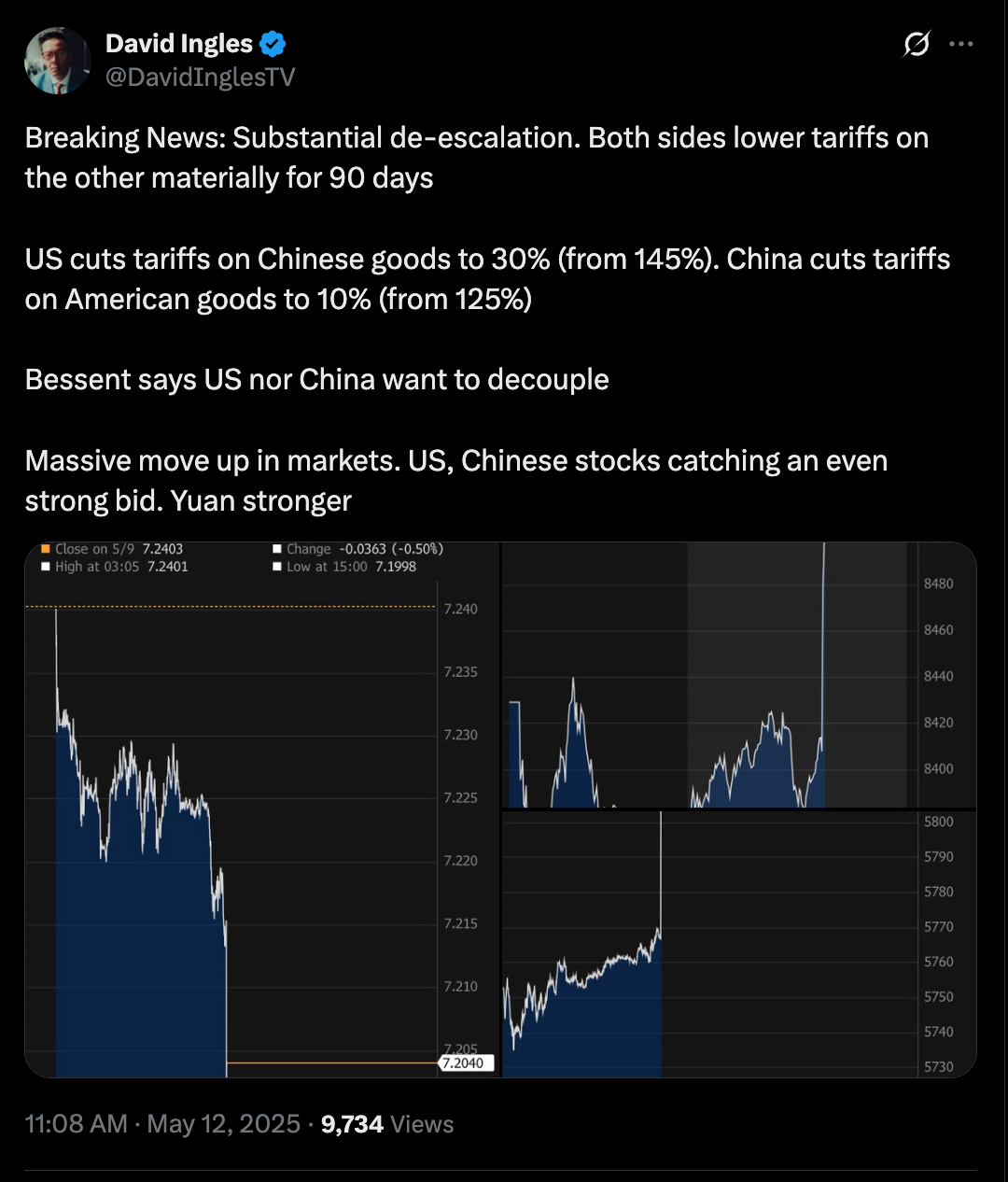

Source: David Ingles, Chief Markets Editor, Bloomberg

Under the deal, the US will lower tariffs on Chinese goods from 145% to 30%, while China will reduce its duties on US imports from 125% to 10%.

