All 12 Bitcoin ETFs See Red as Market Shrugs Off $96 Million Exit | ETF News

Bitcoin Spot ETFs faced significant outflows as market sentiment cooled, with all 12 funds seeing red. However, Bitcoin's futures and options markets are showing promising signs of renewed confidence.

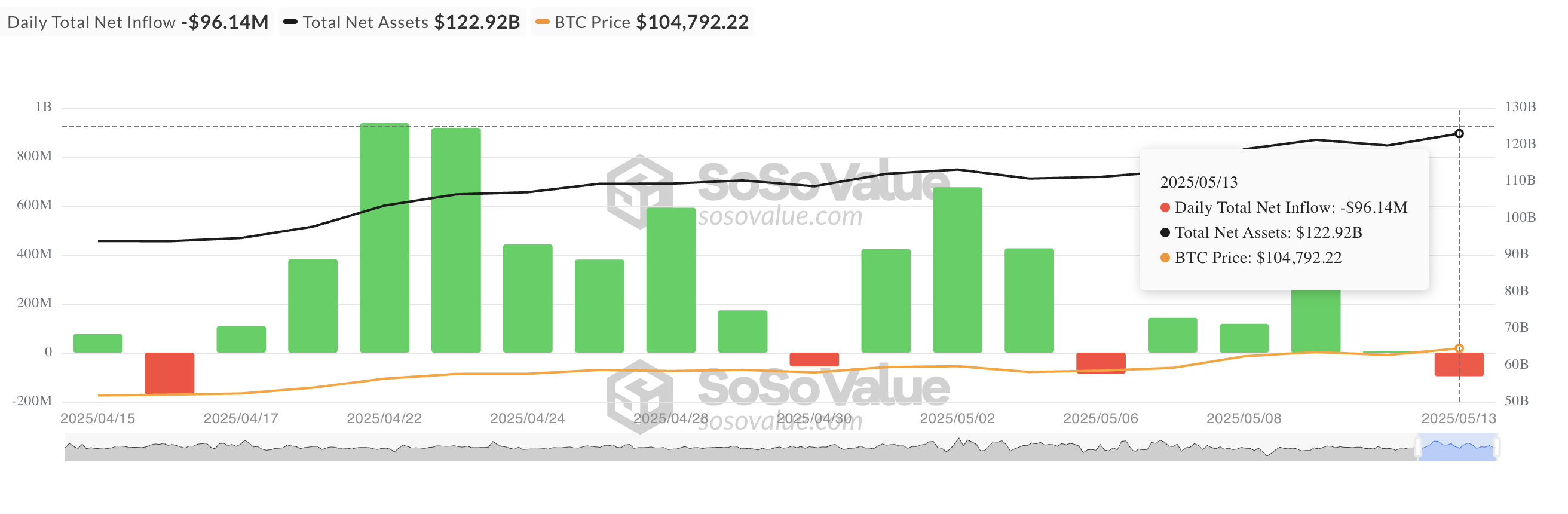

On Tuesday, Bitcoin Spot ETFs recorded a collective net outflow of $96.14 million, with no net inflows reported across the twelve listed funds.

This was attributed to a mild pullback in overall market activity, which pushed BTC’s price to an intraday low of $101,429.

Bitcoin ETFs Record $96 Million in Daily Outflows

On Tuesday, Bitcoin-backed ETFs saw a net outflow of $96.14 million, marking their largest single-day net outflow since April 16. The capital outflow came amid a slight pullback in the general crypto market, which saw BTC’s price fall to an intraday low of $101,429.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

This decline likely unsettled institutional investors, many of whom had been waiting to see if the coin could build momentum above the $105,000 mark, especially amid recent signs of progress in US-China trade relations.

Yesterday, Fidelity’s FBTC led the exit, recording the highest outflows among all ETF issuers. The fund’s capital outflow totaled $91.39 million. As of this writing, its total historical net inflow is $11.61 billion.

With all twelve BTC ETFs recording no inflows yesterday, it was clear that sentiment had turned risk-off, at least temporarily.

BTC Derivatives Signal Optimism

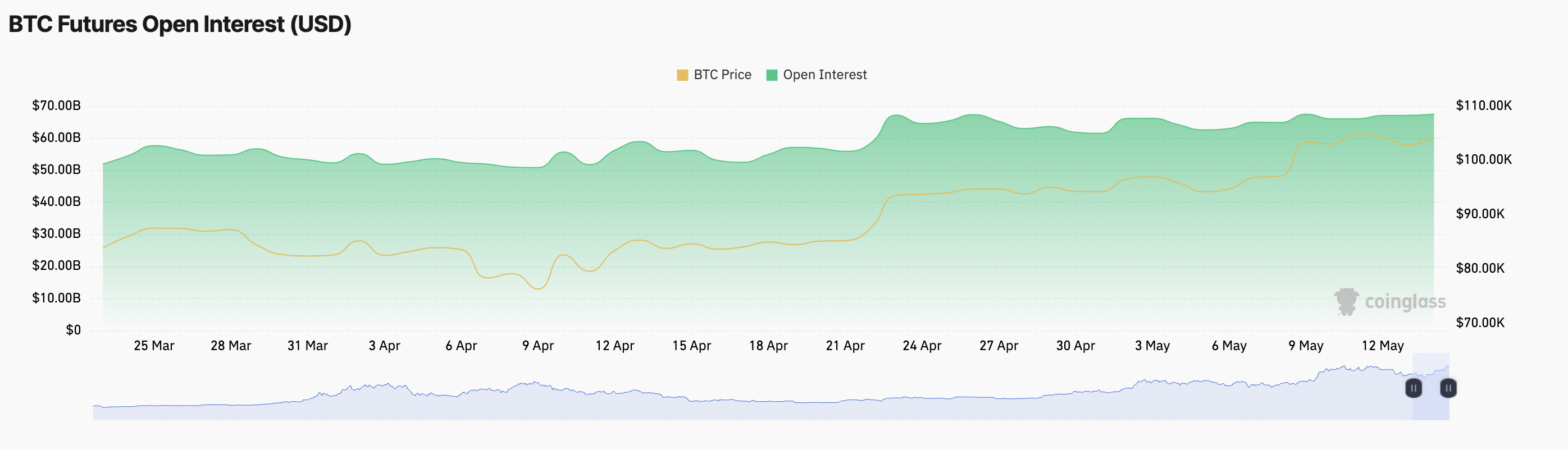

In the past 24 hours, BTC has staged a modest recovery, climbing 1%. This rally is fueled by the steady rise in trading activity over the past day. In its futures market, this is reflected by the coin’s open interest, which currently stands at $67.47 billion, noting a 1% rise.

BTC Futures Open Interest. Source:

Coinglass

BTC Futures Open Interest. Source:

Coinglass

While BTC’s price and open interest rallies are modest, the trend suggests a gradual return of confidence among traders. The uptick in open interest indicates that market participants are re-entering the market with fresh positions, potentially anticipating more upside.