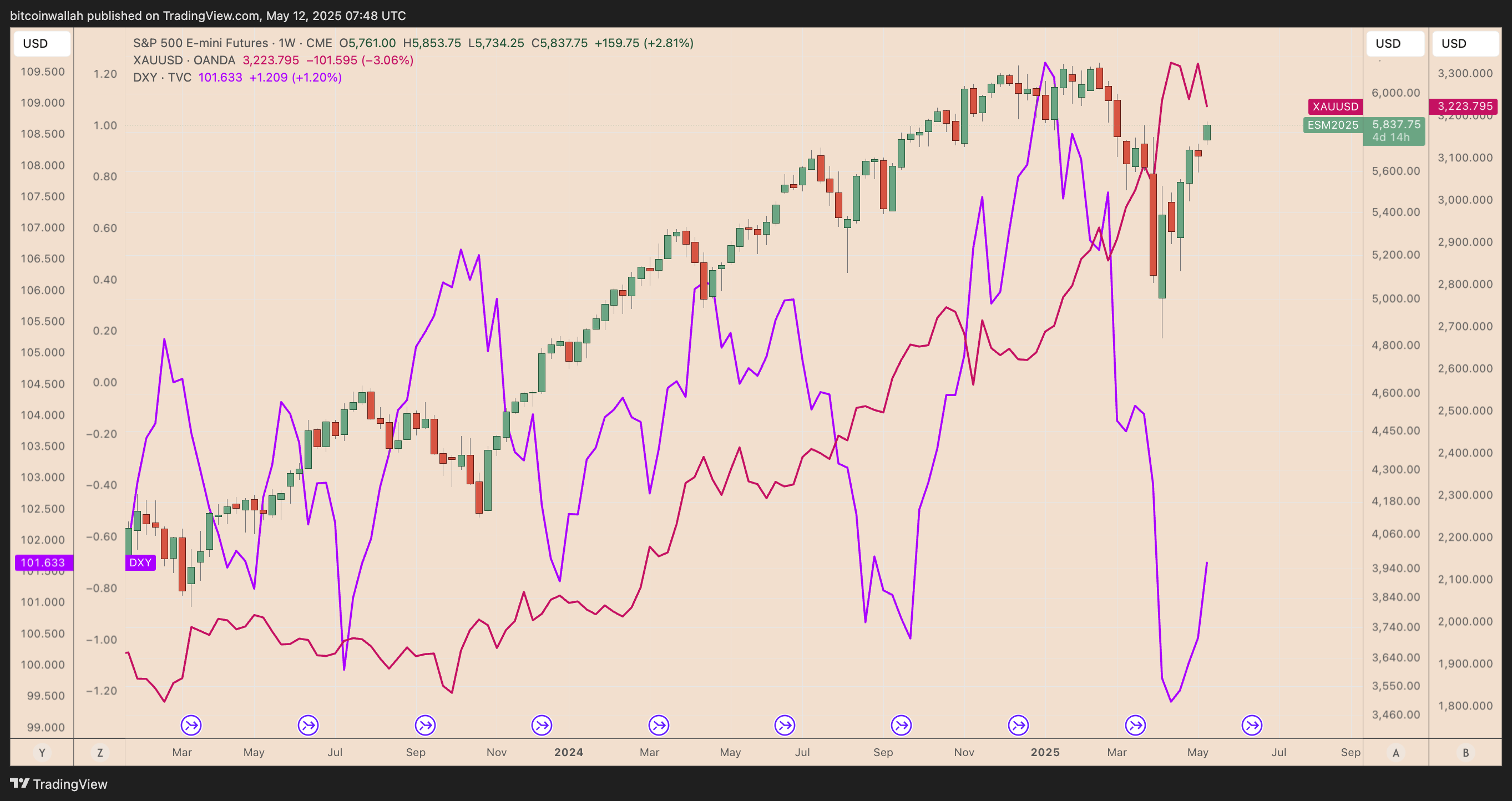

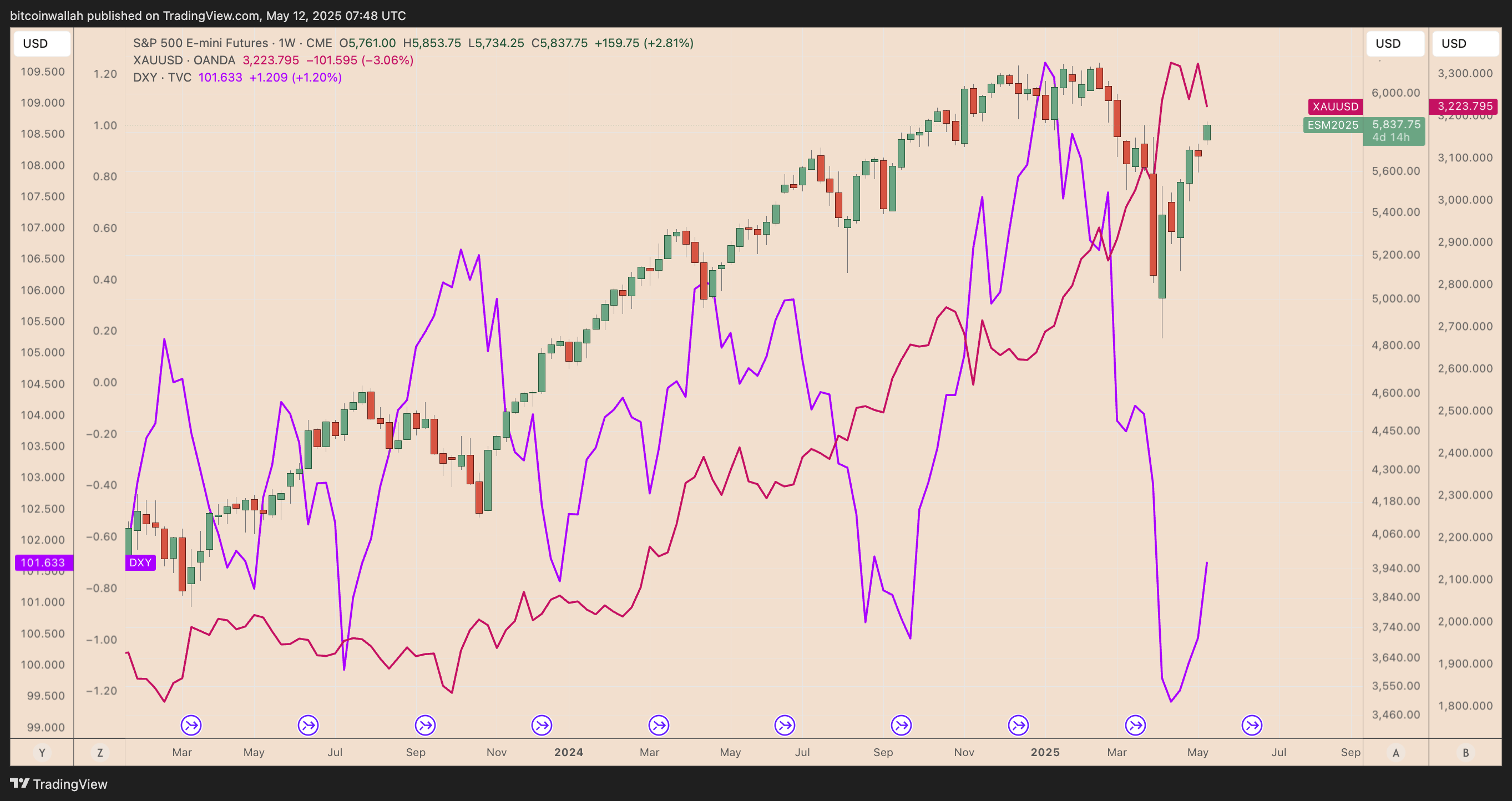

The agreement triggered a broad-based market rally, with S&P 500 futures rising 2.8% and the US dollar gaining 0.7%. In contrast, gold dropped 2.3%, signaling a shift away from safe-haven assets.