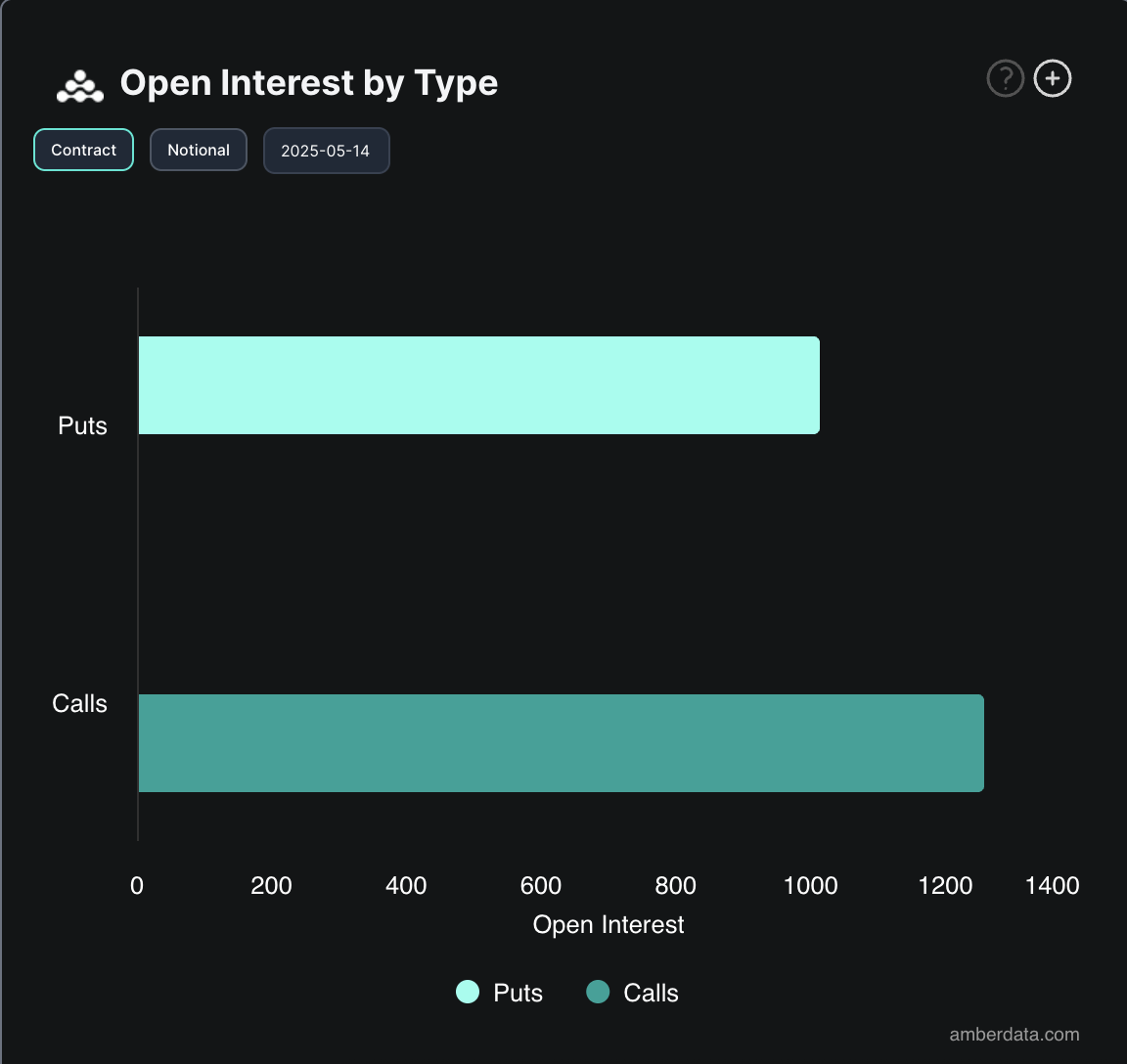

Further, the BTC options market confirms this bullish outlook. Today’s higher demand for calls over puts indicates that traders are positioning themselves for potential upside in the coin’s price.

BTC Options Open Interest. Source:

Deribit

BTC Options Open Interest. Source:

Deribit

The resilience shown in the BTC derivatives market signals that the market remains ready to capitalize on any positive momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will PayFi be the next narrative for RWA?

Can uncollateralized credit lending protocols work in the DeFi world?

Why are the new DAT setups by Multicoin, Jump, and Galaxy underestimated?

a16z's Latest Insight: Consumer AI Companies Will Redefine the Enterprise Software Market

The boundaries between the consumer market and the enterprise market are gradually becoming blurred to some extent.

Bitcoin all-time highs due in ‘2-3 weeks’ as price fills $117K futures gap