S&P 500 futures, gold, and the US Dollar Index weekly chart comparison. Source: TradingView

Bitcoin, often seen as a high-beta risk asset , had suffered under the weight of the trade war, with increased investor caution suppressing crypto inflows. The truce now signals improved liquidity and risk appetite, conditions historically favorable for BTC rallies.

Bull flag breakout points to $150K target

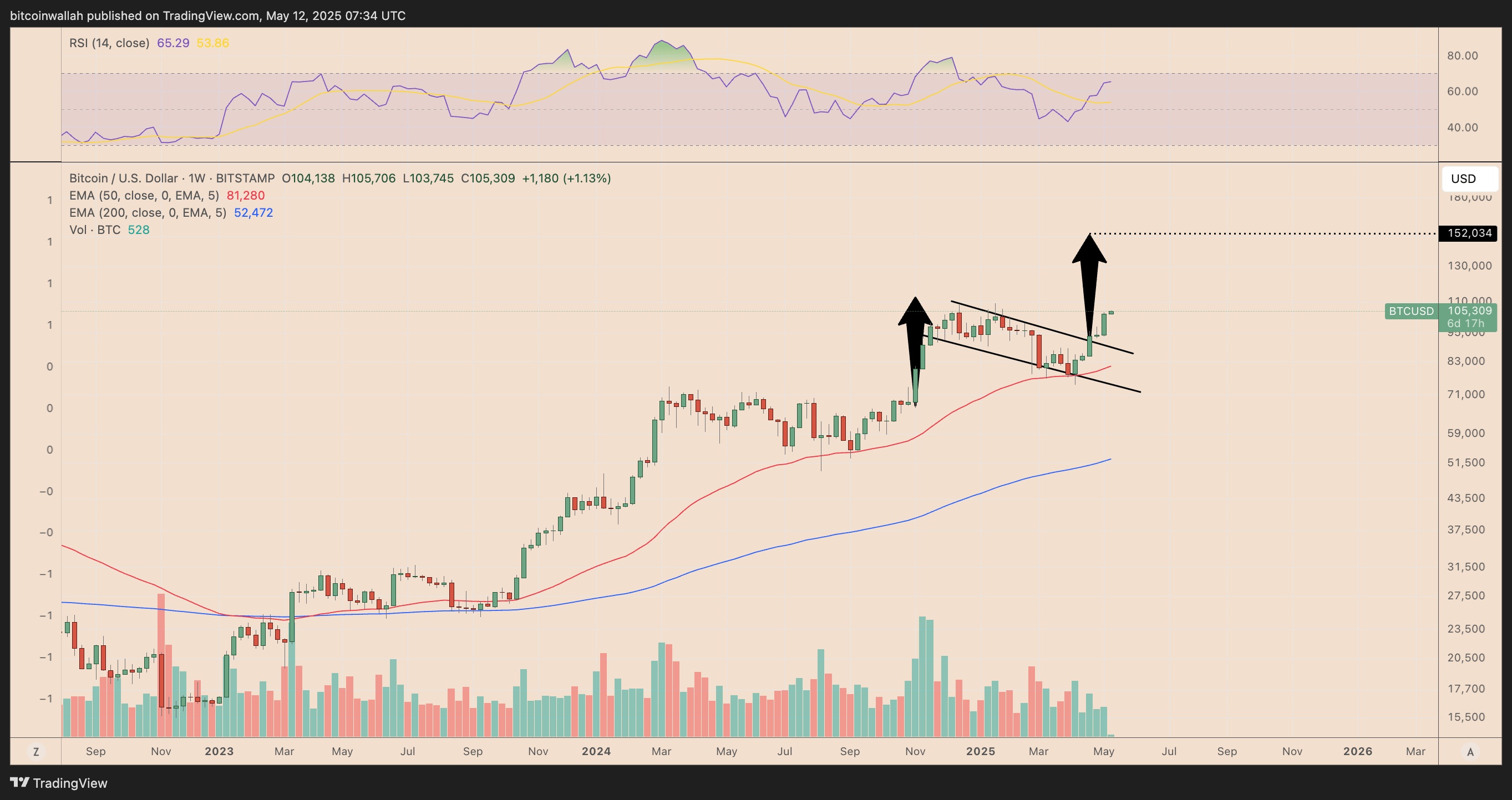

The current Bitcoin rally follows the textbook breakout of a bull flag pattern on the weekly chart, a bullish continuation setup formed when the price consolidates downward in a parallel channel after a sharp upward move.

In Bitcoin’s case, the flag began forming after BTC peaked at nearly $110,000 in January. The consolidation persisted for months until early May when the price broke above the flag’s upper trendline with a slight volume increase.

BTC/USD weekly price chart. Source: TradingView

This breakout confirms bullish continuation, with the pattern's projected upside target now sitting near $150,000, measured after adding the height of the initial flagpole to the breakout point.

Momentum indicators, including the relative strength index (RSI) , are also supportive, with weekly RSI rebounding above 65, reflecting renewed buying pressure without entering overbought territory above 70.

BTC may return to $100,000 first

Some analysts are urging caution as Bitcoin’s sentiment is becoming euphoric.

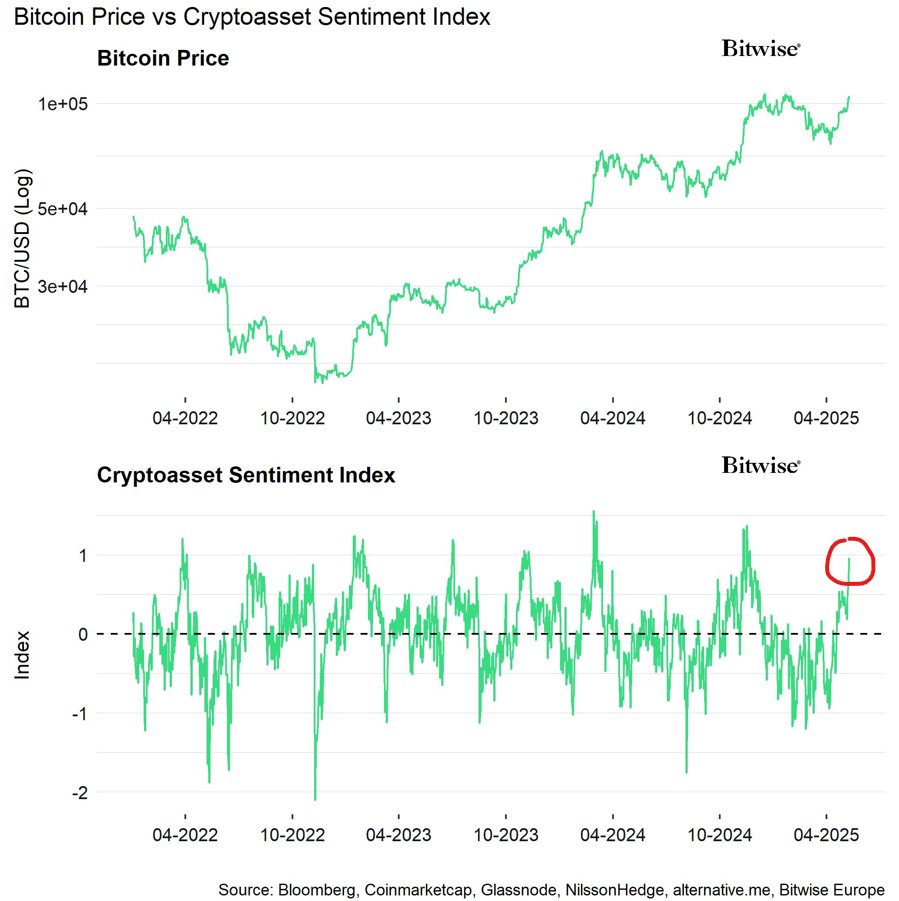

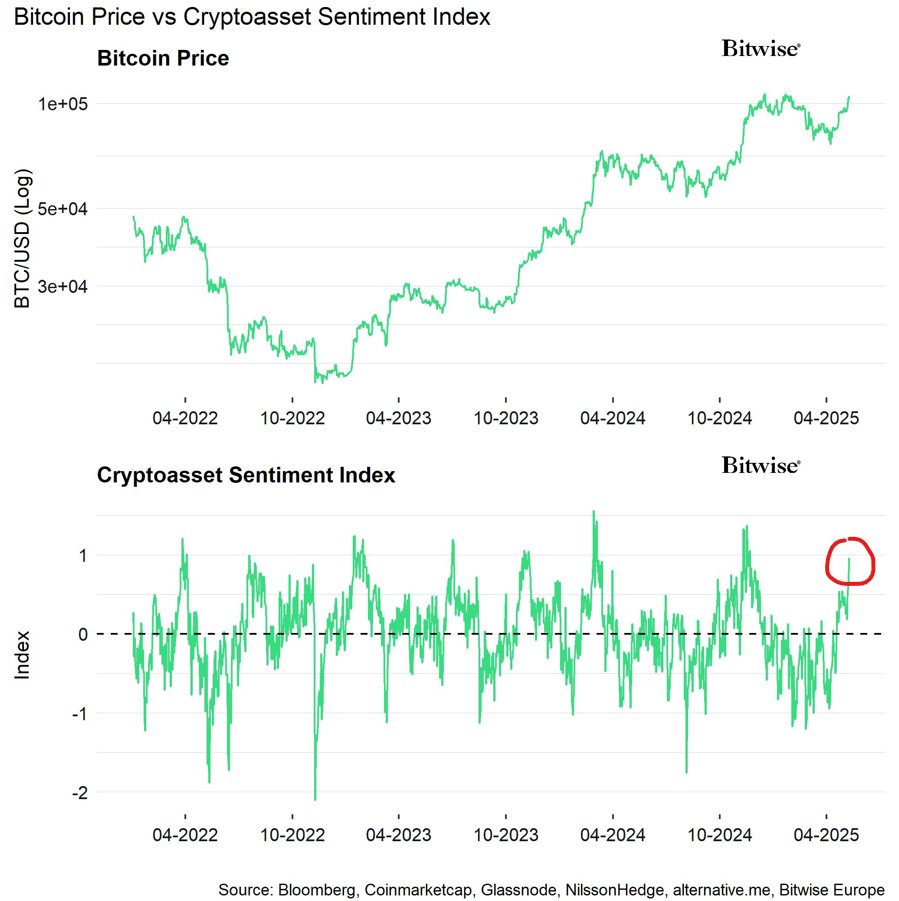

André Dragosch, European Head of Research at Bitwise, notes that the firm’s Cryptoasset Sentiment Index has reached its highest level since November 2024, a level that previously aligned with local market tops.

Cryptoasset Sentiment Index. Source: Bitwise

The chart shows that past peaks in sentiment, such as those in April 2022, October 2023, and November 2024, were followed by short-term corrections or sideways price action.

This suggests growing optimism may be stretched, raising the risk of a near-term pullback despite Bitcoin’s strong long-term outlook.

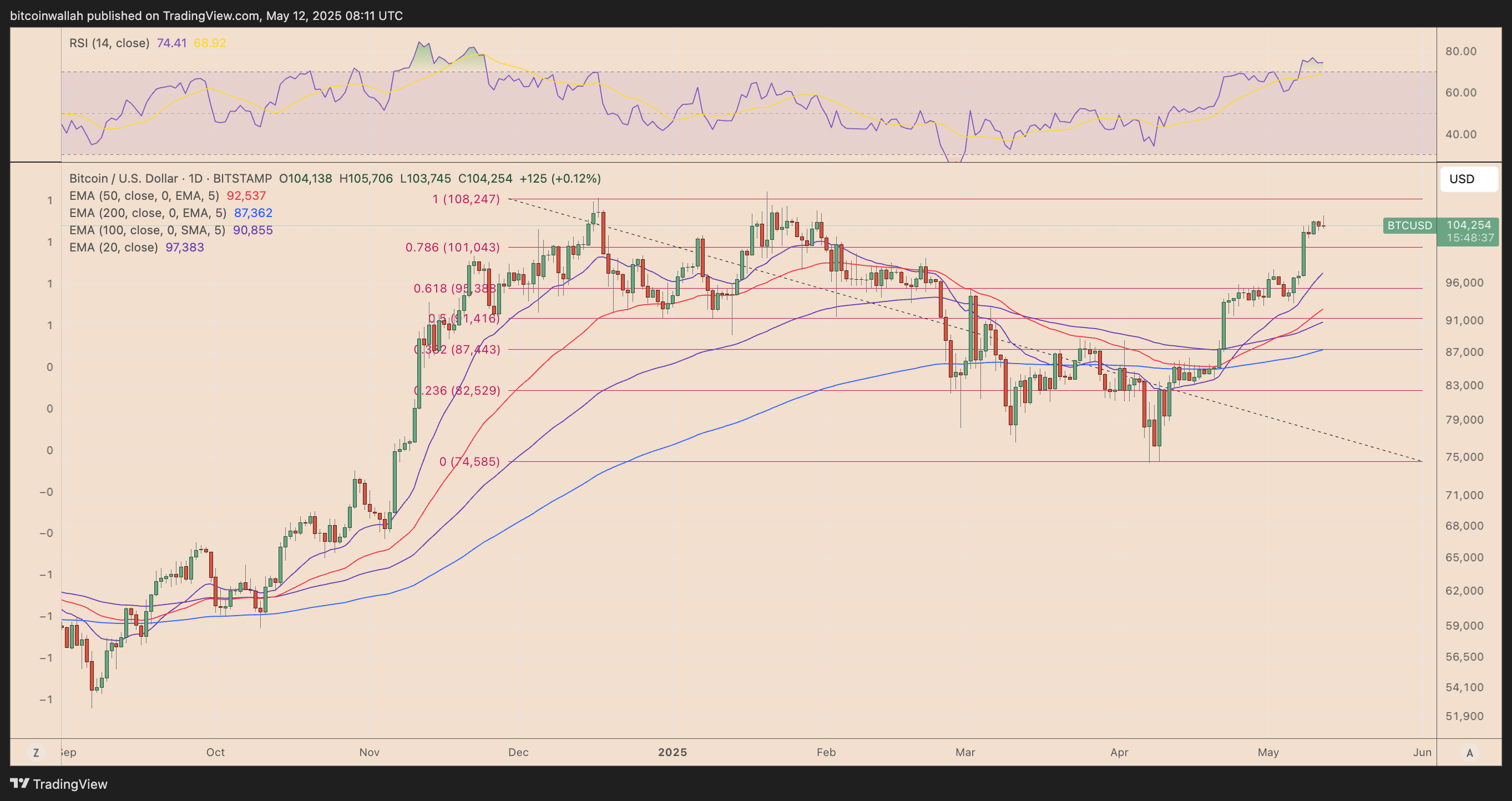

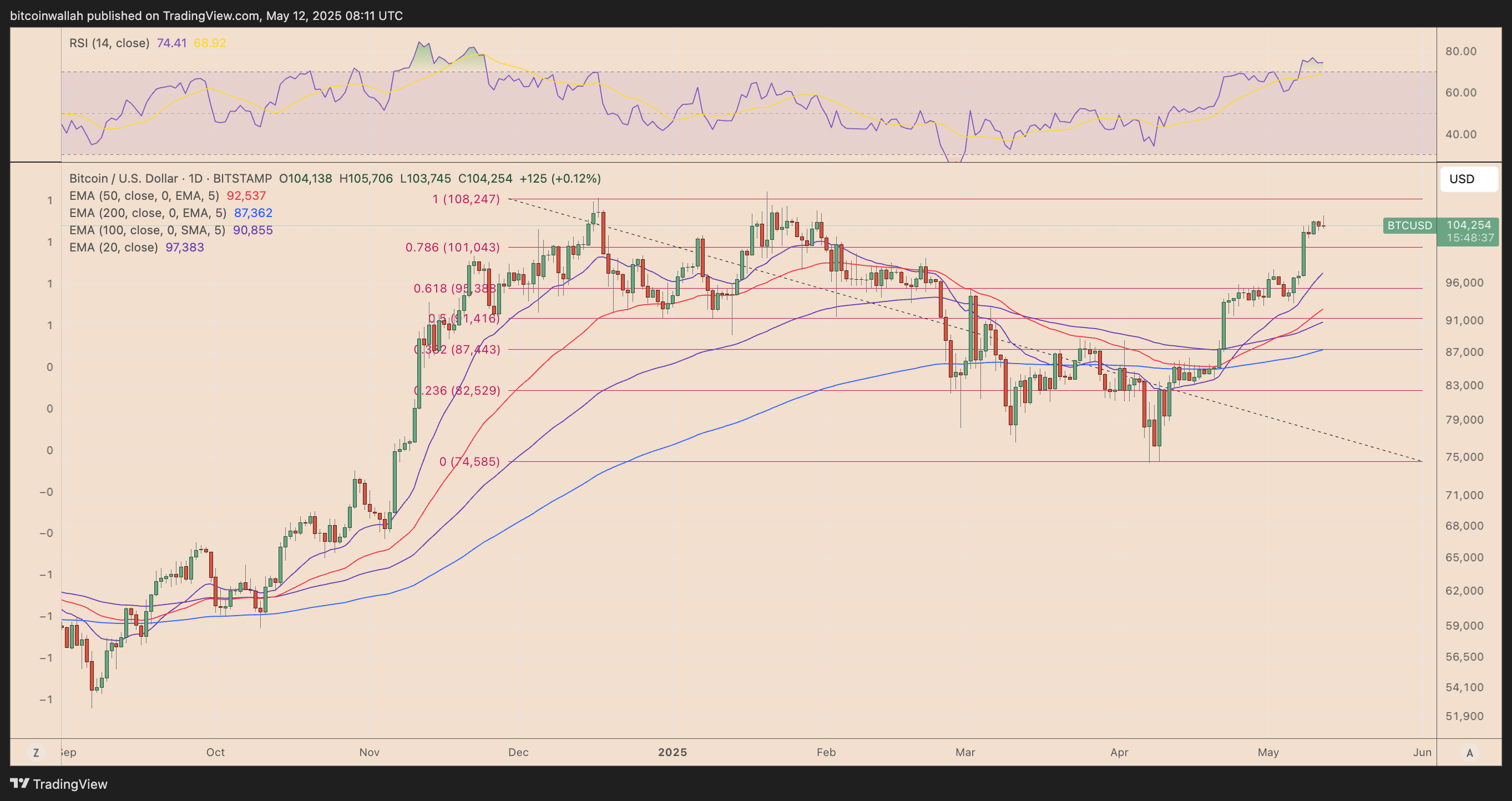

Bitcoin’s price was retracing following its climb above $107,000 as of May 12, with its daily RSI alarming about overbought conditions.

BTC/USD daily price chart. Source: TradingView

The next support target sits around $100,000, aligning with its 0.786 Fibonacci retracement line.

A decisive drop below the level could have BTC test its exponential moving average (EMA) supports below, with the 20-day EMA (the purple wave) at around 97,385 as the initial downside target.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.